This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

The Week That Was (27 Nov – 03 Dec, 2022)

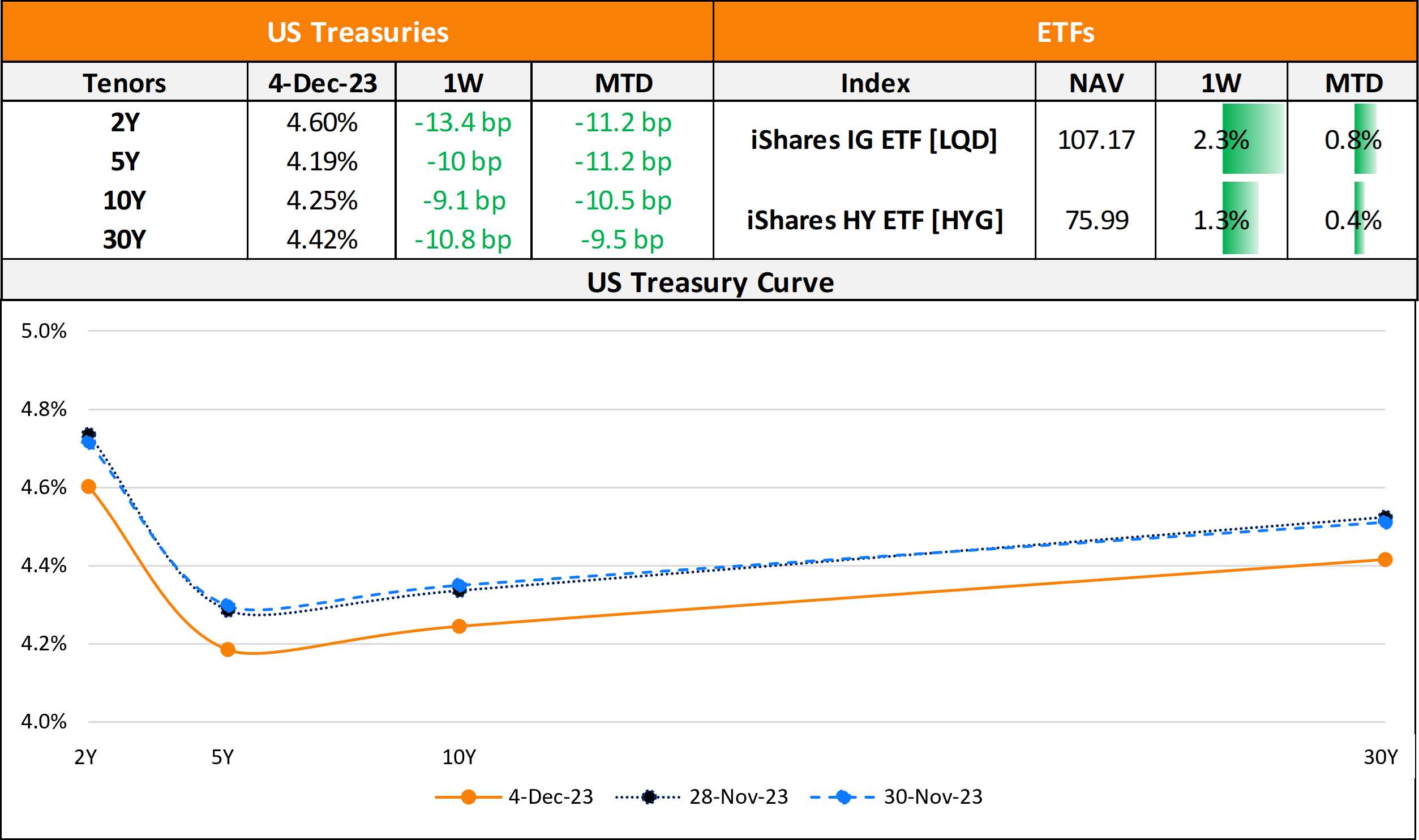

December 4, 2023

US primary market new deals rose last week to $11.6bn vs. $2.5bn a week prior with a volumes mostly taken by IG issuers with $9.75bn in deals. These were led by Citibank and Thermo Fisher raising $2.5bn each via two and three part deals respectively. HY issuers saw $1.8bn in deals led by Summit Materials and Genesis Energy raising $800mn and $600mn each. In North America, there were a total of 15 upgrades and 35 downgrades across the three major rating agencies last week. US IG funds saw $325mn in outflows for the week ending November 29, while HY funds saw $296bn in inflows last week.

EU Corporate G3 issuances dropped to $19.9bn vs. $28.6bn a week prior. Issuance volumes were led by ING Bank’s €2.5bn issuance, Engie’s €1.5bn two-trancher and BNP Paribas’ $2bn deal. The region saw 40 upgrades and 36 downgrades across the three major rating agencies. The GCC dollar primary bond market saw no new deals last week after $770mn in deals a week prior to it. Across the Middle East/Africa region, there was 1 upgrade and downgrade each across the major rating agencies. LatAm saw only $514mn in new issuances led by CSN Resources’ $500mn issuance, following no deals a week earlier. The South American region saw 4 upgrades and 1 downgrade each across the rating agencies.

G3 issuance volumes from APAC ex-Japan stood at $5.34bn vs. $4.4bn a week prior to it led by Macquarie’s $2.25bn three-tranche issuance, Philippines $1bn sukuk issuance. In the APAC region, there were 12 upgrades and 20 downgrades each across the three rating agencies last week.

Go back to Latest bond Market News

Related Posts:

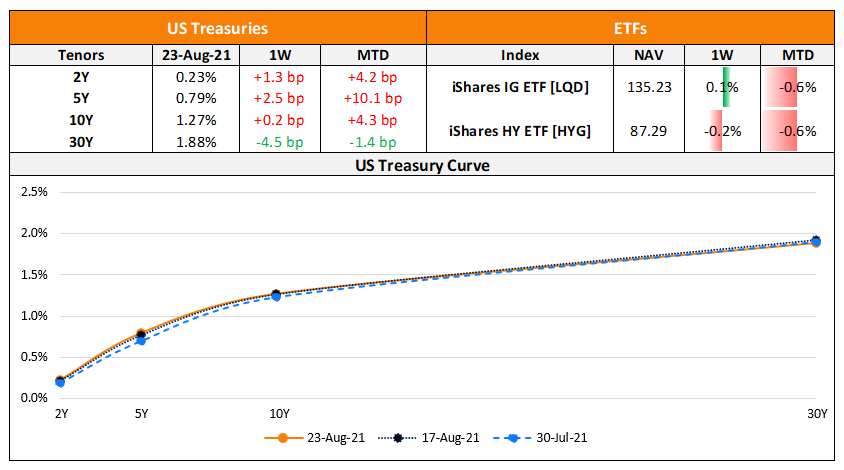

The Week That Was – (16th -22nd Aug)

August 23, 2021

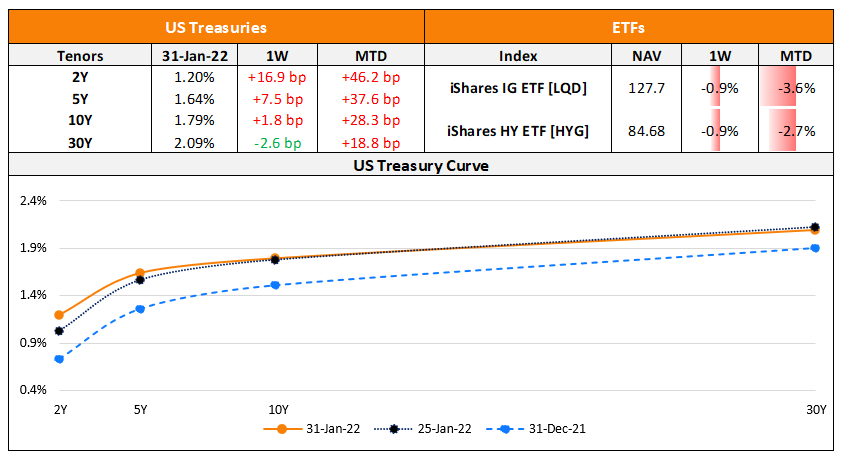

The Week That Was (24 – 30 Jan, 2022)

January 31, 2022

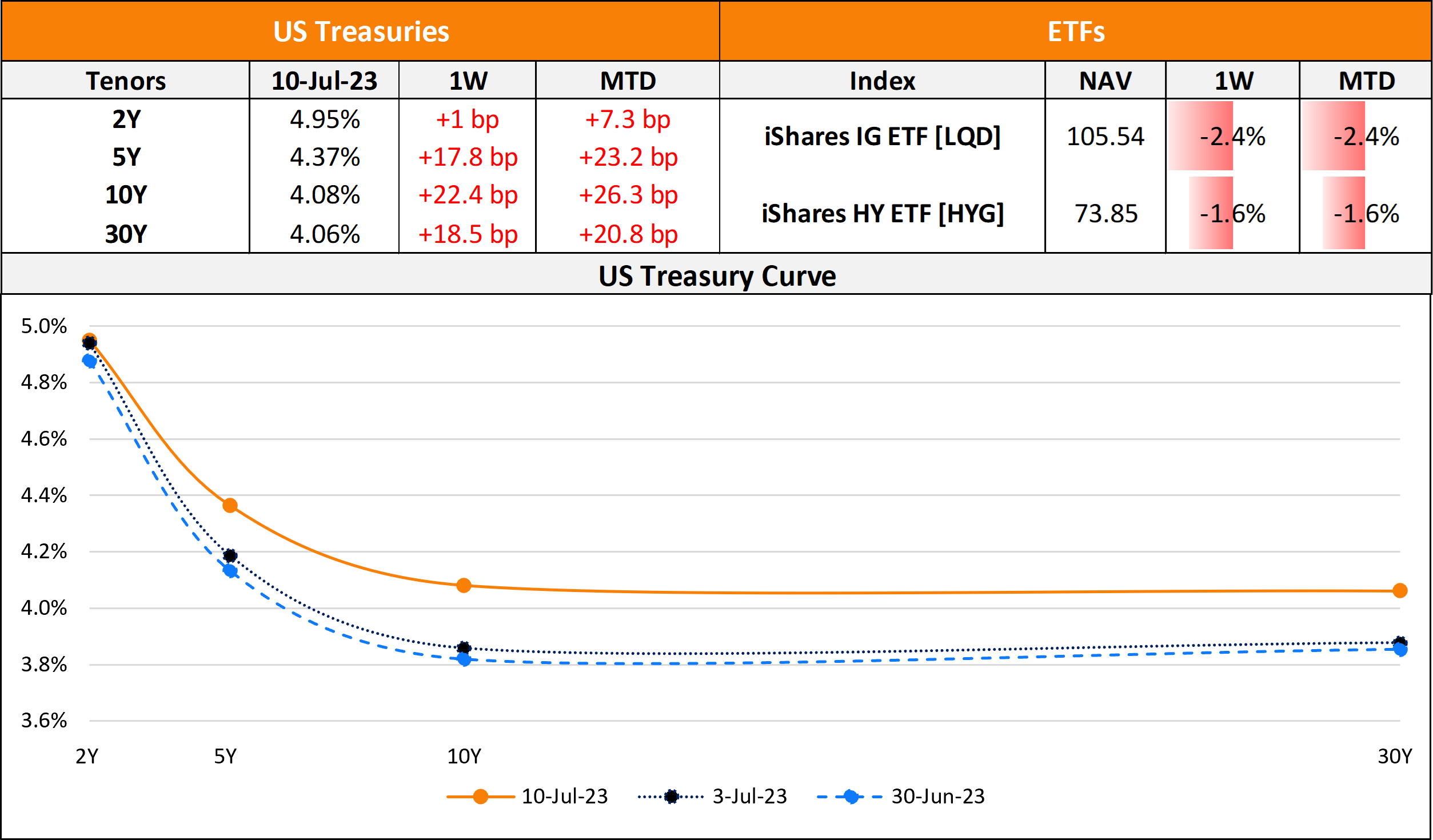

The Week That Was (3 – 9, July 2023)

July 10, 2023