This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Swiss Re, BTN Indonesia Launch Bonds; HSBC, VW, ING, Ford and Others Price Bonds

March 19, 2025

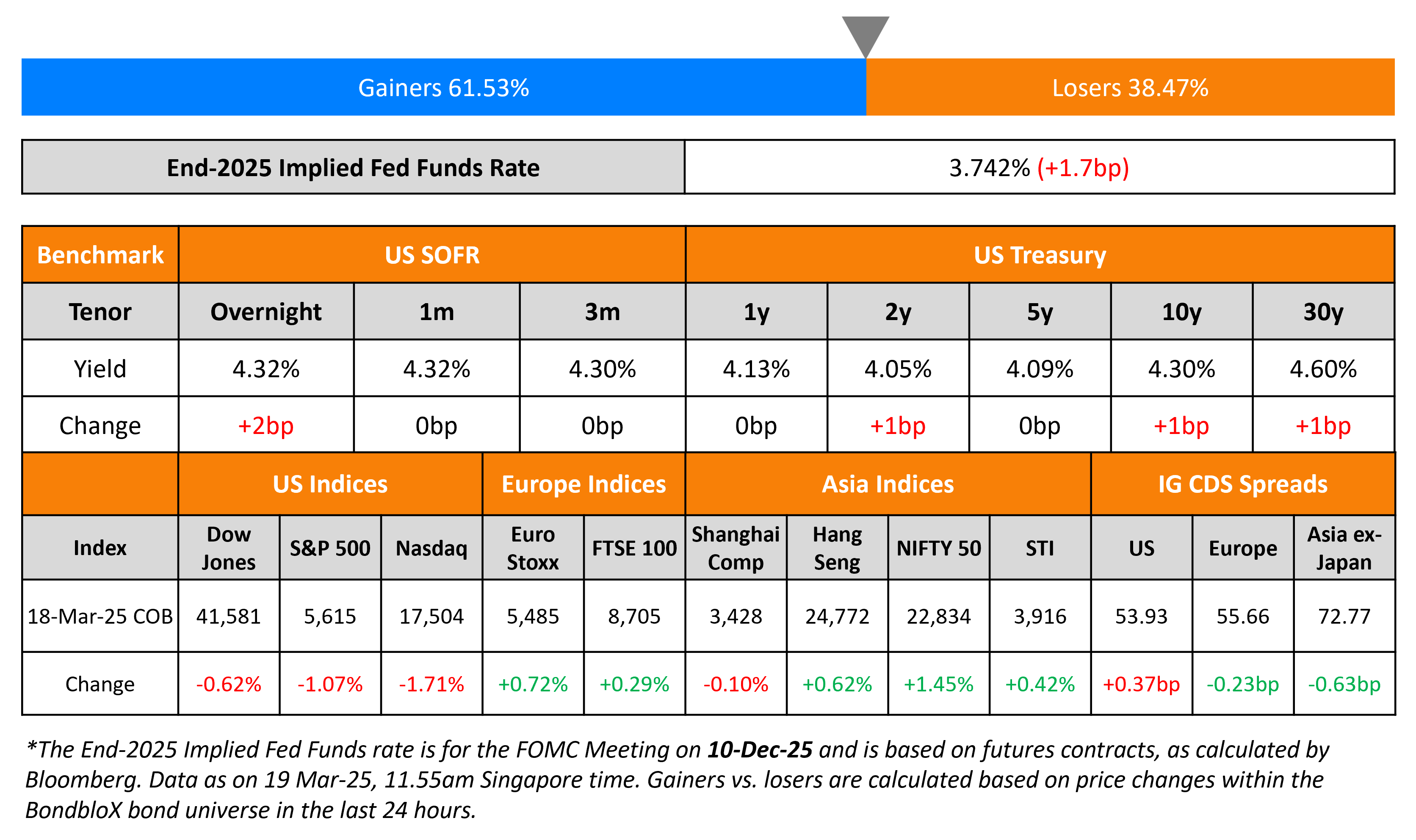

US Treasury yields remained stable on Tuesday, ahead of the two-day FOMC meeting. The final decision is expected later today where Fed is set to keep the Fed Funds range unchanged at 4.25-4.50%. However, some banks believe that the Fed might pause their quantitative tightening policy that aims to normalize its balance sheet.

US equity markets moved lower on Tuesday, with the S&P and Nasdaq down 1.1% and 1.7% respectively. Looking at credit markets, US IG and HY spreads CDS spreads widened 0.4bp and 3.4bp respectively. European equity markets ended higher. The iTraxx Main and Crossover CDS spreads tightened by 0.2bp and 4bp respectively. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were tighter by 0.6bp.

New Bond Issues

- BTN Indonesia $ 5Y Tier 2 at 6.55% area

- Swiss Re S$ 6NC5 at 4% area

- Muthoot Finance $ 4Y Tap at 6.375% area

HSBC raised S$800mn via a PerpNC5.5 AT1 bond at a yield of 5%, 25bp inside initial guidance of 5.25% area. The subordinated note is rated Baa3/BBB (Moody’s/Fitch). If not called by 24 September 2030, the coupon will reset to the 5Y SORA-OIS rate plus 270.5bp. A trigger event will occur if the consolidated CET1 capital ratio of the group falls below 7%. Proceeds will be used for general corporate purposes and to to maintain/further strengthen its capital base pursuant to requirements under UK CRR. This marks the first SGD-denominated AT1 issuance by a European bank this year.

Ford Motor Credit raised $2.1bn via a three-part deal. It raised:

- $1bn via a 3Y bond at a yield of 5.918%, 20bp inside initial guidance of T+210bp area

- $350mn via a 3Y FRN at SOFR+203bp vs. initial guidance of SOFR equivalent area

- $750mn via a 7Y bond at a yield of 6.532%, 20bp inside initial guidance of T+255bp area

The senior unsecured bonds are rated Ba1/BBB-/BBB-. Proceeds will be used for general corporate purposes.

Emirates Islamic Bank raised $750mn via a 5Y sukuk at a yield of 5.059%, 30bp inside initial guidance of T+125bp area. The senior unsecured note is rated A+ (Fitch). Proceeds will be used for general corporate purposes.

ING Groep raised $3.5bn via a four-trancher:

The senior unsecured bonds are rated Baa1/A-/A+. Proceeds will be used for general corporate purposes.

Volkswagen raised $3.5bn via a six-part deal.

The senior unsecured bonds are rated Baa1/BBB+/A-. Proceeds will be used for general corporate purposes.

Bangkok Bank raised $1bn via a 15NC10 bond at a yield of 6.056%, 37bp inside initial guidance of T+215bp area. The subordinated Tier 2 note is rated Baa1/BBB+/BBB. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Shinhan Bank hires for $ bond

- Greenko Wind hires for $ 3.5Y bond

Rating Changes

-

Three Saudi Corporates Upgraded To ‘A+’ From ‘A’ After Similar Rating Action On Sovereign; Outlooks Stable

-

Moody’s Ratings upgrades Alpha Bank S.A.’s long- and short-term deposit ratings to Baa2/P-2; outlook on the long-term deposits remains positive

-

Moody’s Ratings upgrades Piraeus Bank S.A.’s long- and short-term deposit ratings to Baa2/P-2; outlook on long-term deposit changes to stable

-

Moody’s Ratings downgrades Volkswagen Financial Services AG’s and Volkswagen Financial Services Overseas AG’s long-term issuer ratings

-

Fitch Downgrades Oriflame’s IDR to ‘C’ on Distressed Debt Exchange

-

Moody’s Ratings downgrades Nine Energy’s CFR to Caa2; negative outlook

-

Moody’s Ratings takes actions on four Romanian banks

-

Various Rating Actions Taken On Large Indian Finance Companies On Improving Regulatory

Environment

Term of the Day: Quantitative Tightening (QT)

Quantitative Tightening (QT) is a contractionary monetary policy measure used by central banks to decrease the amount of liquidity or money supply in the economy. This is the opposite of quantitative easing (QE) which tries to increase the liquidity and money supply. This typically takes place via the central bank’s balance sheet normalization policy where it reduces the pace of reinvestment of proceeds from maturing government bonds, ABS and other securities that it bough during the period when it conducted QE.

Talking Heads

On BNP Paribas Seeing Risk German Yield Hits 4% on Spending Boost

““While the ECB is likely to continue cutting rates this year, that might mark the low in this policy cycle in our base case. And if that is followed by higher rates thereafter, that also contributes to the range in bund yields rising over time”

On ECB Retaining Full Freedom to Act Amid Uncertainty – ECB’s Olli Rehn

“The Governing Council wants to retain full freedom of action, especially in our current times of pervasive uncertainty… not pre-committed to any particular rate path… By the time of the meeting we’ll get the relevant data, and then we’ll decide in which direction we’ll go

On Fed watchers see good chance of change in balance sheet drawdown

Evercore ISI

“We think the Fed will opt for a slowdown” in the pace of Treasury bond run-off… The Fed could announce this change at the March meeting to get ahead of potentially complicated meetings on the rates side in May and June”

BofA

“QT will likely be paused”

Goldman Sachs

“Likely to announce a pause in QT beginning in April”

Top Gainers and Losers- 19-March-25*

Go back to Latest bond Market News

Related Posts: