This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

The Week That Was (23 June 2025 – 29 June 2025)

June 30, 2025

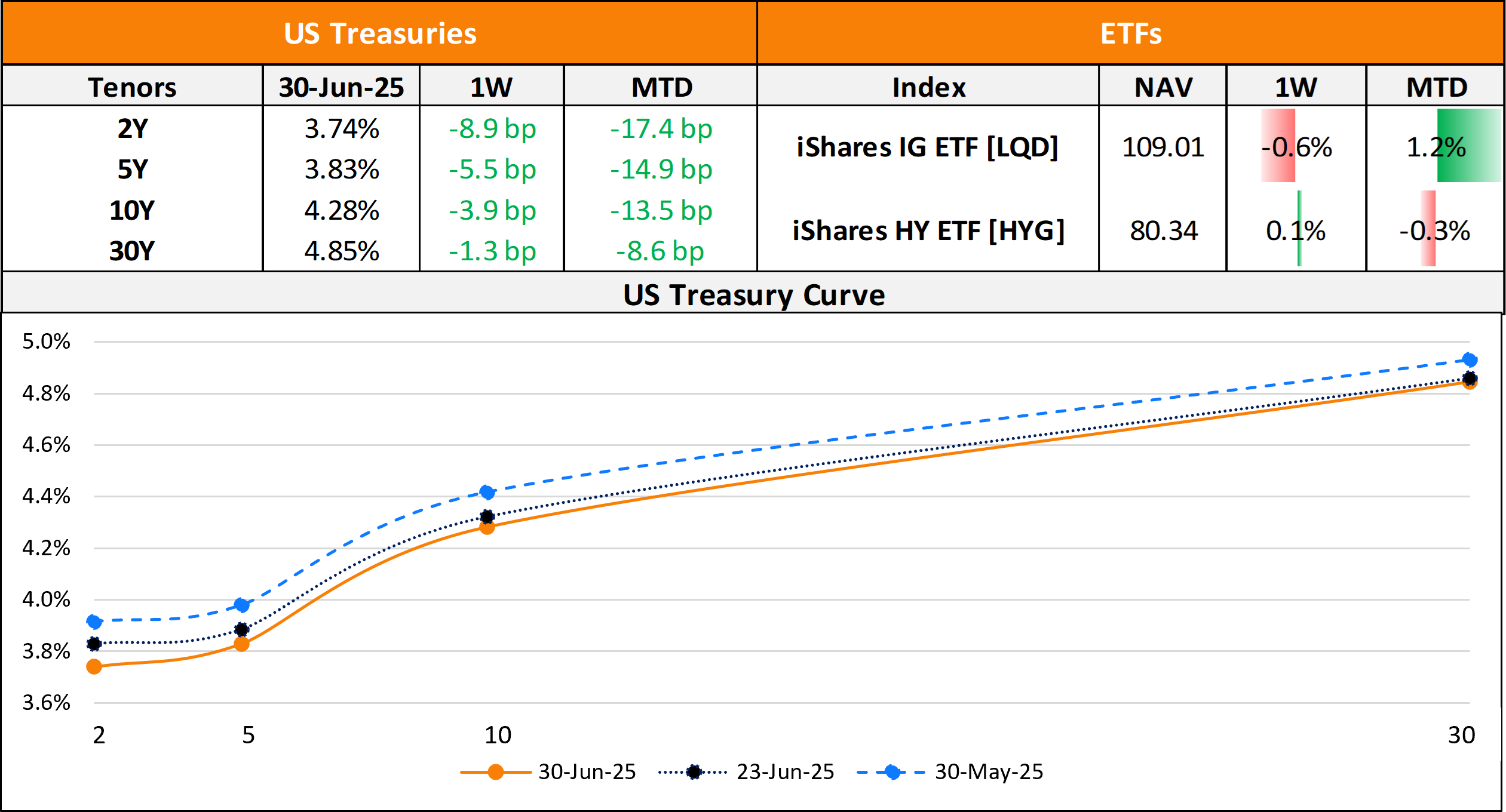

US primary market issuances jumped to $27bn vs. $20.7bn in the previous week. IG issuers took up $16.9bn of the total, led by JBS’ $3.5bn three-trancher and Takeda US’ $2.4bn two-part deals each. HY issuances stood at $9.9bn, led by Beach Acquistion’s $4.4bn two-part issuance and Azorra’s $1.1bn two-part deal. In North America, there were a total of 63 upgrades and 19 downgrades each, across the three major rating agencies last week. US IG funds saw $1.3bn in inflows during the week ended June 25, adding to the $929.6mn inflow seen during the week before that. US HY bond funds saw $3.5bn of inflows, adding to the $356.3mn inflows in the prior week, marking its highest flow since November 2023.

EU Corporate G3 issuances rose to $45.7bn vs. $41.3bn in the prior week, led by TotalEnergies’ €3bn three-trancher, followed by CaixaBank’s $3bn three-part deal and Imperial Brands’ $2.2bn three-part deal. The region saw 33 upgrades and 27 downgrades each, across the three major rating agencies. Last week, the GCC dollar primary bond market saw just one deal by Dar Al-Arkan raising $750mn compared to $1.25bn in issuances during the prior week. In the Middle East/Africa region, there were 3 upgrades and 1 downgrade across the major rating agencies. LatAm saw $900mn in new issuances last week, with a $500mn deal by America Movil and $400mn deal by Banco Marco SA compared to $500mn in issuances the prior week. The South American region saw 7 upgrades and 22 downgrades each across the three major rating agencies last week.

G3 issuances from the APAC ex-Japan region stood at $12.8bn vs. $5.88bn in the prior week. This was led by Westpac’s $2.4bn multi-currency three-trancher, followed by Korea’s €1.4bn two-tranche deal, and DBS’ €1.25bn issuance. In the APAC region, there were 13 upgrades and 14 downgrades across the three rating agencies.

Go back to Latest bond Market News

Related Posts: