This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

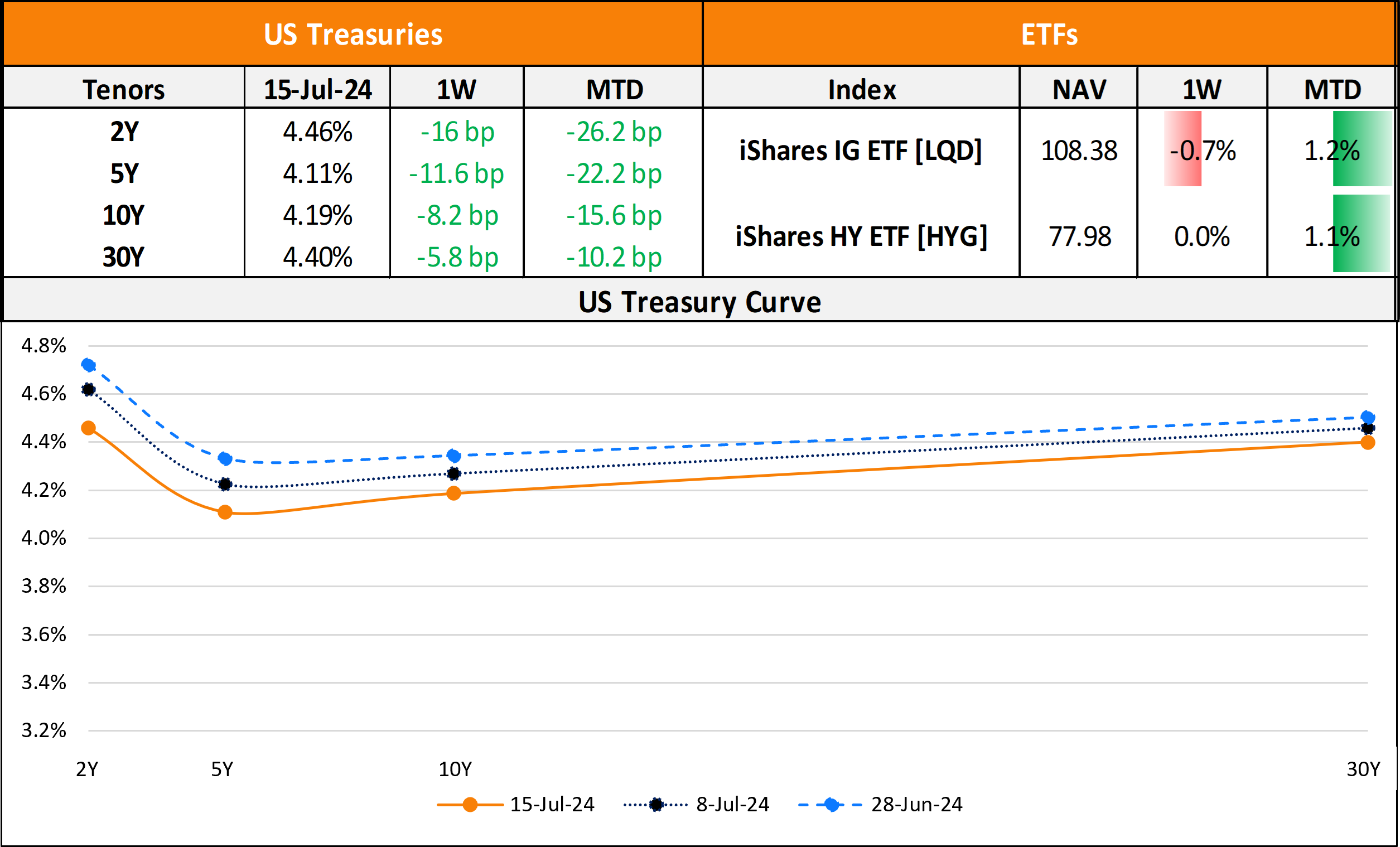

The Week That Was (15 – 21 July, 2024)

July 22, 2024

US primary market issuances jumped to $43.6bn last week from only $9.85bn in the week prior to it. IG issuers took up $40.4bn of the total, led by big banks after their earnings reports. JPMorgan’s $9bn and Morgan Stanley’s $8bn four-part deals each, were followed by Goldman Sachs’ $5.5bn two-trancher topping the tables. HY issuers accounted for $3bn of the volume with SM Energy’s $1.5bn two-trancher and Summit Midstream’s $575mn deals leading the tables. In North America, there were a total of 24 upgrades and 42 downgrades across the three major rating agencies last week. US IG funds saw inflows of $1.30b for the week ending July 17 compared to $38.4mn of inflows seen in the prior week. HY funds saw $2.64bn in inflows, adding to the $675.5mn inflows seen a week before this.

EU Corporate G3 issuances recorded a sharp drop in new deals last week to $14.1bn vs. $27.8bn seen in the week prior to it. Credit Mutuel’s €1.5bn two-trancher deal led the tables, followed by €1bn deals each from NRW Bank, Credit Agricole, Intesa Sanpaolo and Nationwide Building Society. The region saw 40 upgrades and 19 downgrades each across the three major rating agencies. The GCC dollar primary bond market saw $5.6bn in new deals last week compared to $7.75bn in new issuances in the week prior. Greensaid Pipelines’ $3bn and National Bank of Ras-Al-Khaimah’s $1.2bn two-trancher deals. In the Middle East/Africa region, there were no upgrades and nor downgrades across the major rating agencies. LatAm saw issuance volumes of $747bn vs. $500mn a week prior, led by Transportadora de Gas del Sur’s $490mn and BDB’s $213mn deals. The South American region saw 1 upgrade and 4 downgrades across the rating agencies.

G3 issuance volumes from APAC ex-Japan stood at $5.3bn vs. $5.7bn in the week prior to it. Hong Kong’s $1.82bn multi-currency two-trancher led the tables, followed by China Cinda’s $1bn two-trancher and NongHyup Bank’s $600mn two-part deal. In the APAC region, there were 2 upgrades and 6 downgrades across the three rating agencies last week.

Go back to Latest bond Market News

Related Posts:

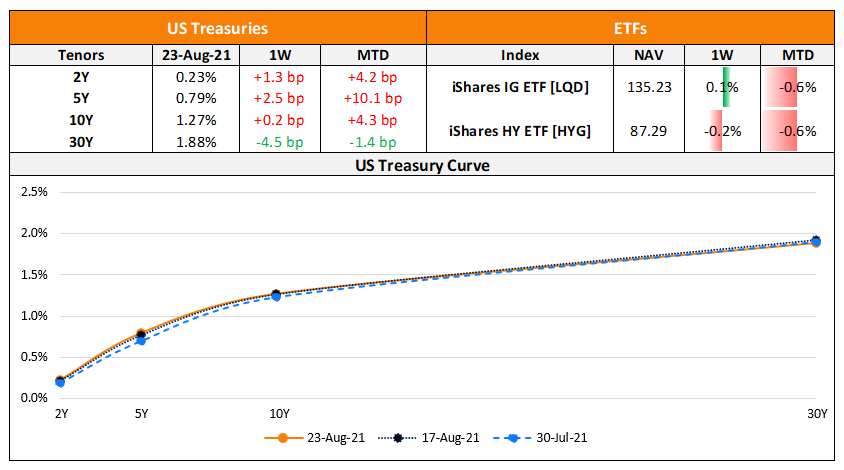

The Week That Was – (16th -22nd Aug)

August 23, 2021

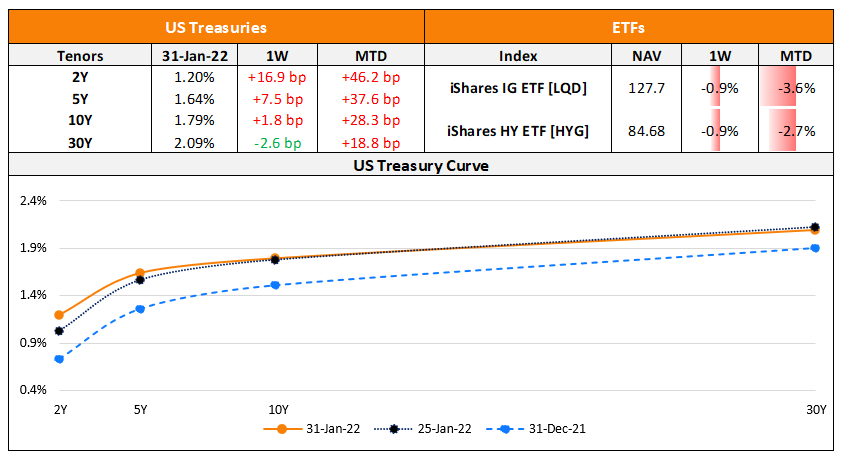

The Week That Was (24 – 30 Jan, 2022)

January 31, 2022

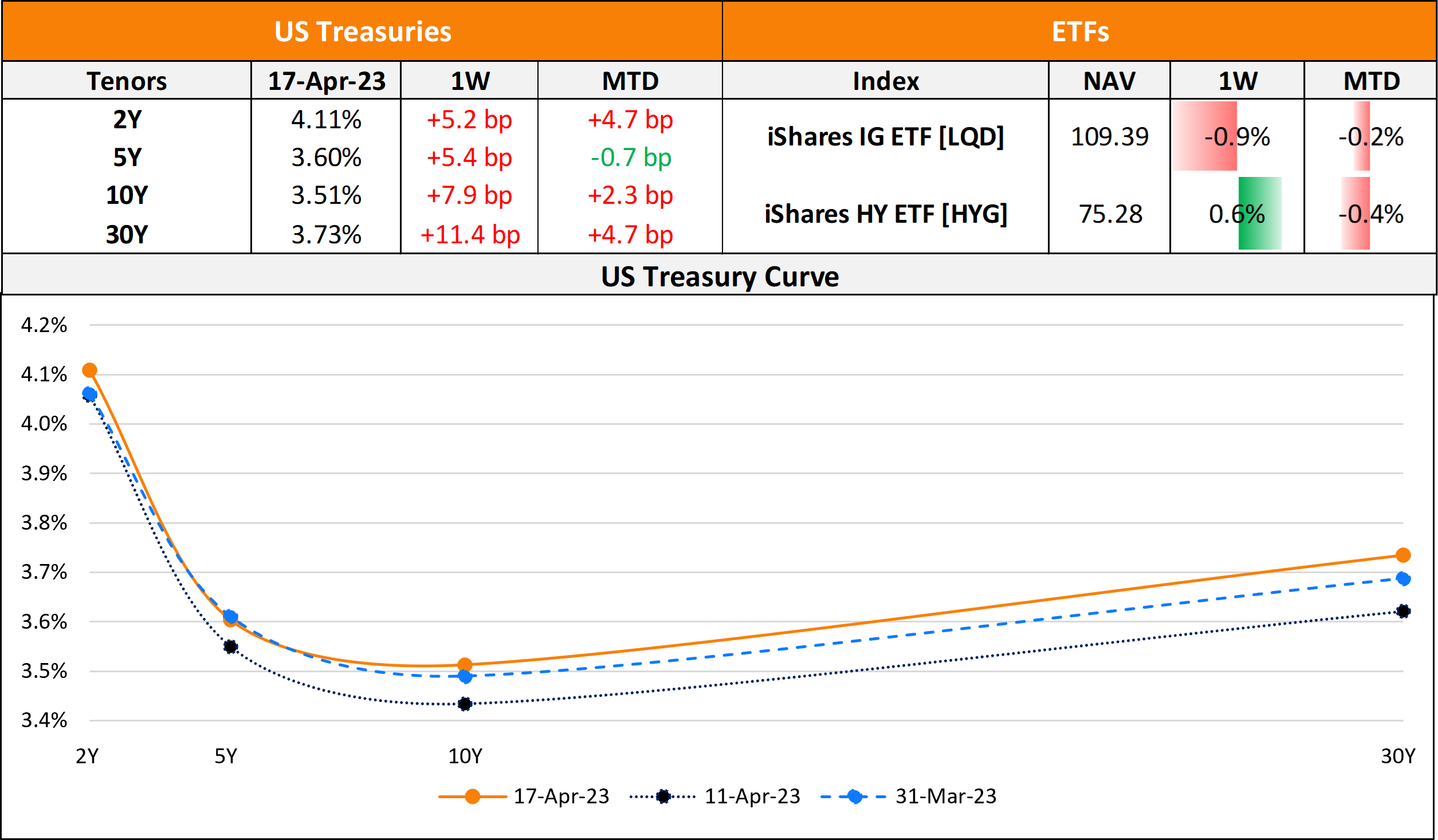

The Week That Was (10 – 16 April, 2023)

April 17, 2023