This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Three Gorges, SoftBank, Korea Launch Bonds

October 22, 2025

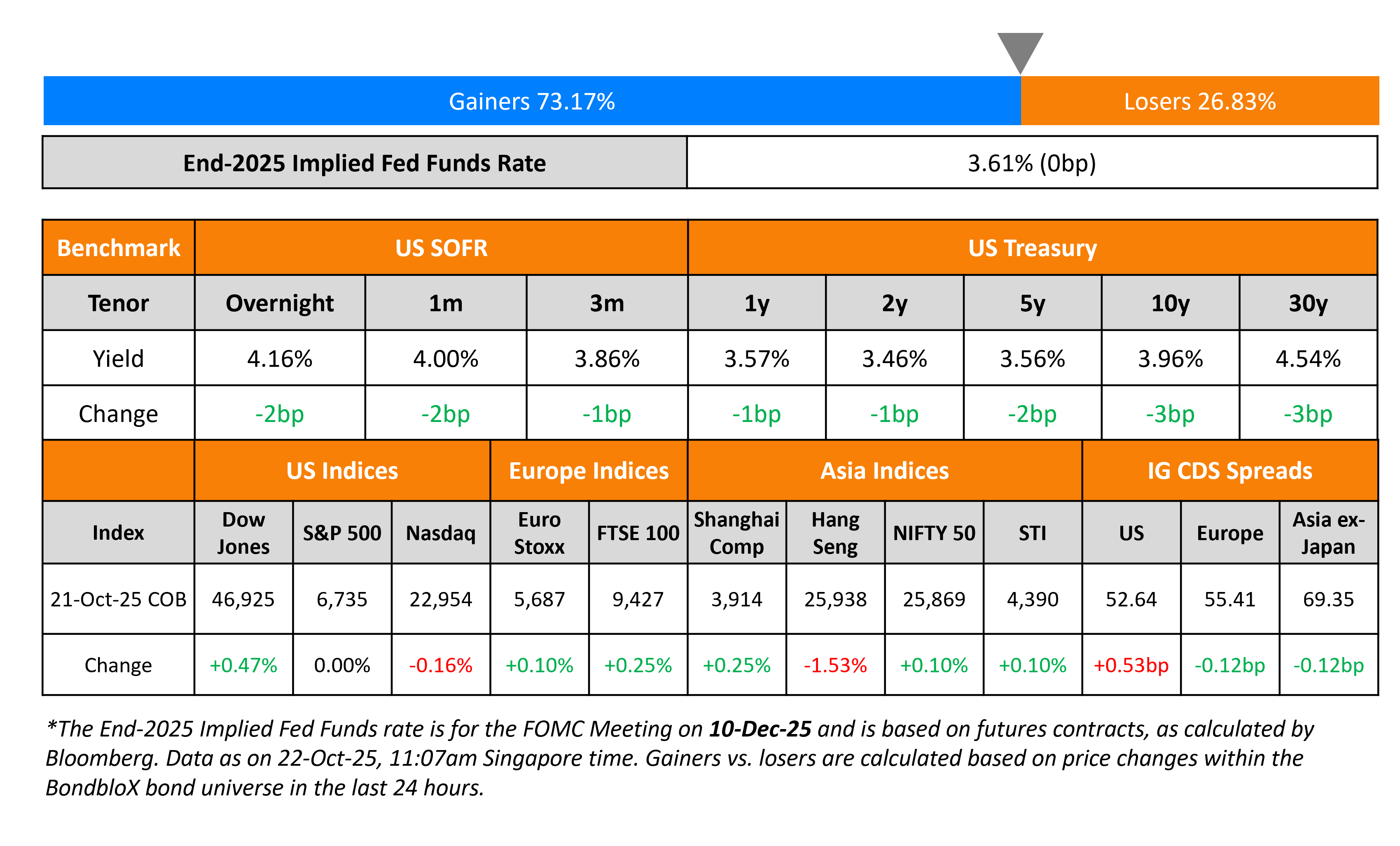

US Treasury yields eased by ~2bp across the curve as the government shutdown entered its fourth week. Reports suggested that the GOP leaders were aiming at new stopgap spending measures to end the shutdown. Separately, reports also suggested an easing in US-China trade tensions.

Looking at equity markets, the S&P ended unchanged while the Nasdaq closed 0.2% lower. The US IG and HY CDS spreads widened by 0.5bp and 3.1bp respectively. European equity indices ended in the green. The iTraxx Main and Crossover CDS spreads were 0.1bp and 2.1bp tighter respectively. Asian equity markets have opened lower today. Asia ex-Japan CDS spreads were 0.1bp tighter.

New Bond Issues

-

Three Gorges $ 3Y at T+70bp area

-

SoftBank Group $/€ hybrid 35.5NC5.5, 40NC10, 37NC7 at 7.875-8%/8.5-8.625%/6.75-7% areas

- The Republic of Korea $ 5Y at T+22bp area

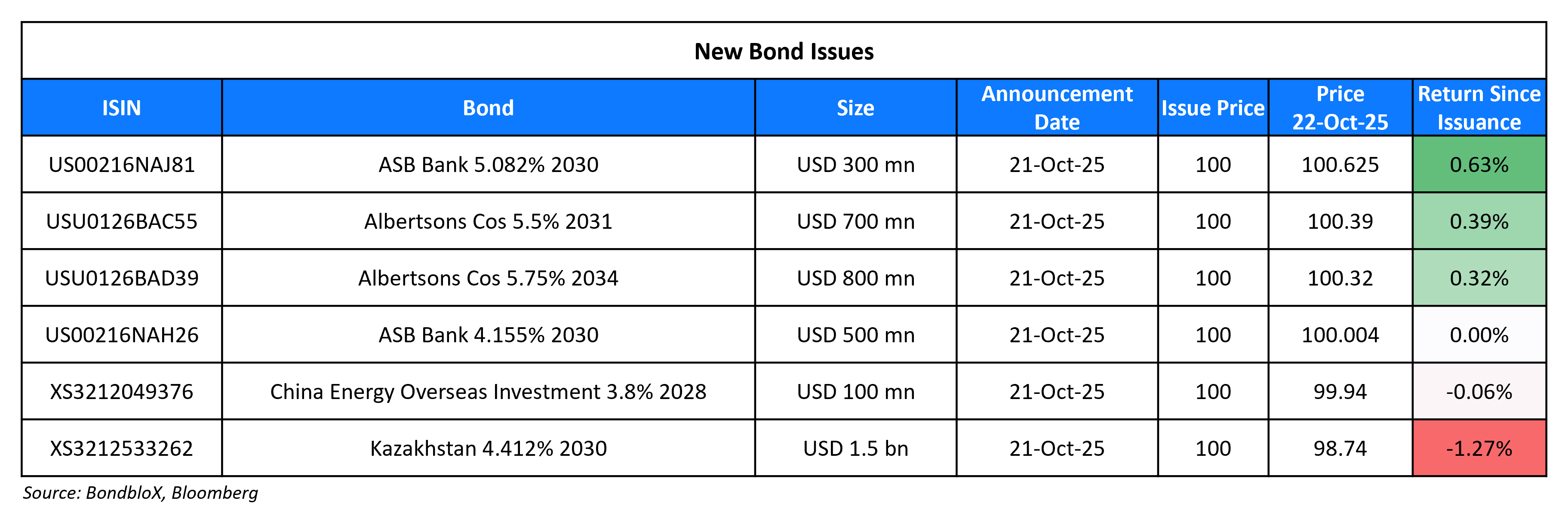

China Energy Engineering raised $100mn via a 3Y green bond at a yield of 3.8%, 50bp inside initial guidance of 4.3% area. The senior unsecured bond is rated BBB+ (Fitch). China Energy Overseas Investment (Hong Kong) Co., is the issuer. Proceeds will be used to redeem its outstanding $200mn Perp, and an equivalent amount to finance and/or refinance, eligible projects under its green framework.

ASB Bank raised $800mn via a two-tranche deal. It raised $500mn via a 5Y bond at a yield of 4.155%, 25bp inside initial guidance of T+85bp area. It also raised $300mn via a 5Y FRN at SOFR+90bp vs initial guidance of SOFR equivalent area. The senior secured bond is rated Aa3/AA- (Moody’s/S&P). Proceeds will be used for general corporate purposes.

Kazakhstan raised $1.5bn via a 5Y bond at a yield of 4.142%, 35bp inside initial guidance of T+120bp area. The senior unsecured note is rated Baa1/BBB-/BBB (Moody’s/S&P/Fitch). Proceeds will be be allocated mainly to eligible assets related to real estate activities.

New Bonds Pipeline

-

Hon Hai € 6Y offering

-

Oman Electricity Transmission $ green 5Y sukuk

Rating Changes

- Fitch Revises Zorlu’s Outlook to Negative; Affirms IDR at ‘B+’

- City of Paris Ratings Lowered To ‘A+/A-1’ From ‘AA-/A-1+’ Following A Similar Action On France; Outlook Stable

- Japfa Comfeed Outlook Revised To Stable On Reduced Refinancing Risk; ‘B+’ Ratings Affirmed

- Moody’s Ratings downgrades Orbia’s rating to Ba1; outlook remains negative

- Moody’s Ratings changes outlook on Zorlu Enerji to stable, affirms B3 ratings

Term of the Day: Debt-for-Education Swap

A widow-maker trade is considered to be a particular trade that repeatedly surprises markets and defies historical patterns, thereby resulting in large losses. These trades are typically considered rational and sometimes even the most obvious as patterns like mean-reversion or consensus views may seem the most likely outcome. However, the actual market moves turn out to be completely opposite to what is expected and thus causes big losses, making “widows” of traders.

One of the most popular widow-maker trades known to market participants is that of shorting Japanese government bonds (JGBs). Several traders have shorted JGBs over the past decades given the massive rise in Japanese government debt, very loose monetary policy and expectations of a eventual pick-up in inflation. As with widow-maker trades, this trade would logically seem to make sense. However, the BOJ had only pushed interest rates lower and continued to keep policy broadly loose. Thus, JGB prices moved higher causing losses to many traders. In recent times, analysts note that the same trade has infact started benefitting traders due to the resurgence of the possibility that the BOJ will raise interest rates and a potential spending surge by the new Prime Minister.

Talking Heads

On ‘Widow-Maker’ Trade Becoming World Beater as Japan Bonds Sink

Mark Nash, Jupiter Asset Management

“Forget Treasuries or gilts, one of the cleanest plays is to sell JGBs. The widow-maker trade has been one of the most profitable relative to other markets”

Lauren van Biljon, Allspring Global Investments UK

“We expect there is a deal to be done on fiscal stimulus, although the size of any spending is unclear… caution is warranted when it comes to duration in Japan. The yield curve is steep but that doesn’t mean it can’t be steeper”

On ECB Achieved Soft Landing and Resilient Economy – ECB GC member, Yannis Stournaras

“This achievement is inextricably linked to the building of the ECB’s credibility – a valuable asset – thanks to which, even during the recent sharp rise in inflation, long-term inflation expectations have remained very close to 2%… Increased demand for European securities can enhance the liquidity and financing capabilities of the European economy”

On Bank of England Warning of Growing Private Credit Risks

BOE Deputy Governor Sarah Breeden

“I would hope that we’d be able to come up with an answer to the question, is a shock here likely to be contained, or likely to subprime-like spiral in an amplifying way?”

BOE Governor Andrew Bailey

“We certainly are beginning to see, for instance, what used to be called sort of slicing and dicing and tranching of loan structures for instance, going on”

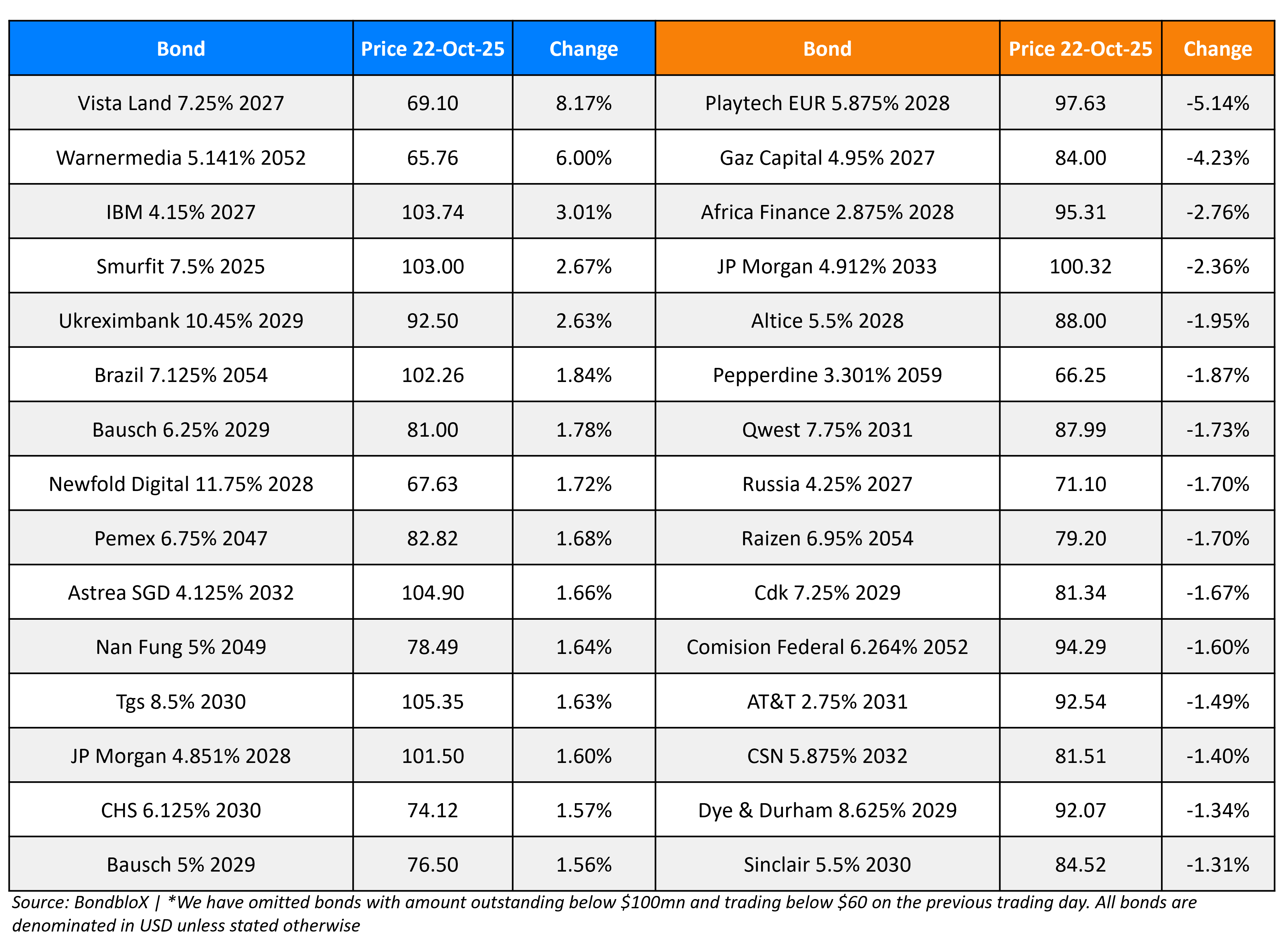

Top Gainers and Losers- 22-Oct-25*

Go back to Latest bond Market News

Related Posts: