This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

The Week That Was (22 – 28 Sep, 2025)

September 29, 2025

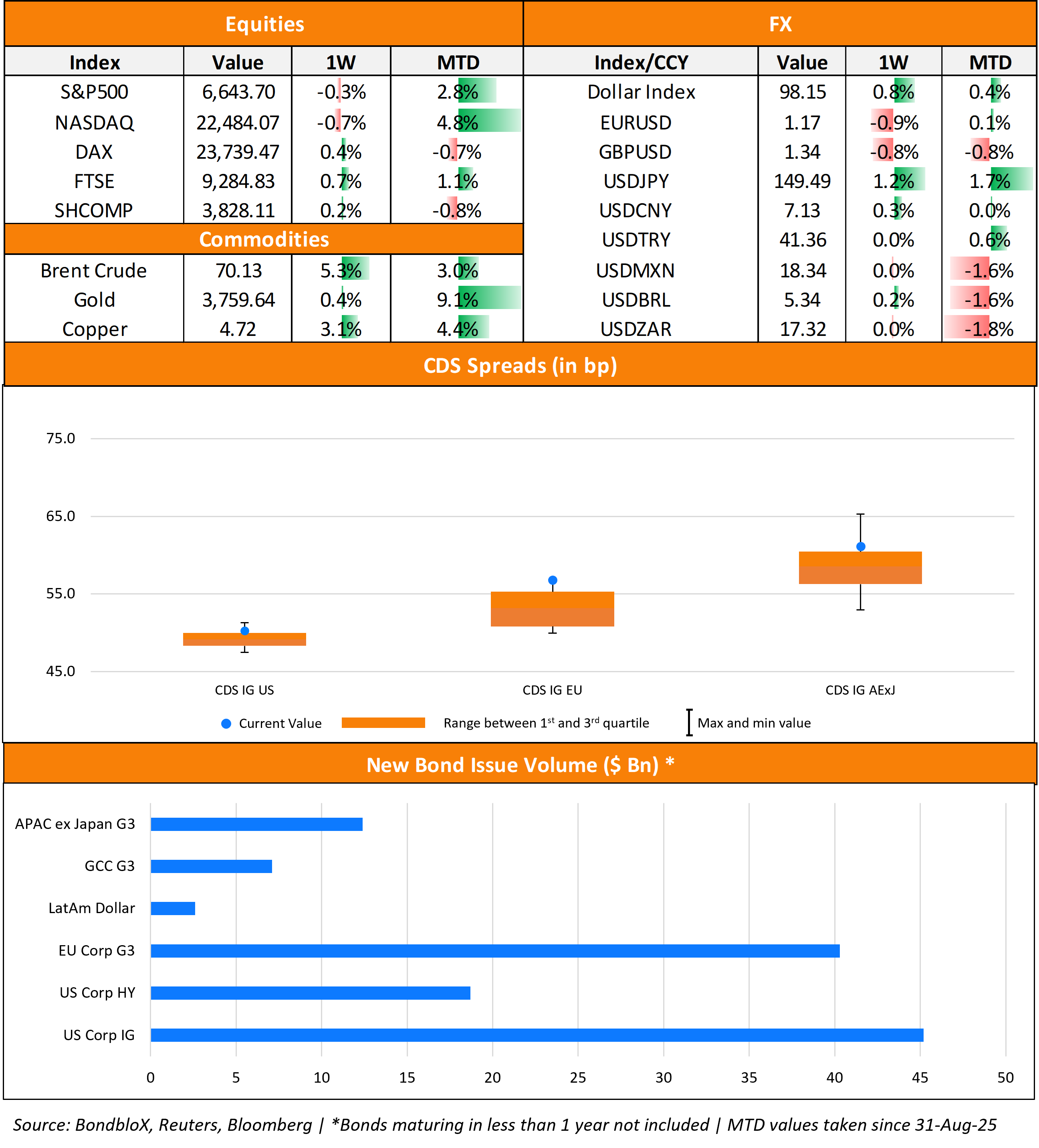

US primary market issuances soared last week to $63.3bn vs. $23.2bn in new deals seen a week prior to it. IG issuers took up $45.2bn of the total, led by Oracle’s $18bn eight-trancher (the second largest deal this year), followed by Broadcom and Lowe’s $5bn multi-tranche deals each, and Dell’s $4.5bn four-part issuance. HY deals stood at $18.7bn, led by NRG Energy’s $3.65bn and Windstream Holdings’ $2.8bn two-part issuance deals each. In North America, there were a total of 46 upgrades and 34 downgrades, across the three major rating agencies last week. US IG funds saw $1.8bn in inflows during the week ended September 24, adding to the $1.9bn inflows seen during the week before that. US HY bond funds saw $365mn in outflows, reversing the $939mn inflows seen in the prior week.

EU Corporate G3 issuances held broadly steady at $40.2bn vs. $44.4bn in the prior week, with volumes led by Enel’s $4.5bn four-tranche deal, followed by Heineken and Volkswagen’s €2bn three-part issuances each. The region saw 81 upgrades and 35 downgrades across the three major rating agencies – a majority of the upgrades were on Spanish corporates following the sovereign’s upgrade to A by Fitch. Last week, the GCC dollar primary bond market saw $7.1bn in new issuances, rising sharply from the $1.04bn in new deals seen a week before that. This was led by Abu Dhabi’s $3bn and Saudi Real Estate Refinance Company’s (SRC) $2.5bn two-trancher deals each. In the Middle East/Africa region, there were 5 upgrades and 2 downgrades across the major rating agencies. LatAm saw $2.6bn in new issuances with Embraer’s $1bn issuance and Aros Saneamento’s $750mn deal leading the table. The South American region saw 9 upgrades and 10 downgrades across the three major rating agencies last week.

G3 issuances from the APAC ex-Japan region stood at $12.4bn, similar to the $12bn in deals seen during the prior week. This was led by the State of Victoria’s €2bn issuance, followed by CBA’s $1.5bn two-part issuance and Korea National Oil’s $1.3bn three-trancher. In the APAC region, there were 4 upgrades and 17 downgrades across the three rating agencies.

Go back to Latest bond Market News

Related Posts: