This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

The Week That Was (20 – 26 Oct, 2025)

October 27, 2025

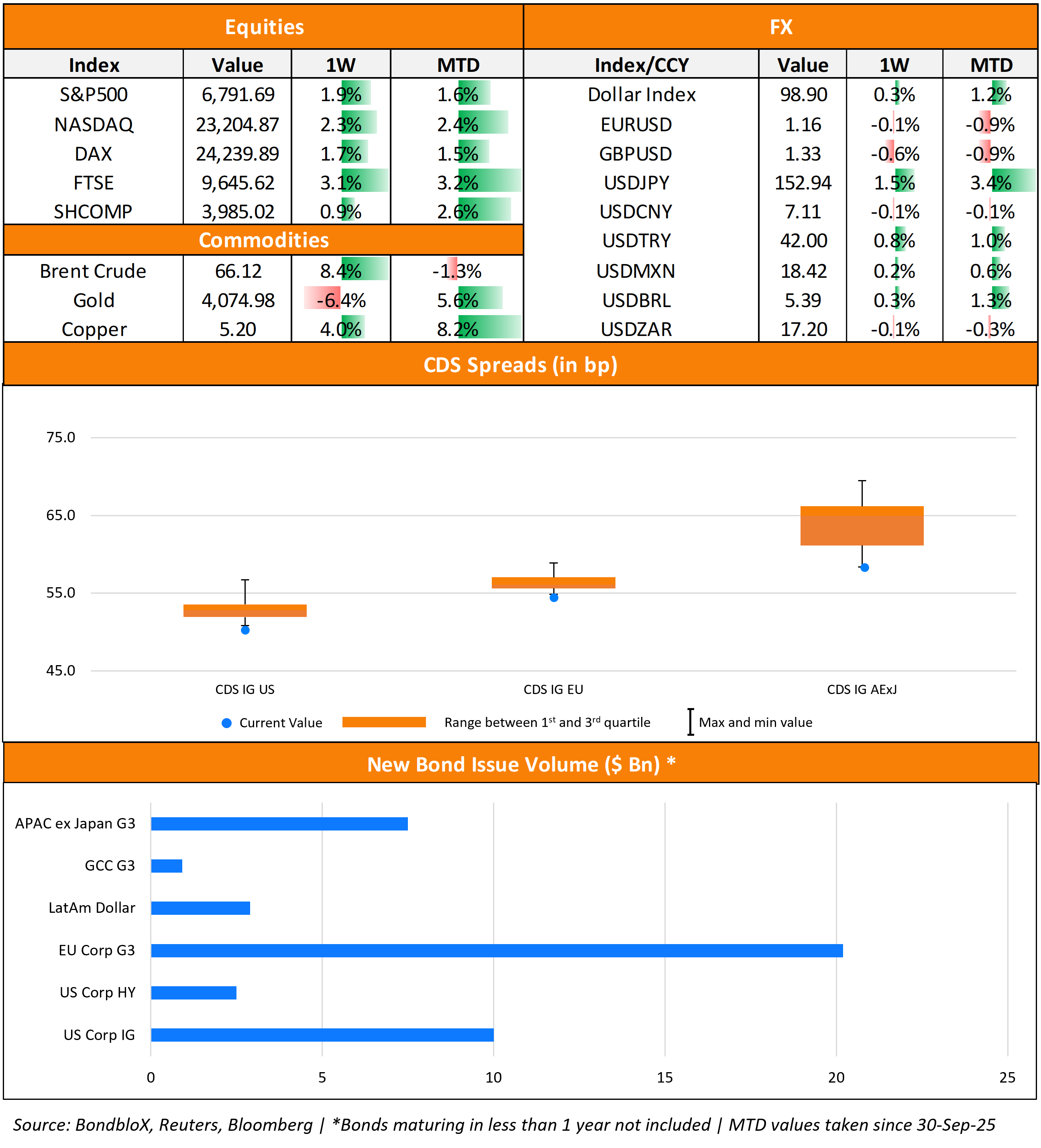

US primary market issuances fell last week to just $12.8bn vs. $31bn in new deals seen a week prior to it. IG issuers took up $10bn of the total, led by Truist Financial’s $2.5bn two-tranche deal and American Express’ $2bn issuance. HY deals stood at $2.5bn, led by Albertsons Cos’ $1.5bn two-part issuance and Versant Media’s $1bn issuance. In North America, there were a total of 28 upgrades and 26 downgrades, across the three major rating agencies last week. US IG funds saw $3.7bn in inflows during the week ended October 22, adding to the $2.2bn inflows seen during the week before that. These were the highest weekly inflows within the high-grade space in nearly four months. US HY bond funds saw $98mn in outflows, adding to the $796mn outflow seen in the prior week. CDS spreads across regions are at their tightest levels MTD, as seen in the chart below.

EU Corporate G3 issuances rose to $20.2bn vs. $16.3bn in the prior week, with volumes led by CaixaBank’s €4.25bn three-part deal, followed by Aegix Lux and British American Tobacco’s $2bn and $1.1bn two-part deals respectively. The region saw 22 upgrades and 73 downgrades across the three major rating agencies – a majority of the downgrades came on the back of S&P’s downgrade of France and several French companies, alongside Moody’s negative outlook action. Last week, the GCC dollar primary bond market saw a pick-up to $920mn in new issuances from $500mn in new deals seen a week before that, with Nama Holding’s $750mn issuance leading the table. In the Middle East/Africa region, there were 2 upgrades and 3 downgrades each across the major rating agencies. LatAm saw $2.9bn in new issuances last week. This was led by Dominican Republic’s $1.6bn deal and Volcan’s $750mn issuance. The South American region saw 9 upgrades and 6 downgrades across the three major rating agencies last week.

G3 issuances from the APAC ex-Japan region jumped to $7.5bn vs. $2.9bn in deals seen during the prior week. This was led by Select Access Investment’s $2bn issuance, Korea’s ~$1.7bn multi-currency deal and CBA’s $800mn two-part deal. In the APAC region, there were 14 upgrades and 10 downgrades each across the three rating agencies.

Go back to Latest bond Market News

Related Posts: