This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

The Week That Was ( 18 Aug 2025 – 24 Aug 2025)

August 25, 2025

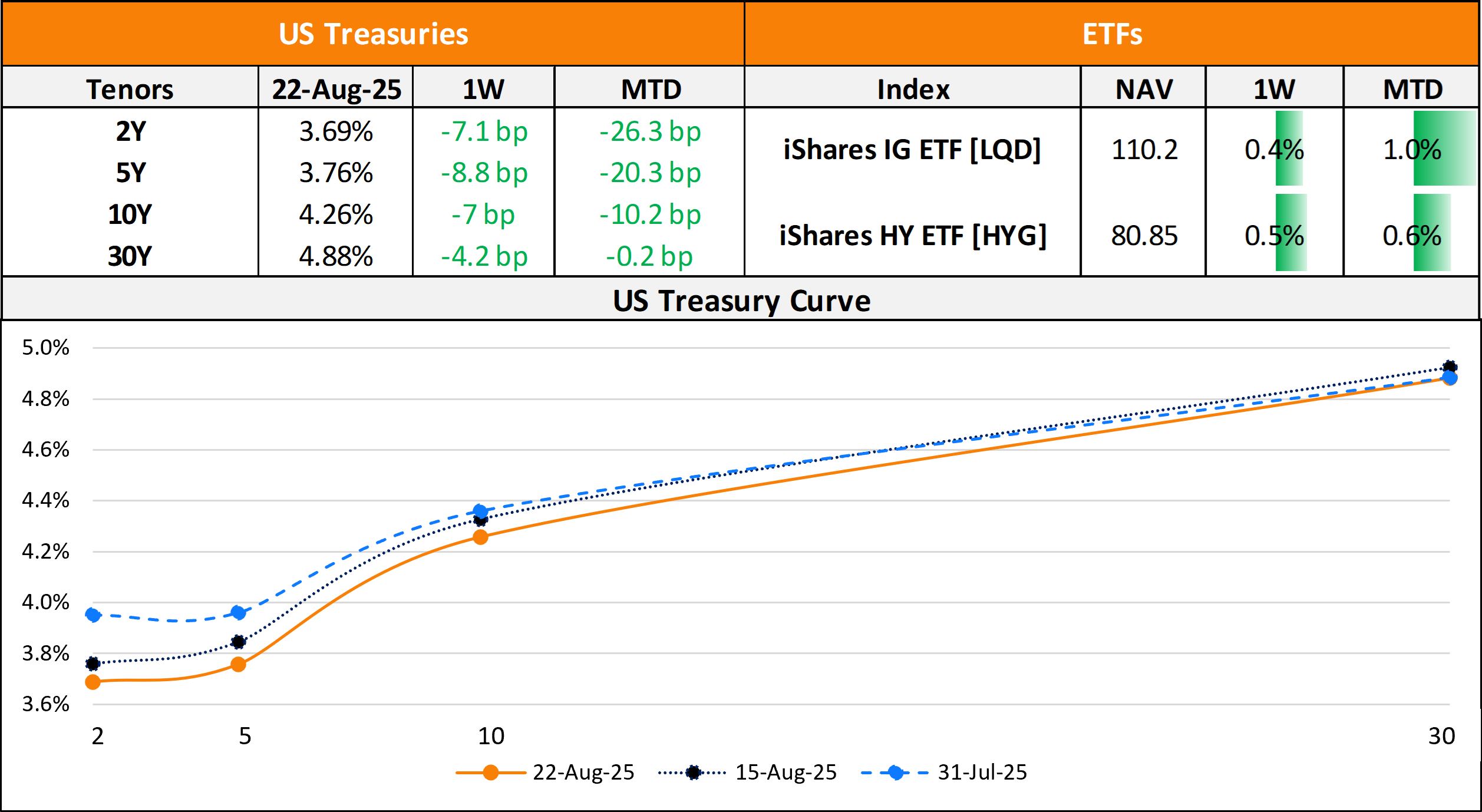

US primary market issuances fell to $23.5bn vs. $39.2bn in the prior week. IG issuers took up $22.6bn of the total, led by Eli Lilly’s $6.75bn seven-trancher and Charter Communications’ $2bn two-part issuance. HY issuances stood at $500mn, led by a solo deal from American National Group. In North America, there were a total of 46 upgrades and 42 downgrades, across the three major rating agencies last week. US IG funds saw $3.4bn in inflows during the week ended August 20, adding to the $2.5bn inflows seen during the week before that. US HY bond funds saw $185mn in inflows, adding to the $136mn inflows in the prior week. Credit spreads, as measured by the CDS spreads, across all regions are at their lowest levels seen in the last month.

EU Corporate G3 issuances rose to $16bn vs. $13.3bn in the prior week, led by Credit Agricole’s $2.25bn two-tranche deal and Nordea Bank’s $1bn two-part issuance. The region saw 9 upgrades and 18 downgrades across the three major rating agencies. Last week, the GCC dollar primary bond market saw no new deals for a third consecutive week. In the Middle East/Africa region, there were 7 upgrades and no downgrades across the major rating agencies. LatAm saw $1bn in new issuances with a solo deal by Grupo Nutresa, after having seen no new issuances for two consecutive weeks. The South American region saw 1 upgrade and 2 downgrades across the three major rating agencies last week.

G3 issuances from the APAC ex-Japan region stood at $5.8bn vs. $5bn in the prior week. This was led by DBS Group’s $2bn issuance, NAB’s €1.75bn and China Merchants Bank’s $600mn issuance. In the APAC region, there were 13 upgrades and 5 downgrades across the three rating agencies.

Go back to Latest bond Market News

Related Posts: