This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

The Week That Was (22 – 28 April, 2024)

April 29, 2024

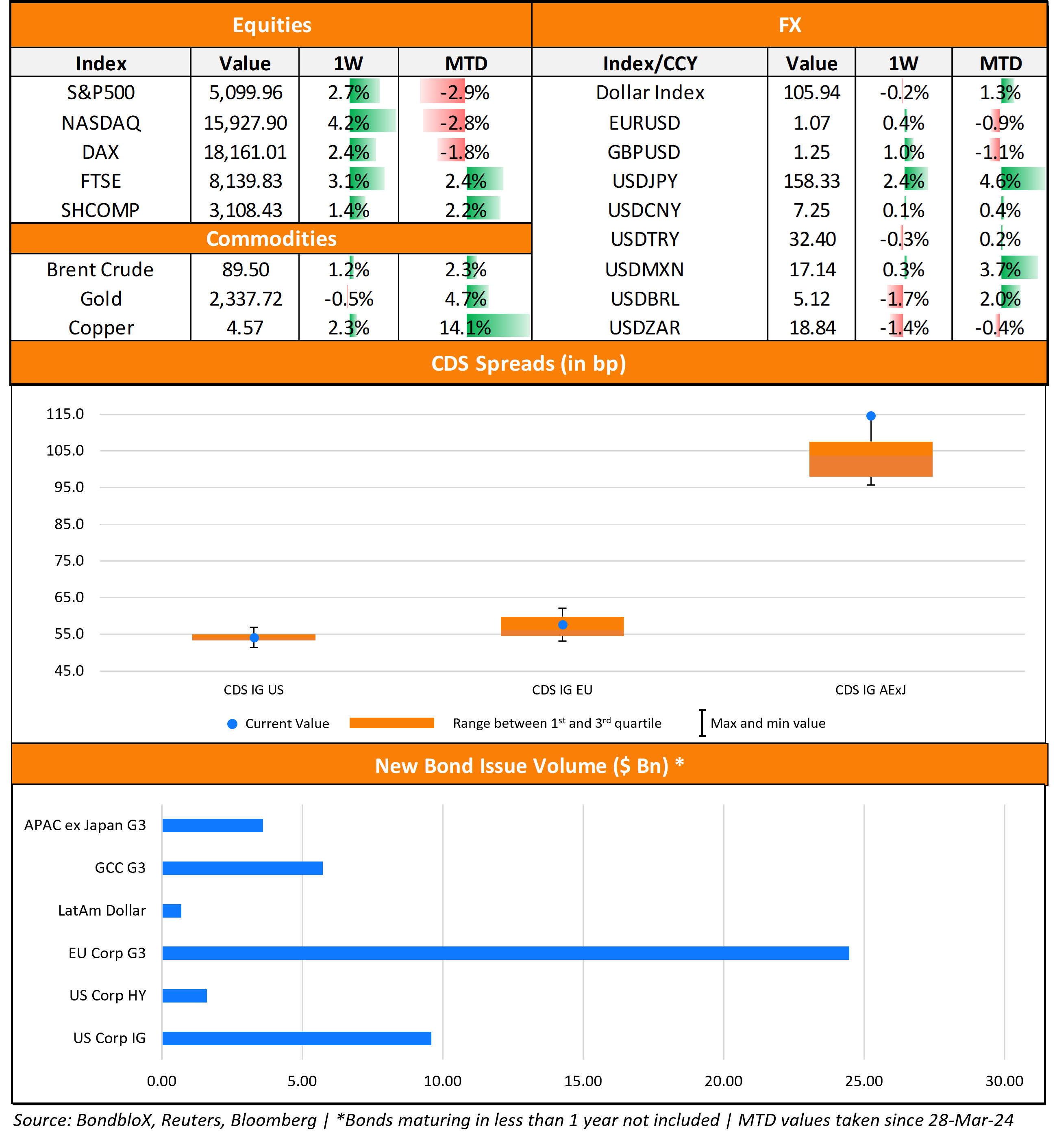

US primary markets were muted last week, with new deals at $11.4bn vs. $36.9bn seen a week before. IG issuers racked up $9.6bn of the total with Citibank’s $4bn two-trancher and American Express’ $2.7bn two-tranchers leading the tables. HY issuers accounted for $1.6bn of the volume with Vail Resorts’ $600mn issuance and Helios Software’s $500mn issuances leading the tables. In North America, there were a total of 33 upgrades and 30 downgrades across the three major rating agencies last week. US IG funds saw outflows of $607.1mn for the week ending April 24, reversing the $170mn inflows seen the week before this. As per the data provider LSEG Lipper, US High-Grade bond funds saw their first outflow of the year. Investors withdrew $604.3mn from junk bond funds during the same period, adding to the outflows of $3.75bn seen a week prior.

EU Corporate G3 issuances recorded $24.5bn in new deals, lower than the $37.1bn seen in the week prior to it. The largest deals were led by BNL’s €2.7bn deal, CK Hutchison’s $2bn two-tranche and Rabobank’s €1bn issuance. The region saw 37 upgrades and 27 downgrades each across the three major rating agencies. The GCC dollar primary bond market saw $5.8bn in new deals last week after only $150mn in issuances a week prior to it. Abu Dhabi raised $5bn via a three-part deal and Shelf Drilling raised $630mn via a two-trancher to lead the tables. In the Middle East/Africa region, there were no upgrades and 1 downgrade across the major rating agencies. LatAm saw $700mn in new deals after no new deals a week ago, led by Pan America Energy’s $400mn and COFIDE’s $300mn deals. The South American region saw 2 upgrades and 14 downgrades across the rating agencies.

G3 issuance volumes from APAC ex-Japan stood at $3.6bn vs. $4bn in the week prior to it. This was led by Sydney Airport’s €1bn two-trancher, Glencore’s €600mn issuance, Korea Ocean Business’ $600mn dual-trancher, followed by Goodman Australia’s €500mn deal and Indika Energy’s $300mn issuance. In the APAC region, there were 2 upgrades and 7 downgrades across the three rating agencies last week.

Go back to Latest bond Market News

Related Posts:

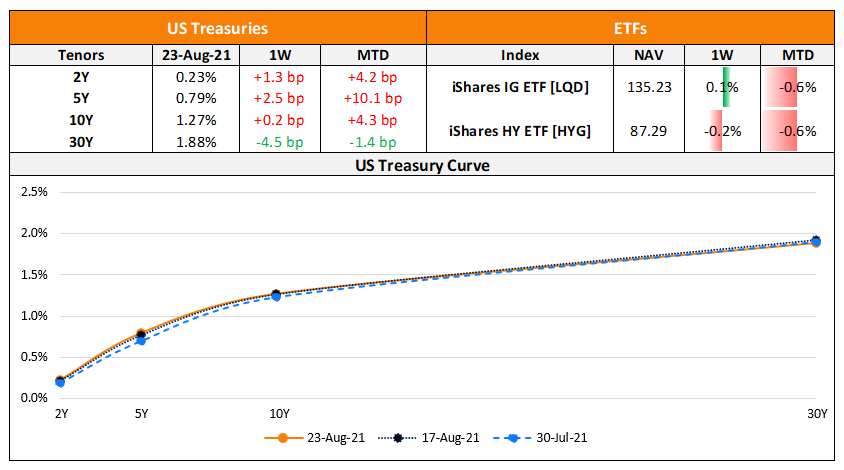

The Week That Was – (16th -22nd Aug)

August 23, 2021

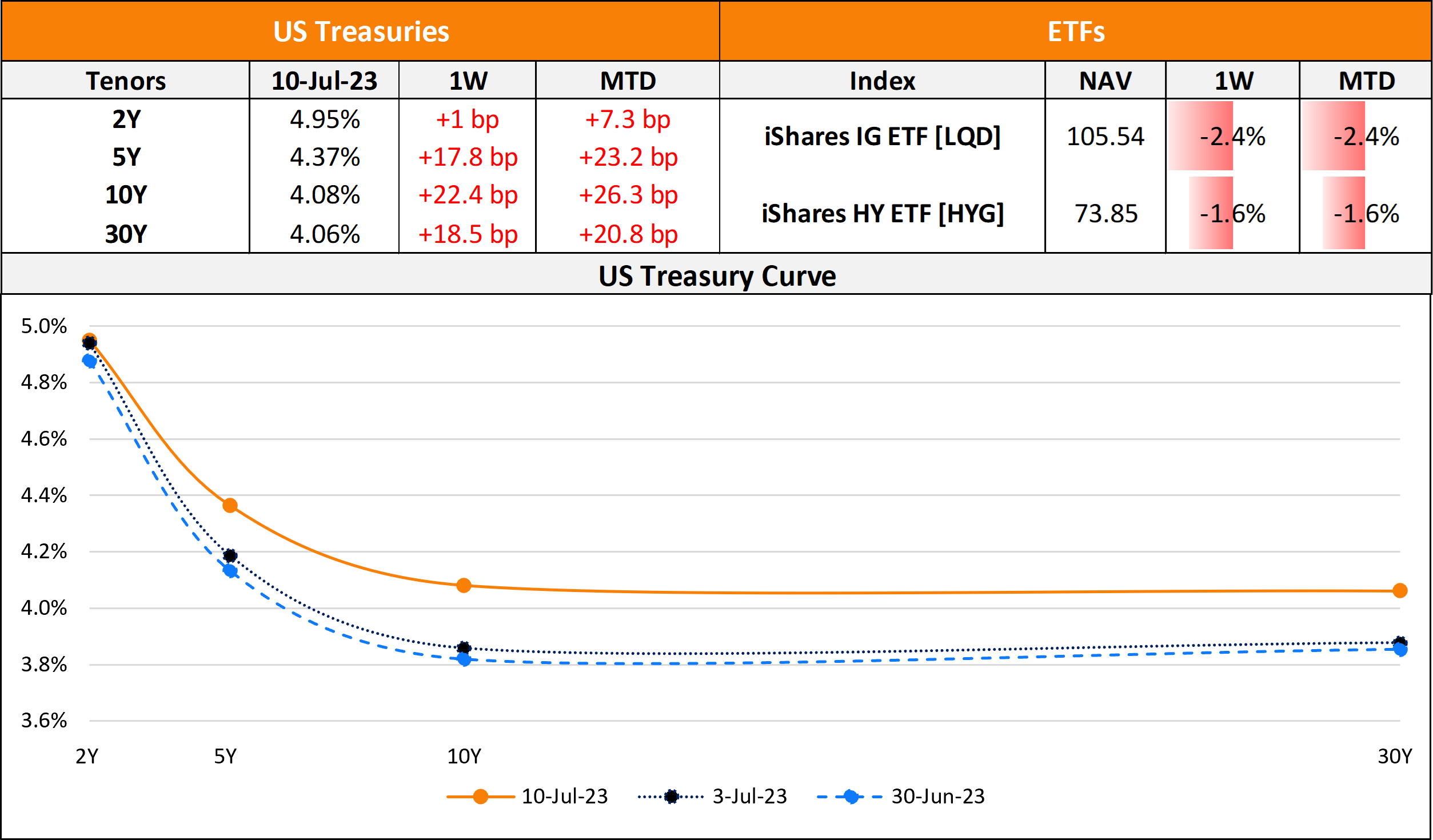

The Week That Was (3 – 9, July 2023)

July 10, 2023

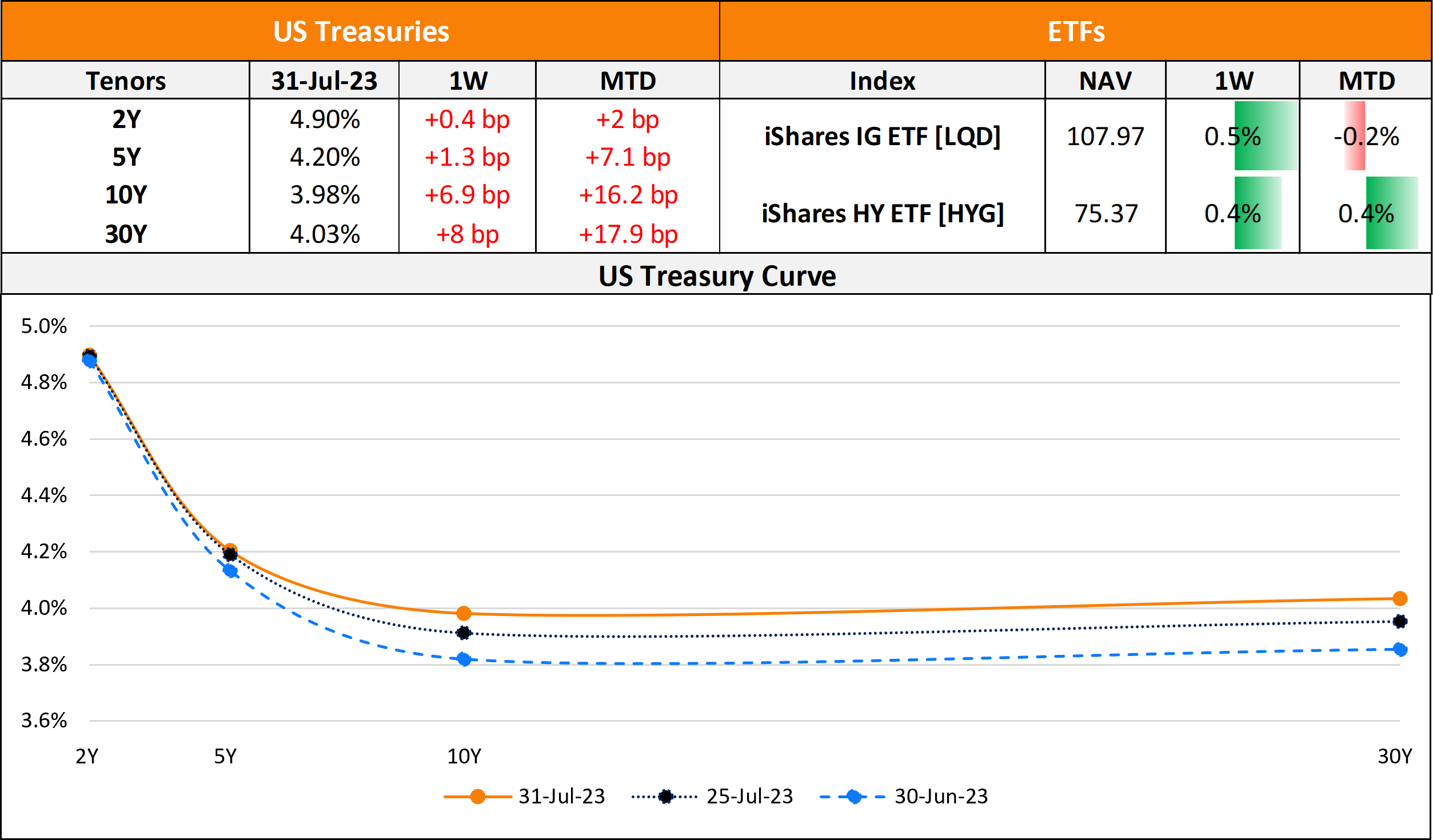

The Week That Was (24 – 30 July, 2023)

July 31, 2023