This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Suntec REIT Launches S$ PerpNC5 Bond

June 10, 2025

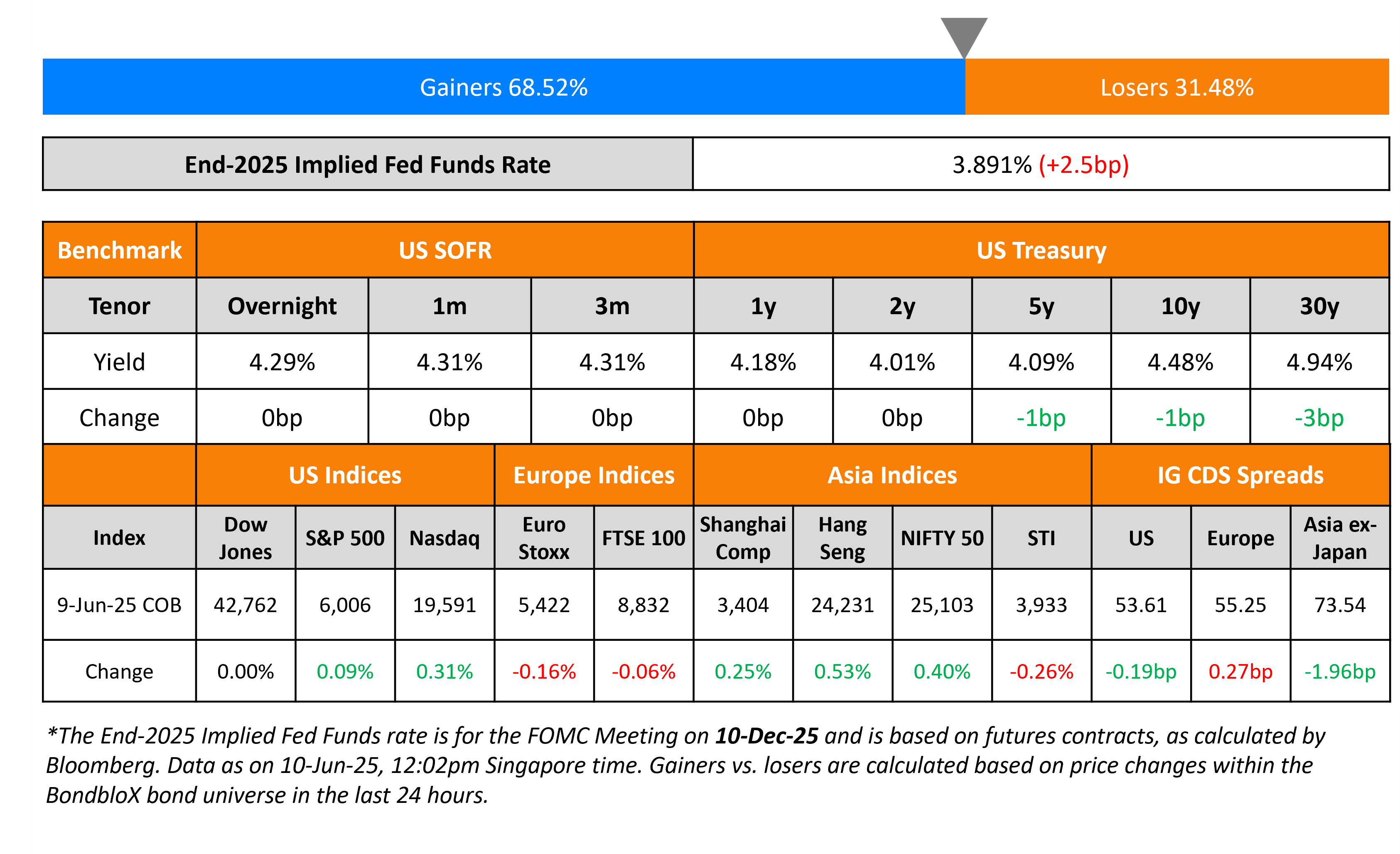

US Treasury yields remained broadly unchanged yesterday. US and Chinese officials met in London on Monday for high-level trade discussions, focusing on easing tariff tensions and securing China’s commitment to resume rare-earth exports. US President Donald Trump described the talks as “going well,” but analysts caution that while short-term deals on minerals and purchases may be possible, broader structural change remains unlikely.

Looking at US equity markets, S&P and Nasdaq were higher by 0.1% and 0.3% respectively. In credit markets, the US IG CDS spreads tightened by 0.2bp while HY CDS spreads widened by 0.1bp. European equity markets closed lower by about 0.1%. The iTraxx Main and Crossover CDS spreads widened by 0.3bp and 1bp respectively. Asian equity markets have opened higher today. Asia ex-Japan spreads tightened by 2bp.

New Bond Issues

- Suntec REIT S$ PerpNC5 at 4.8% area

Rating Changes

- TMK Hawk Parent Corp. Upgraded To ‘CCC+’ On ABL Maturity Extension; Outlook Negative

-

Fitch Upgrades Valmont to ‘BBB’; Outlook Stable

-

Moody’s Ratings downgrades BBVA Colombia’s ratings, changes outlook to stable

-

Moody’s Ratings changes outlook to positive on Terna; affirms rating

Term of the Day: Portfolio trading

Portfolio trading is a mechanism in which dealers move large baskets of bonds in a single trade often using ETFs, hence pricing and transacting an entire portfolio at one shot. The benefit of portfolio trading it to move large buckets of risk with ease by executing fewer, larger trades to reduce market impact, cost and reducing the time taken to execute on portfolios. As ICE notes, it is an “all or none” execution style. Bloomberg notes that portfolio trading has stalled in recent volatility as it becomes harder for dealers to set prices on those bonds when price are rapidly moving.

Talking Heads

On Credit Investors Embracing Portfolio Trades as ETF Grip Eases

Zornitsa Todorova, Barclays

“Many have said that the true test for portfolio trading would come when markets are volatile…it stood ground and provided that liquidity that people wanted…If you take the ETF out of the equation, there will be no portfolio trading.”

Sam Berberian, Citadel

“This growing interconnection between ETFs and PT is an overall positive for the credit marketplace…It integrates liquidity across investor segments and promotes a healthy cycle of innovation and transparency.”

On US corporate defaults to rise on higher-for-longer funding costs – Deutsche Bank

“The Fed is unlikely to provide rate cuts before job cuts. Either weaker growth and/or higher rates should prevent U.S. defaults from falling in 2026.”

On Fed Interest Payments Likely to Stay – JP Morgan

“Such a move would significantly impact banks’ profitability, their liquidity management strategies, lower short-term interest rates, increase usage of the Fed’s standing facilities, and most importantly, risk the Fed losing control of money market rates…the absence of IORB could jeopardize the Fed’s control over money market rates, complicating its monetary policy efforts”

Top Gainers and Losers- 10-Jun-25*

Go back to Latest bond Market News

Related Posts: