This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

The Week That Was (06 – 14 Nov, 2023)

November 14, 2023

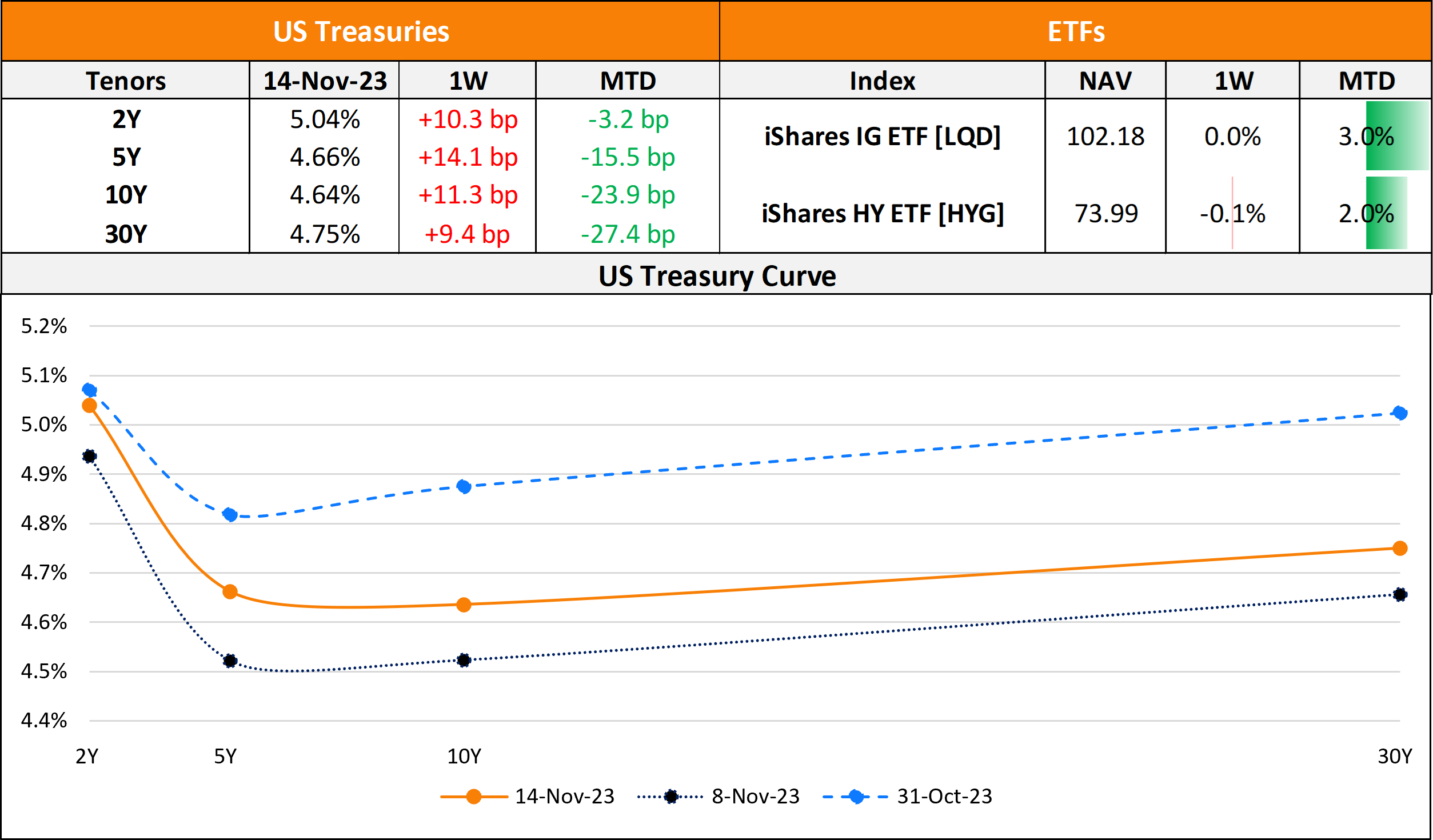

US primary market new deals jumped higher last week to $33.7bn vs. $25.7bn a week prior with IG deals at $23.8bn led by RTX’s $6bn five-trancher and Roche Holdings raising $4.4bn four-tranchers respectively. HY issuances stood at $4.9bn with SRM Concrete’s and Service Properties Trust raising $1.1bn and $1bn each. In North America, there were a total of 27 upgrades and 55 downgrades across the three major rating agencies last week. US IG bond funds saw outflows of $1.5bn, adding to outflows of $2.76bn for the week ended November 8. For the same period, HY funds saw inflows of $6.3bn, reversing $953mn in outflows seen in the week prior. Some investment managers have noted that buying high yield bonds could be the top contrarian trade in 2024 as default rates peak and rates ease (scroll to Talking Heads for more details).

EU Corporate G3 issuances were significantly higher at $42.9bn vs. $12.4bn a week prior. Issuance volumes were led by banks including UBS’s $3.5bn dual-trancher, HSBC’s $2bn deal and Intesa Sanpaolo’s €1.75bn issuance each. The region saw 29 upgrades and 20 downgrades across the three major rating agencies. The GCC dollar primary bond market saw $500mn in new deals with ADIB being the sole issuer, after seeing $450mn in deals a week prior. Across the Middle East/Africa region, there was 1 upgrade and downgrade each across the major rating agencies. LatAm saw $5.2bn in new deals after $1.8bn in deals a week earlier, with Colombia raising $2.5bn via a two-trancher and Costa Rica’s $1.25bn issuance. The South American region saw 8 upgrades and 16 downgrades each across the rating agencies.

G3 issuance volumes from APAC ex-Japan jumped to $9.3bn vs. $1.4bn a week prior to it led by Westpac raising $3.5bn via a four-trancher followed by Indonesia’s $2bn dual-tranche deal. In the APAC region, there were 6 upgrades and 7 downgrades each across the three rating agencies last week.

Go back to Latest bond Market News

Related Posts: