This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sunac Issues a Profit Warning; Creditors Of COGARD Demand Payment

August 22, 2023

Sunac China Holdings Ltd. issued a profit warning of RMB 16bn (~$2.2bn) in an exchange filing released on Friday. The developer attributed losses to the broader downturn in the real estate market, deteriorating gross profit margins of property projects, and expected net foreign exchange losses. As a result, Sunac shares slumped 13% in Hong Kong on Monday to HK$0.97, with its market value shrinking to $675mn, a steep fall from a peak at $28bn in December 2019.

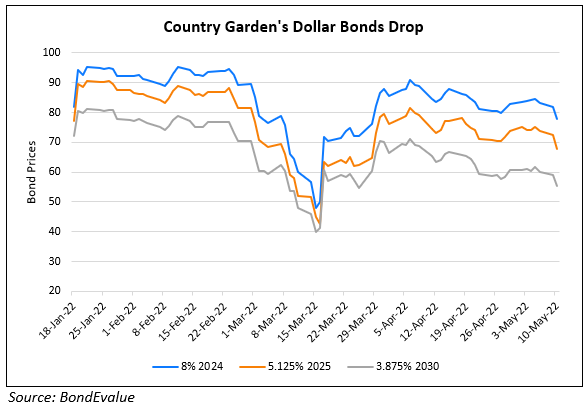

In other news, some of Country Garden’s bondholders demanded full repayment of local notes due early next month. The bondholders collectively hold 10.5% of the 5.65% notes with RMB 3.9bn ($534mn) of principal outstanding. The bondholders’ move brings about uncertainties over Country Garden’s proposal to delay repayment to avoid a default. According to the filing, COGARD plans to convene a bondholder meeting to vote on its extension plan and a separate full repayment request between August 23-25.

SUNAC and COGARD’s bonds continue to trade at distressed levels between 7 to 12 cents to the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts: