This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

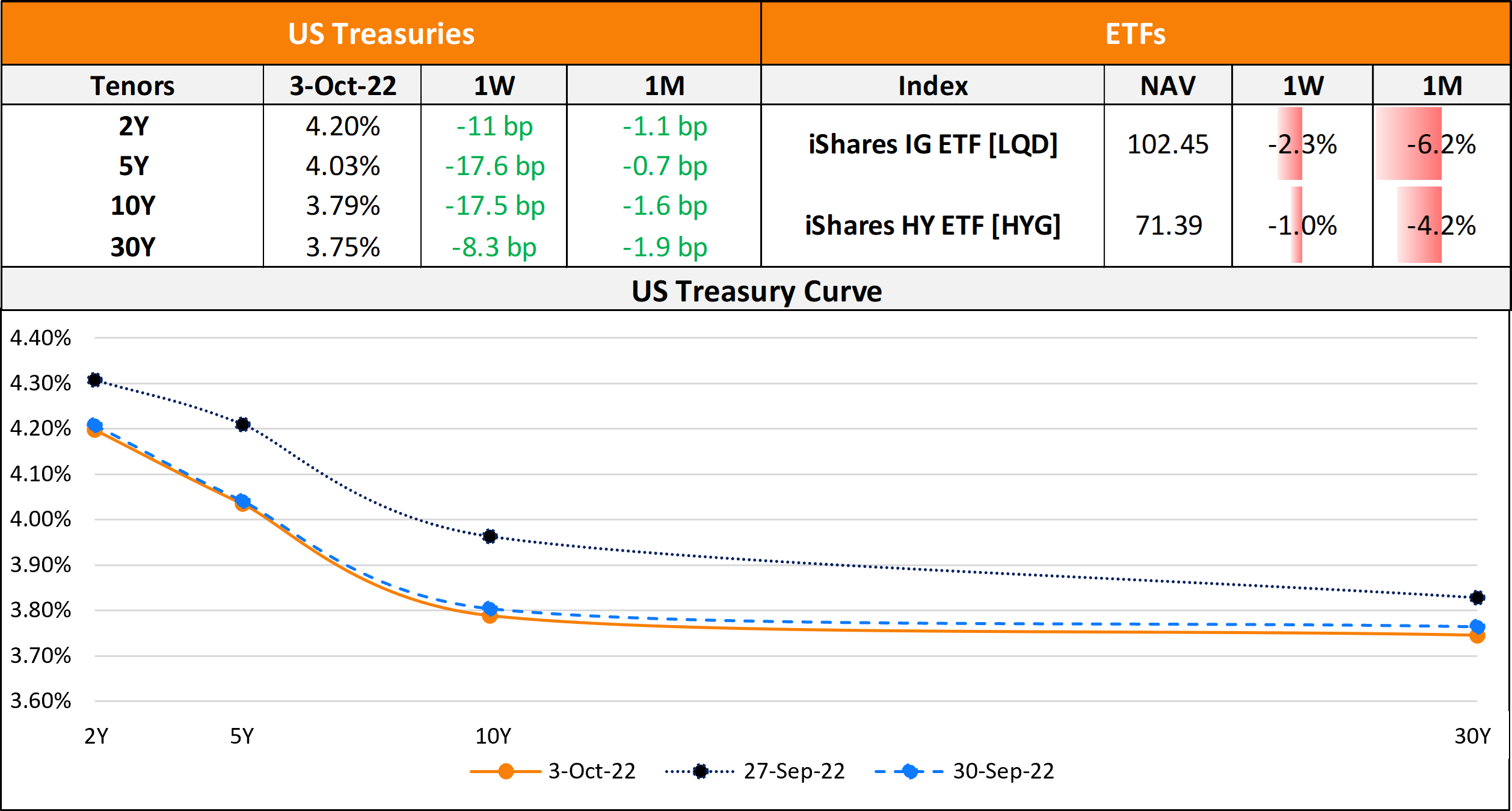

The Week That Was (26 September – 2 October, 2022)

October 3, 2022

US primary market issuances saw a drop in new bond deals to $1.7bn last week vs. $11.9bn in the week prior. The entire deal volumes were taken up by IG issuances led by Atmos Energy’s $800mn two-trancher and Komatsu’s $600mn issuance. In North America, there were a total of 45 upgrades and 31 downgrades across the three major rating agencies last week. As per Lipper data, US IG funds saw a massive $10.3bn in outflows in the week ended 28 September, a sixth straight week of outflows. This was the third largest outflow on record across US IG bonds. HY funds too saw $3bn in outflows. LatAm saw $300mn in issuances led by Banco Safra’s $200mn deal, after four consecutive weeks of no new bond deals from the region. In South America, there was 1 upgrade and 2 downgrades across the major rating agencies. EU Corporate G3 issuance dropped to $13.8bn vs. $16.6bn one week prior – KfW’s €4bn deal and Bankinter SA’s €2.3bn deal led the tables. Across the European region, there were 19 upgrades and 44 downgrades. The GCC G3 primary bond market saw no new deals for a second consecutive week. Across the Middle East/Africa region, there were no upgrades and 9 downgrades across the three major rating agencies. APAC ex-Japan G3 issuances were at $1bn vs. $1.3bn in the week prior led Korea Electric Power’s $800mn dual-trancher and Tongling State-owned Capital’s $200mn issuance. In the APAC region, there were 2 upgrades and 12 downgrades combined across the three rating agencies last week.

.png?upscale=true&width=1418&upscale=true&name=BEV%20Weekly%20Bottom%20Half%203%20Oct%202022%20(1).png)

Go back to Latest bond Market News

Related Posts:

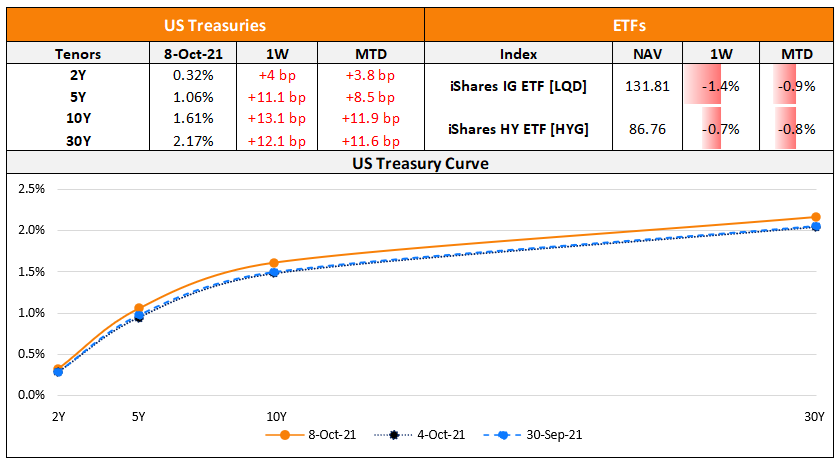

The Week That Was (Oct 4th – 11th)

October 11, 2021

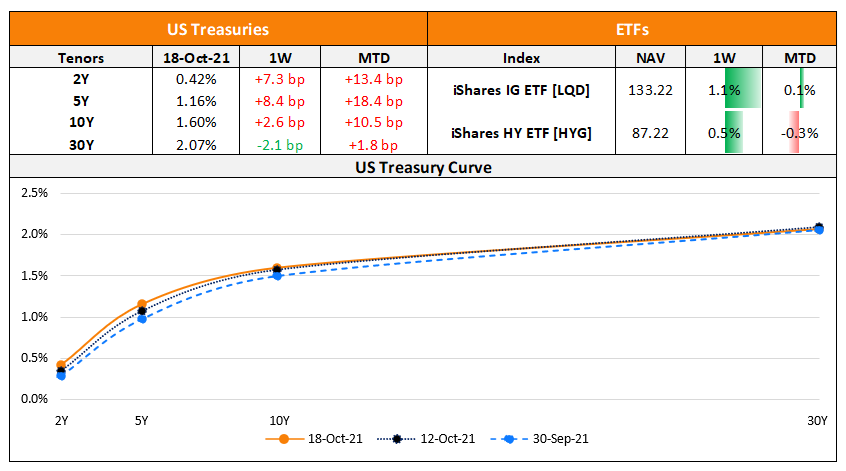

The Week That Was (11 – 17 Oct 2021)

October 18, 2021

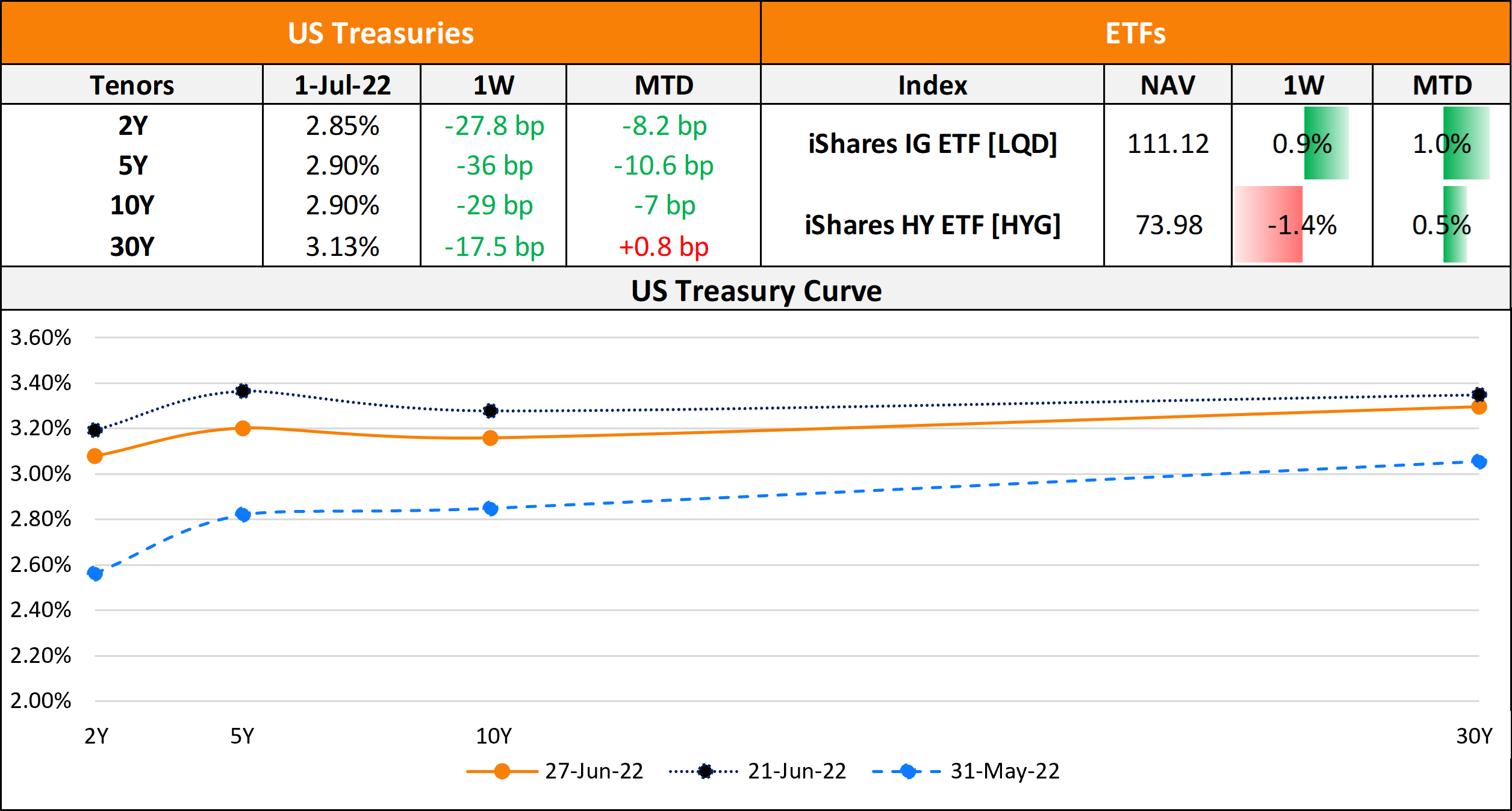

The Week That Was (27 June – 03 July, 2022)

July 4, 2022