This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

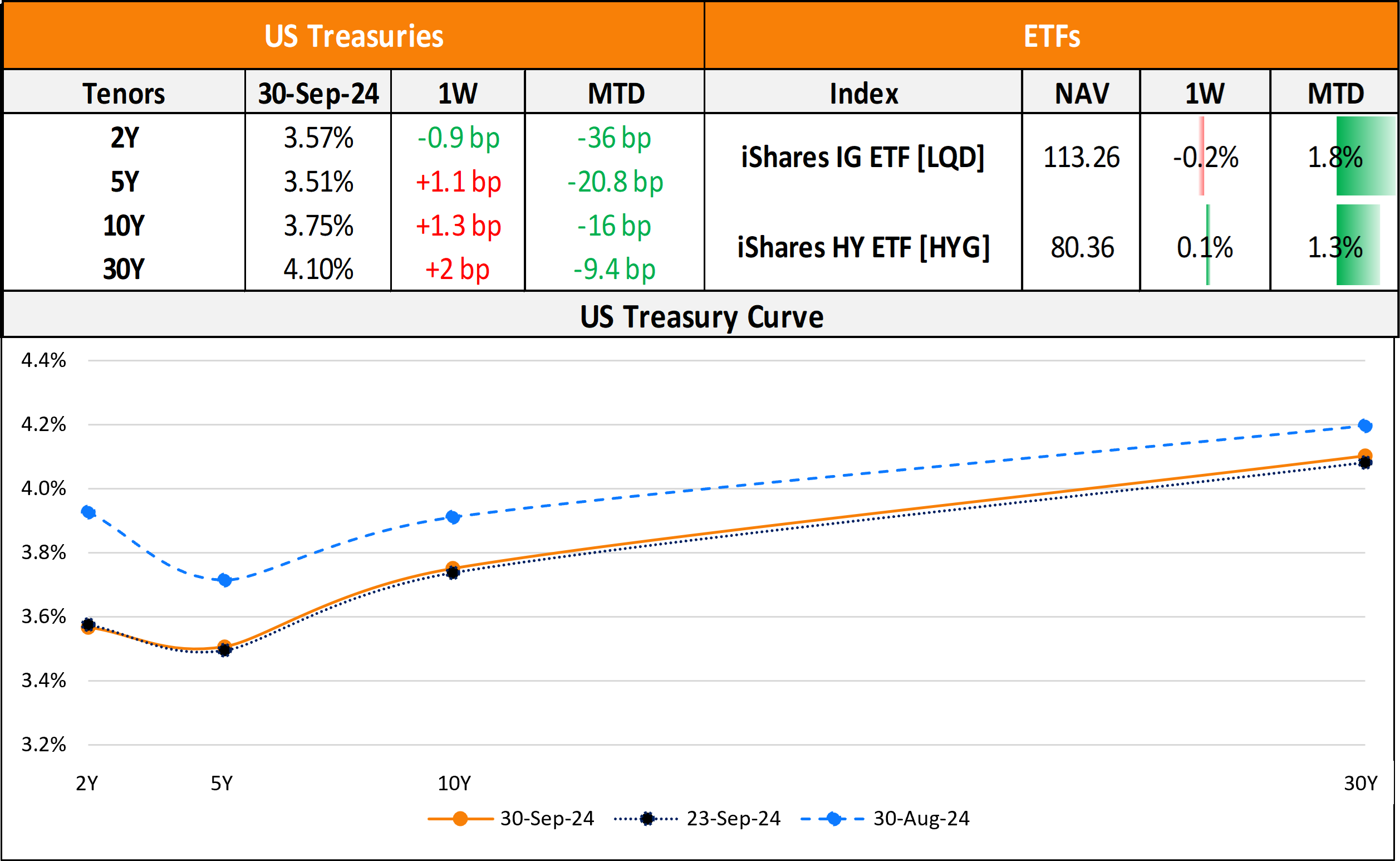

The Week That Was (23 – 30 Sep, 2024)

September 30, 2024

US primary market issuances rose last week to $35bn vs $16.3bn seen in the prior week. IG issuers took up $25.2bn of the total, led by Oracle’s $6.25bn and Broadcom’s $5bn four-trancher deal each. Last week saw $9.6bn in HY issuances from the region, led by Venture Global Partners’ $3bn deal followed by CD&R Labels’ $950mn offering. In North America, there were a total of 40 upgrades and 31 downgrades across the three major rating agencies last week. US IG funds saw $1.34bn of inflows, adding to the $1.94bn of inflows in the prior week. HY funds saw $73.1mn of inflows adding to the $1.75bn of inflows in the previous week.

EU Corporate G3 issuances rose last week to $51bn vs. $35.9bn in the prior week. LBBW’s €5.4bn multi-tranche issuance deal led the tables, followed by Santander’s €3bn two-trancher deal. The region saw 35 upgrades and 36 downgrades, across the three major rating agencies. The GCC dollar primary bond market saw total issuance of $8.25bn compared to $250mn seen in the prior week. Saudi Aramco’s $4.5bn and Abu Dhabi Development Authority’s $3bn three-trancher deal each led the tables. In the Middle East/Africa region, there were 4 upgrades and 16 downgrades across the major rating agencies. LatAm saw $4.6bn in issuances last week vs $1.5bn in the prior week. Liberty Latin America’s $1.5bn three-part offering led the tables, followed by B&C Privatstiftung’s $1.3bn two-tranche deal. The South American region saw 12 upgrades and 9 downgrades across the rating agencies.

G3 issuance volumes from APAC ex-Japan jumped to $16.9bn vs. $1.9bn seen in the previous week. China’s $2.6bn four-trancher deal led the table, followed by ANZ’s $2.5bn three-part issuance. Besides these, the week also saw Meituan’s $2.5bn and AIA’s $1.25bn two-part deals and Shriram’s $500mn deal being priced. In the APAC region, there were no upgrades and 11 downgrades, across the three rating agencies last week.

Go back to Latest bond Market News

Related Posts:

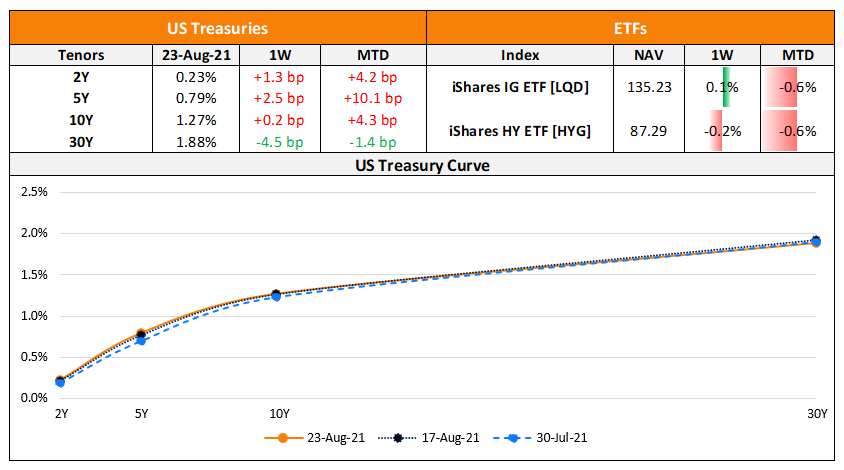

The Week That Was – (16th -22nd Aug)

August 23, 2021

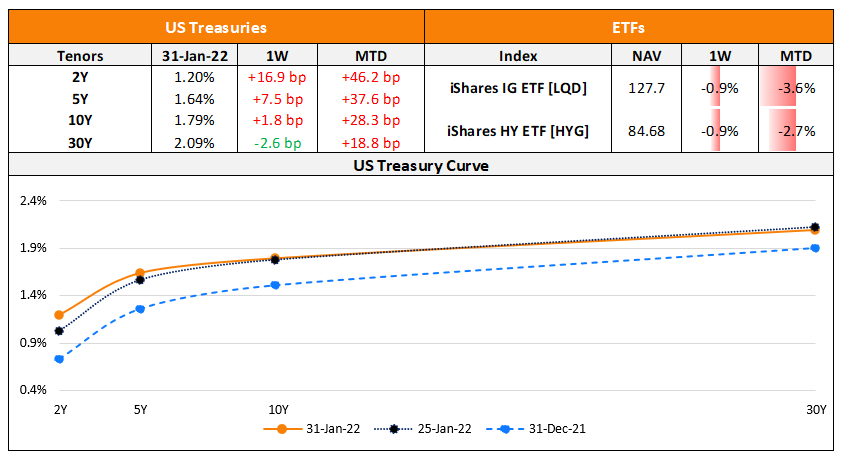

The Week That Was (24 – 30 Jan, 2022)

January 31, 2022

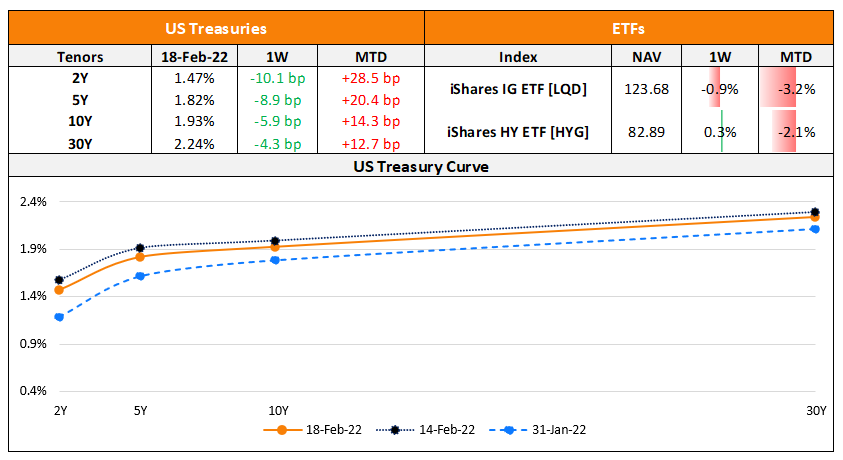

The Week That Was (14 – 20 Feb, 2022)

February 21, 2022