This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Tata Capital, Great Eastern Price $ Bonds

January 15, 2025

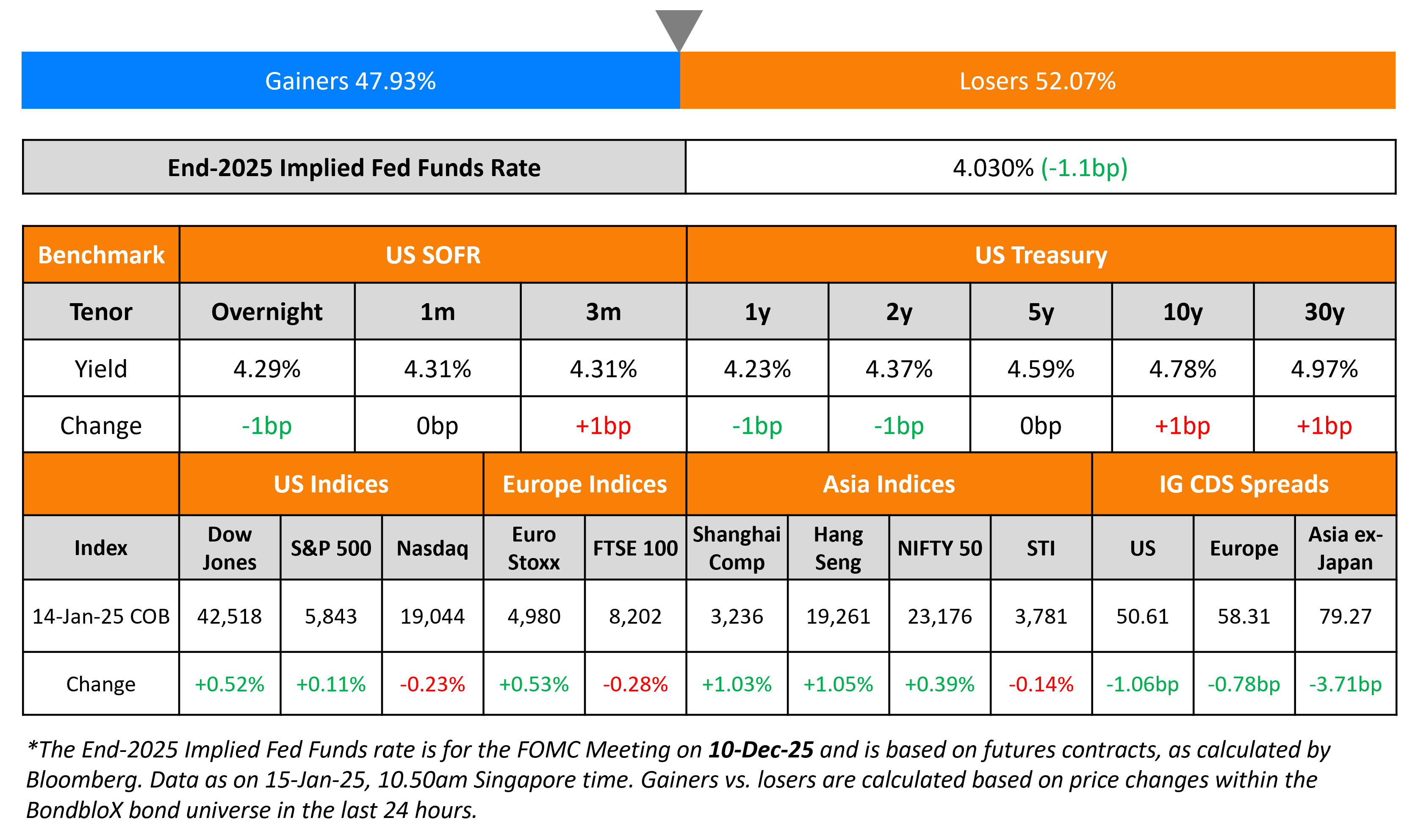

US Treasuries were broadly stable yesterday. The US Producer Price Index (PPI) for December rose 3.3% YoY, softer than the expected 3.5%. Also, the core reading came-in softer at 3.5% vs expectations of 3.8%. Some analysts note that overall inflation pressures might have potentially eased, adding that the reading tends to be a leading indicator of the consumer price inflation report that markets await later today.

US IG and HY CDS spreads tightened by 1.1bp and 0.4bp respectively. US equity markets were mixed, with the S&P up 0.1% while the Nasdaq was down 0.2%. European equities ended mixed too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.8bp and 2.7bp respectively. Asian equities are trading broadly mixed this morning. Asia ex-Japan CDS spreads were 3.7bp tighter.

New Bond Issues

Tata Capital raised $400mn via a 3.5Y bond at a yield of 5.389%, 32bp inside initial guidance of T+125bp area. The senior unsecured bonds are rated BBB- (S&P), and received orders of over $1.7bn, 4.3x issue size. The notes have a change of control (CoC) put at 100. A CoC event will occur if any person/persons, other than Tata Sons, its subsidiaries, its associates or affiliates, acquire, directly or indirectly, over 51% of voting rights. Proceeds will be used for onward lending and other activities, in accordance with extant ECB guidelines and applicable RBI approvals. The notes have maintenance covenants including a minimum capital adequacy ratio of 15%, and a net NPA ratio of less than or equal to 5%.

Hyundai Capital Services raised $500mn via a 3Y bond at a yield of 5.275%, 25bp inside initial guidance of T+105bp area. The senior unsecured notes are rated A3/A-. Proceeds will be used for general corporate purposes.

Great Eastern raised $500mn via a PerpNC7 bond at a yield of 5.398%, ~50bp inside initial guidance of 5.9% area. The subordinated bonds are rated A (S&P). If not called by 22 January 2032, the coupons reset to the 5Y UST plus 69.6bp. Proceeds will be used for general corporate purposes and for funding working capital and future growth plans.

New Bonds Pipeline

-

IIFL Finance hires for $ 3.5Y bond

- Turkcell hires for $ 5Y/7Y Sustainability bond

Rating Changes

-

Fitch Rates Unipol Assicurazioni IFS ‘A-‘, Upgrades Senior Debt to ‘BBB+’

-

Moody’s Ratings downgrades Foot Locker’s CFR to Ba3

Term of the Day: Change of Control Put

A change of control put is a common covenant in bond offerings, mentioned in the bond’s prospectus. Bonds that carry a change of control put offer bondholders the option to sell the bonds back to the issuer at a pre-defined price upon the occurrence of a change of control event, which is typically a change in ownership of the issuer. The option to redeem the bonds in this case lies with the bondholder, as against a call option, which lies with the issuer, not the bondholder.

Talking Heads

On Own More Bonds as Trump Ushers in Era of Uncertainty – Pimco

“Bond yields are attractive at a time when equity valuations and credit spreads are not, giving high quality fixed income a favorable starting point… Markets are pricing in terminal policy rates for global central bank easing cycles… There is significant near-term potential for lower central bank rates outside the US”

On Euro to Fall to Parity If US Yields Hit 5% – State Street

“Euro/dollar could break parity and maybe go a little below”… a further drop toward 0.95 in the euro would require a fresh driver, including further clarity on the outlook for US tariffs.

On Outcome of Next Policy Meeting Is Unclear – ECB’s Robert Holzmann

“What will happen in two weeks time I don’t know… don’t think we can go down as straight as it is, particularly as we recently had some hiccups with regards to inflation. Core inflation still closer to 3% than to 2%.”

Top Gainers and Losers- 15-January-25*

Go back to Latest bond Market News

Related Posts: