This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

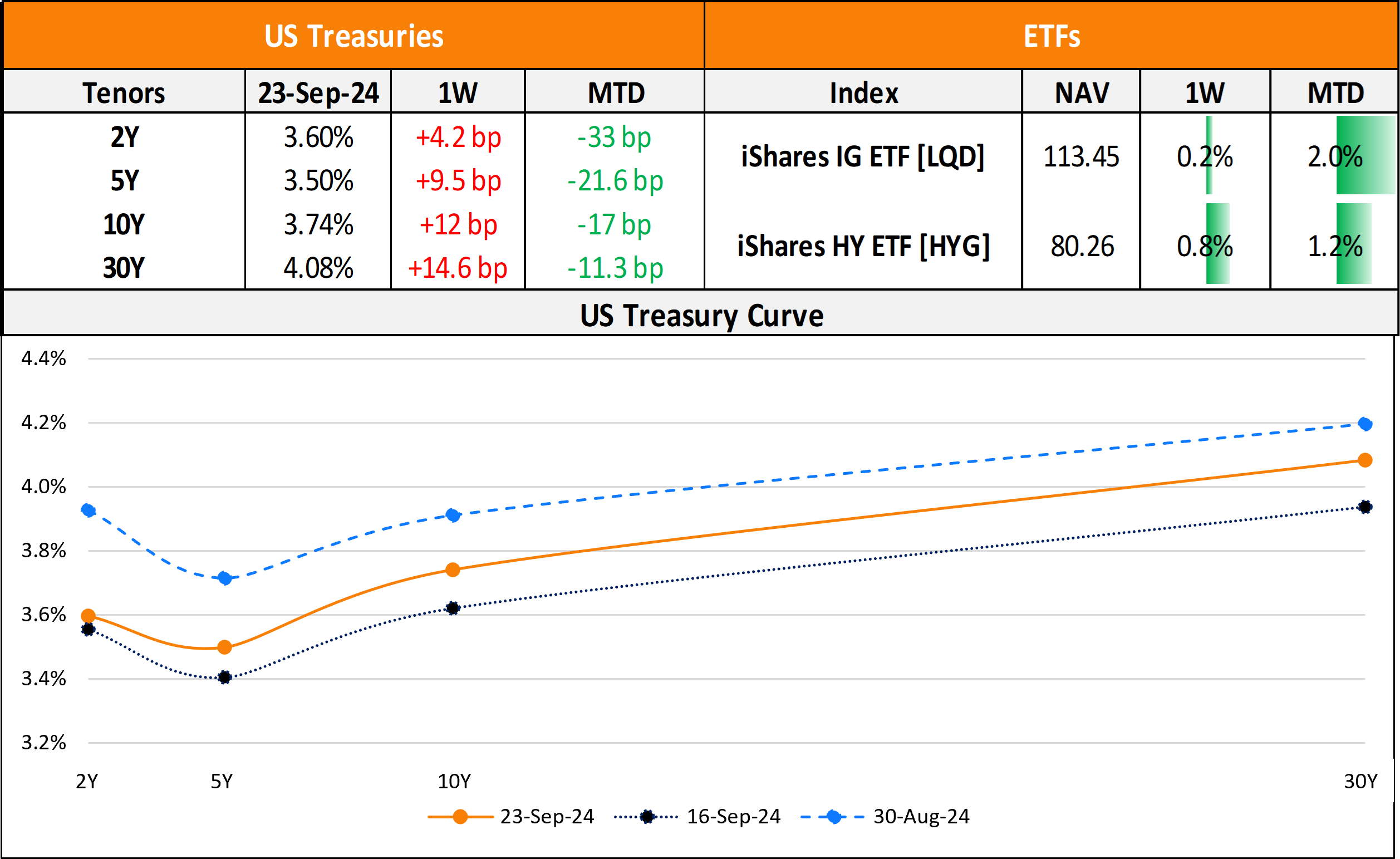

The Week That Was (16- 22 Sep, 2024)

September 23, 2024

US primary market issuances dropped significantly to $16.3bn due to the FOMC meeting vs. $45.3bn in the week prior. IG issuers took up $7.8bn of the total, led by Labcorp Holding’s $2bn and Sonoco Product’s $1.8bn three-trancher deal each. Last week saw $8.4bn in HY issuances from the region, led by Goldman’s $2bn preference share deal followed by Royal Caribbean Cruises’ $1.5bn offering. In North America, there were a total of 49 upgrades and 25 downgrades across the three major rating agencies last week. US bond funds attracted inflows for a 16th straight week in the week ended September 18, with US IG funds seeing $1.86bn of inflows, adding to the $244.1mn the week prior. HY funds saw $1.74bn of inflows adding to the $682.3mn of inflows the previous week.

EU Corporate G3 issuances rose last week to $35.9bn vs. $28.7bn in the week prior. Novartis raised €3.3bn via a four-part offering, followed by HSBC’s €3bn two-trancher deal. The region saw 102 upgrades and 22 downgrades, across the three major rating agencies. The GCC dollar primary bond market saw total issuance of $250mn compared to $1.1bn the previous week, attributable to Qatar Investment Authority’s $250mn two-trancher deal. In the Middle East/Africa region, there were 11 upgrades and no downgrades across the major rating agencies. LatAm saw $1.5bn in issuances last week vs $3.1bn in the prior week, led solely by CFE’s $1.5bn two-part offering. The South American region saw 2 upgrades and 4 downgrades across the rating agencies.

G3 issuance volumes from APAC ex-Japan fell sharply to $1.9bn vs. $5.5bn in the week prior to it. DBS Group’s $1.4bn covered deal led the table, followed by $200mn deal each by Chongqing Banan District and Xinchang Asset Investment Management. Besides these, Singapore’s OUE REIT raised S$180mn via a 7Y green deal. In the APAC region, there were 8 upgrades and 5 downgrades, across the three rating agencies last week.

Go back to Latest bond Market News

Related Posts:

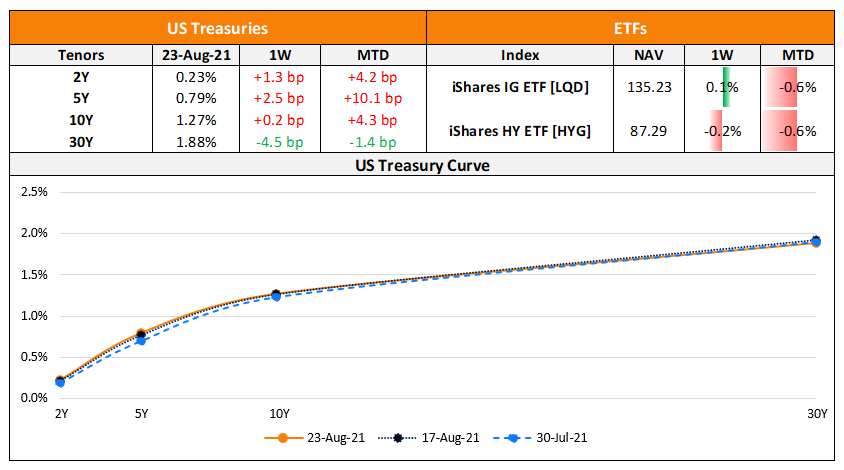

The Week That Was – (16th -22nd Aug)

August 23, 2021

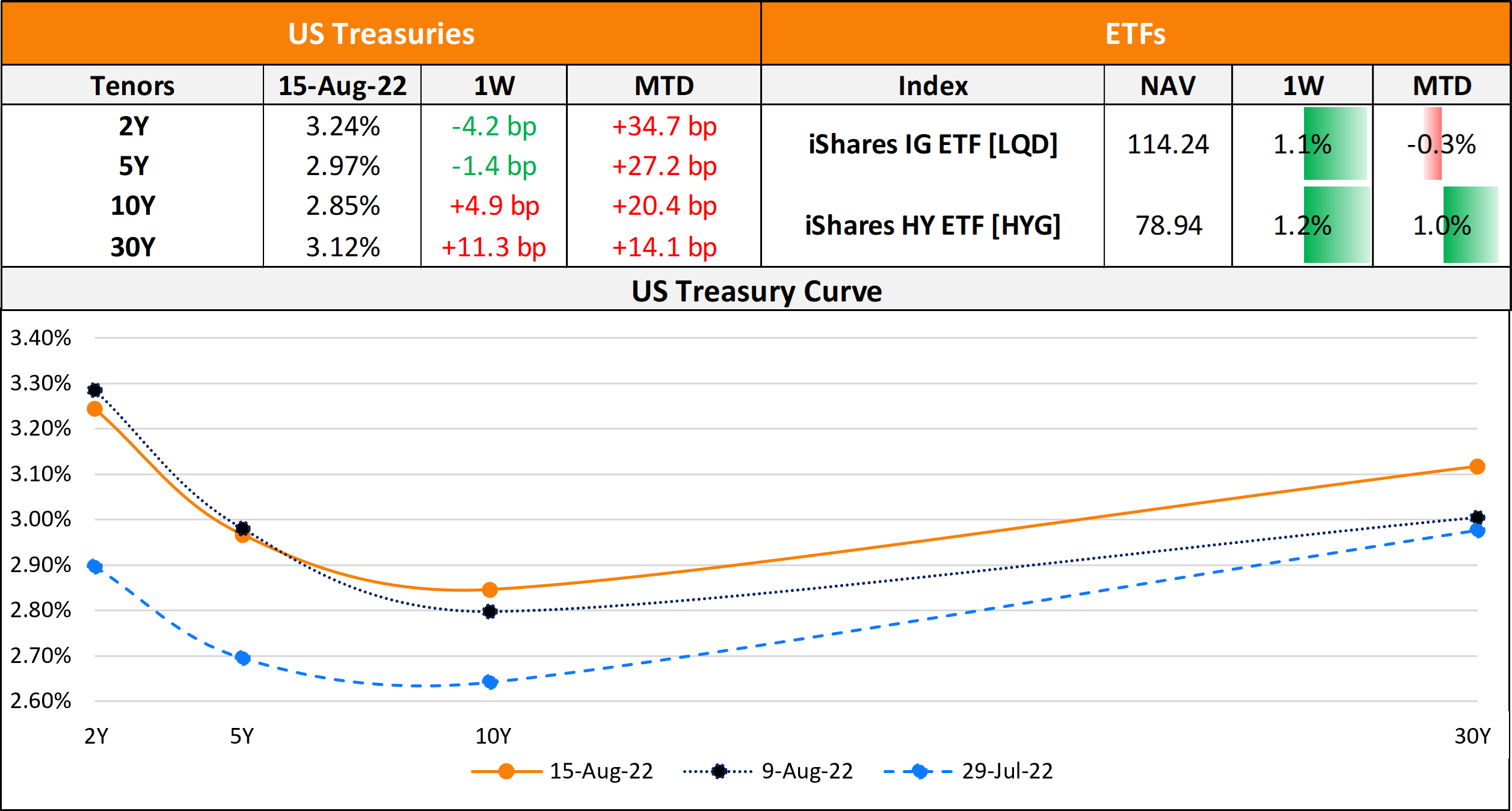

The Week That Was (8 August – 13 August, 2022)

August 15, 2022

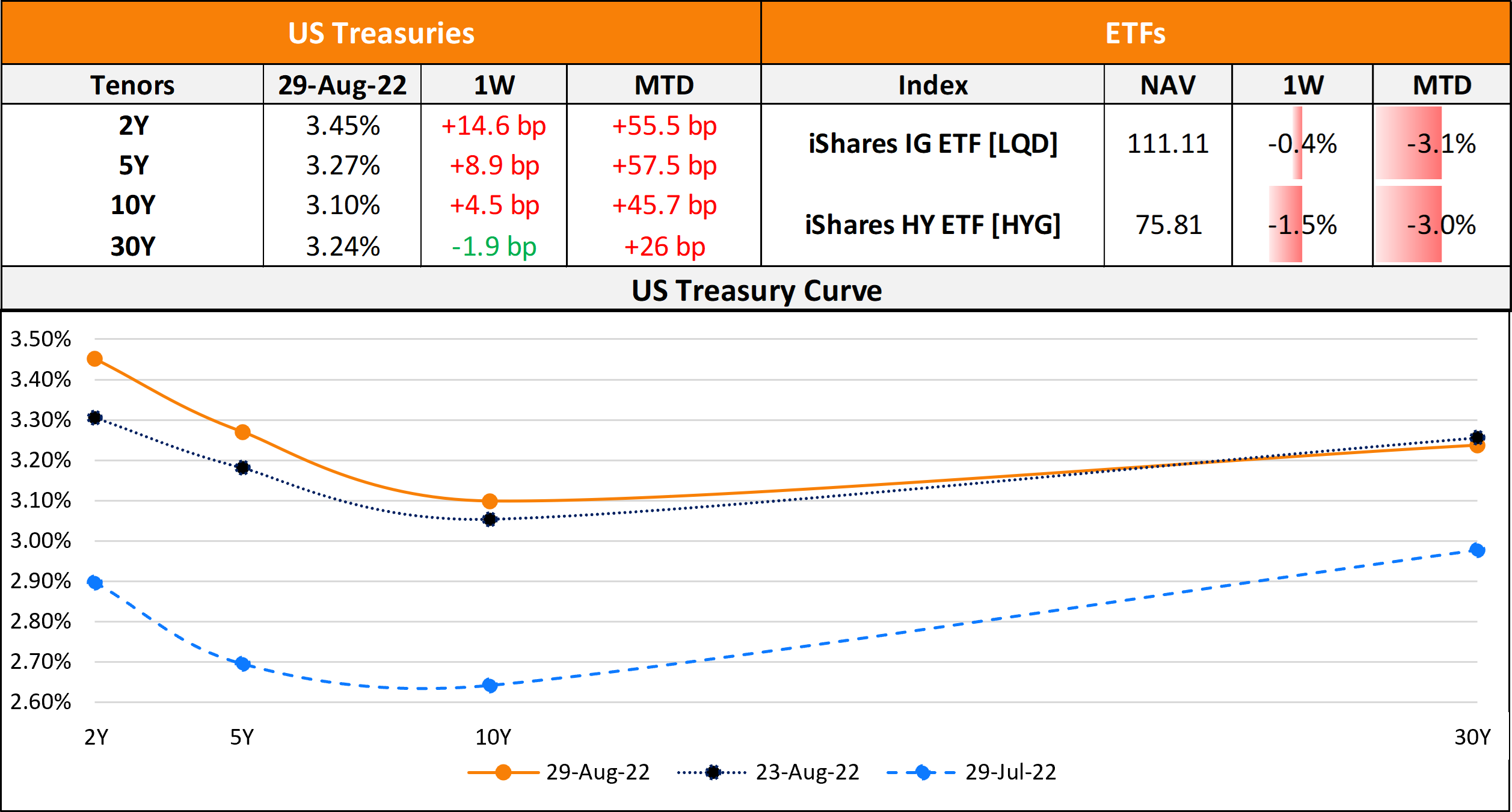

The Week That Was (22 August – 27 August, 2022)

August 29, 2022