This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

The Week That Was (20th – 26th Sep 2021)

September 27, 2021

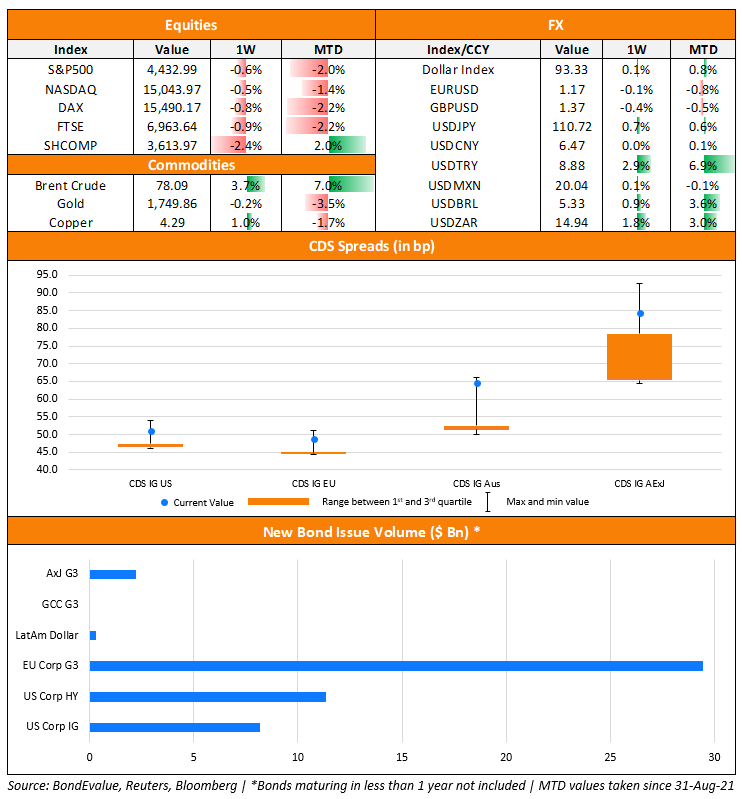

The week gone by was filled with bouts of sharp volatility on account of Evergrande’s impact not just on Chinese markets but overall global markets. Issuance volumes dropped overall and credit risk sentiment worsened, evidenced by the Asia ex-Japan CDS spreads widening 21bp on a single day, to end the week 16bp wider as seen in the chart above.

US primary market saw a decrease in issuance to $21.2bn vs. $37bn in the prior week. IG issuances fell sharply to $8.2bn vs. $27.4bn in the prior week. HY issuances on the other hand were higher at $11.6bn vs. $9.3bn in the prior week. The IG space saw American Tower raised $1.8bn via a three-trancher MetLife raised $1bn via a two-trancher to lead the table. In the HY space, Rocket Mortgage LLC raised $2bn via a two-trancher followed by Olympus Water’s $815mn deal. In North America, there were a total of 58 upgrades and 29 downgrades combined across the three major rating agencies last week. LatAm saw $150mn in issuances vs. $4.27bn in week prior with GOL Finance being the sole issuer. In South America, there were 7 upgrades and 3 downgrades combined across the major rating agencies. EU Corporate G3 issuances rose marginally to $29.4bn vs. $27.8bn in the week prior led by Enel’s €3.5bn three-trancher, British American Tobacco’s €2bn two-trancher and Altice France’s $2bn issuance. Across the European region, there were 50 upgrades and 12 downgrades across the three major rating agencies. GCC G3 issuances saw no issuances last week as compared to a mere $50mn in the week before. Across the Middle East/Africa region, there was 1 upgrade and 5 downgrades across the three major rating agencies. APAC ex-Japan G3 issuances saw a sharp drop to $2.2bn vs. $22.9bn and. $9.4bn in the prior weeks – CCBI raised $700mn via a 5Y bond followed by Gansu Province Electric, Huaibei City Construction and Bank of China Sydney branch each raising $300mn via a 3Y bond. The initial half of week saw chaos across credit markets with the Evergrande crisis impacting primary markets and hurting issuance volumes. In the Asia ex-Japan region, there were 6 upgrades and 10 downgrades combined across the three major rating agencies last week.

Go back to Latest bond Market News

Related Posts: