This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

StarHub Launches S$ PerpNC7; Vakif Katilim, Piraeus, Swedbank T-Mobile Price Bonds

October 7, 2025

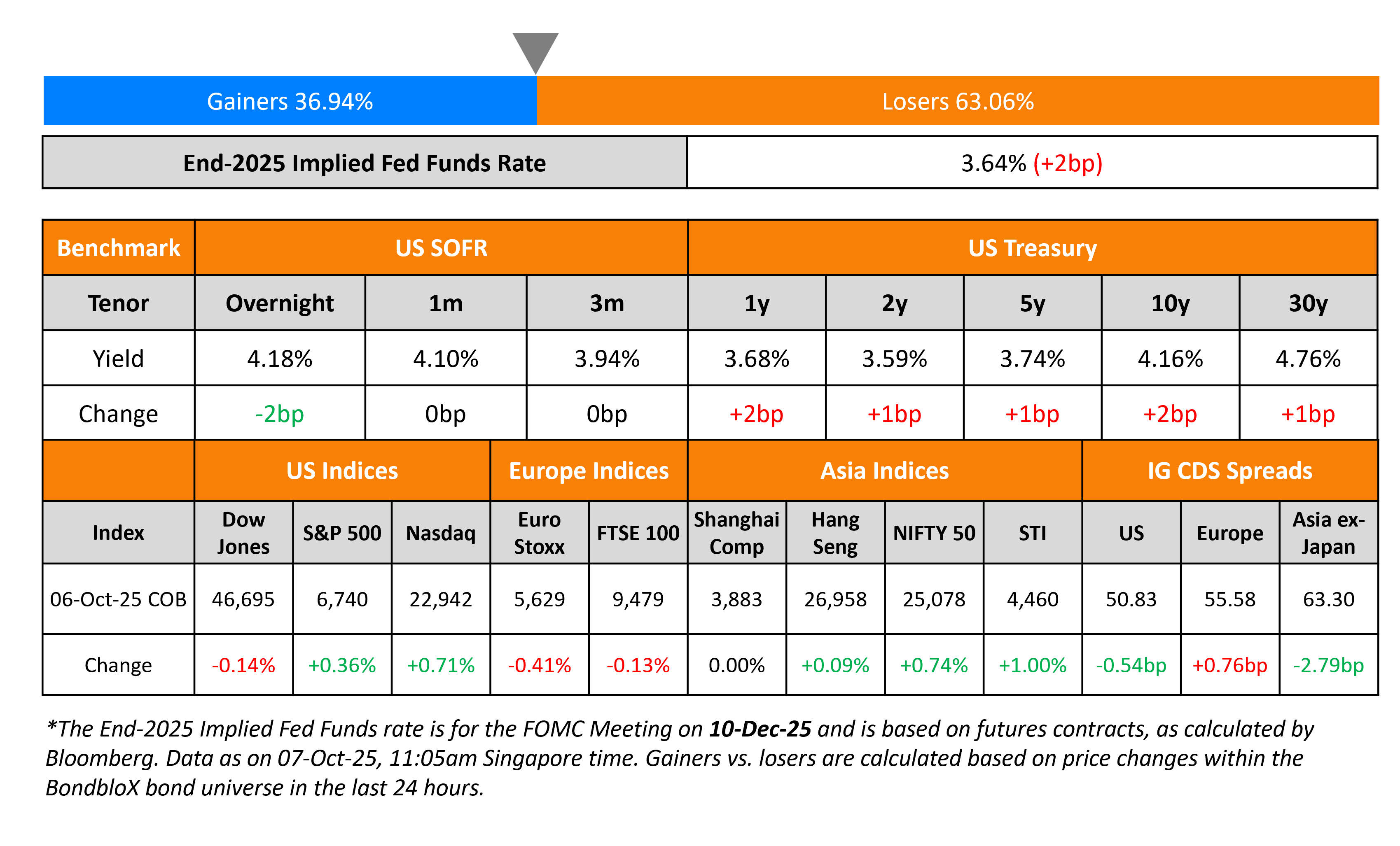

US Treasury yields were 1-2bp higher on Monday, continuing the upward move since late last week. There were no macro data points from the US due to the government shutdown, and no major catalysts driving the move. Separately, gold continued to rally to record highs, crossing $3,970.

Looking at equity markets, both the S&P and Nasdaq ended higher by 0.4% and 0.7% to record highs. US IG and HY CDS spreads were tighter by 0.5bp and 4.5bp respectively. European equity markets ended lower., with the CAC 40 closing 1.4% lower. The iTraxx Main and Crossover CDS spreads were both wider by 0.8bp and 2.9bp respectively. France’s Prime Minister Sebastien Lecornu resigned unexpectedly, with markets now worried about political uncertainty. On the back of this, the spread between the French 10Y and German 10Y bond yields (OAT-Bund spread) widened to ~90bp, its highest level this year. Asian equity markets have opened higher today. Asia ex-Japan CDS spreads were 2.8bp tighter.

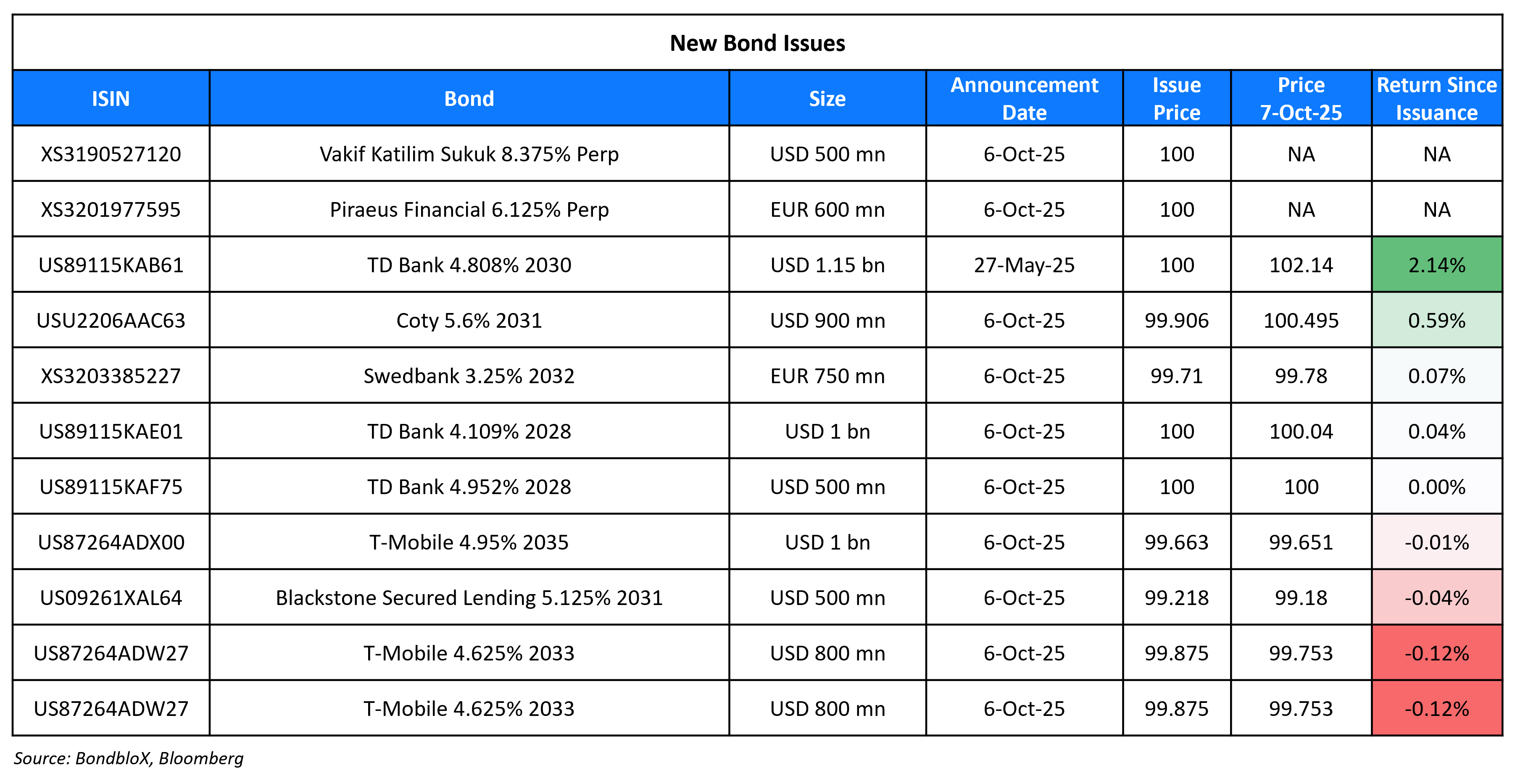

New Bond Issues

- StarHub S$ PerpNC7 at 3.75% area

Vakif Katilim raised $500mn via a PerpNC5.5 AT1 sukuk at a yield of 8.375%, 56.25bp inside initial guidance of 8.875-9% area. The junior subordinated note is unrated and received orders of over $1.6bn, 3.2x issue size. If not called by 13 April 2031, the profit rate will reset to the US 5Y Treasury yield plus 458.5bp. There is no step-up.

Muthoot Finance raised $150mn via a tap of its 6.375% 2030s at a yield of 5.863%. The bonds amortize by 20% each in months 42, 45, 48, 51 and 54. The bonds have a change of control (CoC) that would occur when the founder group collectively no longer holds control of issuer or at least 50% of voting rights. A CoC trigger event implies both a CoC event and a rating decline. Proceeds will be used towards onward lending, in accordance with approvals and relevant external commercial borrowing guidelines.

Piraeus Financial raised €600mn via a PerpNC7 AT1 bond at a yield of 6.125%, 37.5bp inside initial guidance of 6.50% area. The junior subordinated note is rated B1 (Moody’s). If not called by 15 October 2032, the coupon will reset to the 5Y Mid-Swap plus 369.6bp. Net proceeds will be used for general corporate purposes and to further strengthen its capital base and capital adequacy ratios which may include partially refinancing its existing €600mn 8.75% Perp.

T-Mobile raised $2.8bn via a three trancher. It raised:

- $800mn via a long 7Y bond at a yield of 4.642%, ~22.5bp inside initial guidance of T+95/100bp area

- $1bn via a 10Y bond at a yield of 4.928%, ~29.5bp inside initial guidance of T+110/115bp area

- $1bn via a long 30Y bond at a yield of 5.745%, ~29.5bp inside initial guidance of T+125/130bp area

The senior unsecured notes are unrated. Proceeds will be used for refinancing existing debt on an ongoing basis, or for other general corporate purposes.

Blackstone Secured Lending Fund raised $500mn via a long 5Y bond at a yield of 5.298%, 20bp inside initial guidance of T+175bp area. The senior unsecured notes are rated Baa2/BBB-/BBB. Proceeds will be used for general corporate purposes.

Swedbank raised €750mn via a 7Y greenbond at a yield of 3.297%, ~24.5bp inside initial guidance of MS+100/105bp area. The senior non-preferred bond is rated A3/A/AA-. Net proceeds will be applied to a sub-portfolio of loans with a special purpose to finance or refinance, in whole or in part, assets under its green framework.

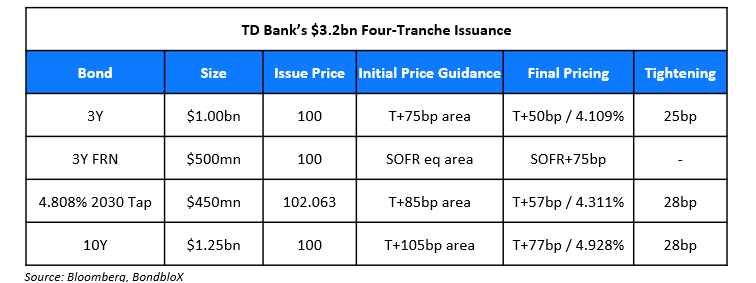

TD Bank raised $3.2bn via a four-trancher:

The senior unsecured notes are rated A2/A-/AA-. Proceeds will be used for general corporate purposes.

Rating Changes

- Marvell Technologies Inc. Upgraded To ‘BBB’ From ‘BBB-‘ On Improved Revenue Scale And Profitability; Outlook Stable

- Mercer International Inc. Downgraded To ‘B-‘ From ‘B’ On High Debt Leverage And Refinancing Risk; Outlook Stable

- TalkTalk Telecom Group Ltd. Downgraded To ‘D’ On Completed Debt Restructuring

- Moody’s Ratings revises BUMA’s outlook to negative

- Moody’s Ratings affirms U.S. Bancorp’s ratings (senior unsecured at A3); outlook changed to stable from negative

- Fitch Revises Paraguay’s Outlook to Positive; Affirms at ‘BB+’

- Outlooks On Two Jamaican Financial Entities Revised To Positive On Improved Banking Industry Operating Conditions

New Bonds Pipeline

- DAE $ 5Y Sukuk Investor Calls

- Avation $300-400mn, up to 5.5NC2 Bonds

- PIF EUR Green; 3Y, 7Y Investor Calls

Term of the Day: Coupon Step-Up

Coupon step-up refers to a feature seen in certain bonds wherein the coupon increases (steps-up) either as per a predefined schedule or upon the occurrence of an event. Coupon step-ups can either be a single step-up or multiple step-ups through the life of the bond. A commonly seen step-up is for perpetual bonds, wherein the coupon increases in the event that the bond is not called on its first call date. However, not every bond’s coupon step-up happens if the bond i not called on its first call date, as it depends on the covenant structure of the bond.

Talking Heads

On Bulls Seen Piling Into EMs as Momentum Returns

Goldman Sachs

EM markets are “thriving, not just surviving”

Jon Harrison, GlobalData

“The outlook for the remainder of the year is positive for equities on improving growth outlook and China stimulus, as well as for local debt as EM central banks continue to cut rates… should be solid inflows into EM assets”

Shamaila Khan, UBS Asset Management

“We’re in the very early stages of the demand continuing to come into emerging market debt”

On Citi Recommending Trade for Reflation, Fed Rate Hikes in 2026-2027

“The risk of a US rebound next year is growing. We think a slight cutting bias priced into this period look excessive”… US government shutdown “will make reading the health of the economy increasingly messy for the next few weeks”

On Treasuries Gain on Week as Shutdown Leaves Market ‘Flying Blind’

Gennadiy Goldberg, TD Securities

“The market’s flying blind at the moment in terms of the data surrounding the shutdown”

Kevin Flanagan, WisdomTree

“There is a sense the Fed is flying blind into a rate cut — that is a fair point, but the bar is high not to cut in October’

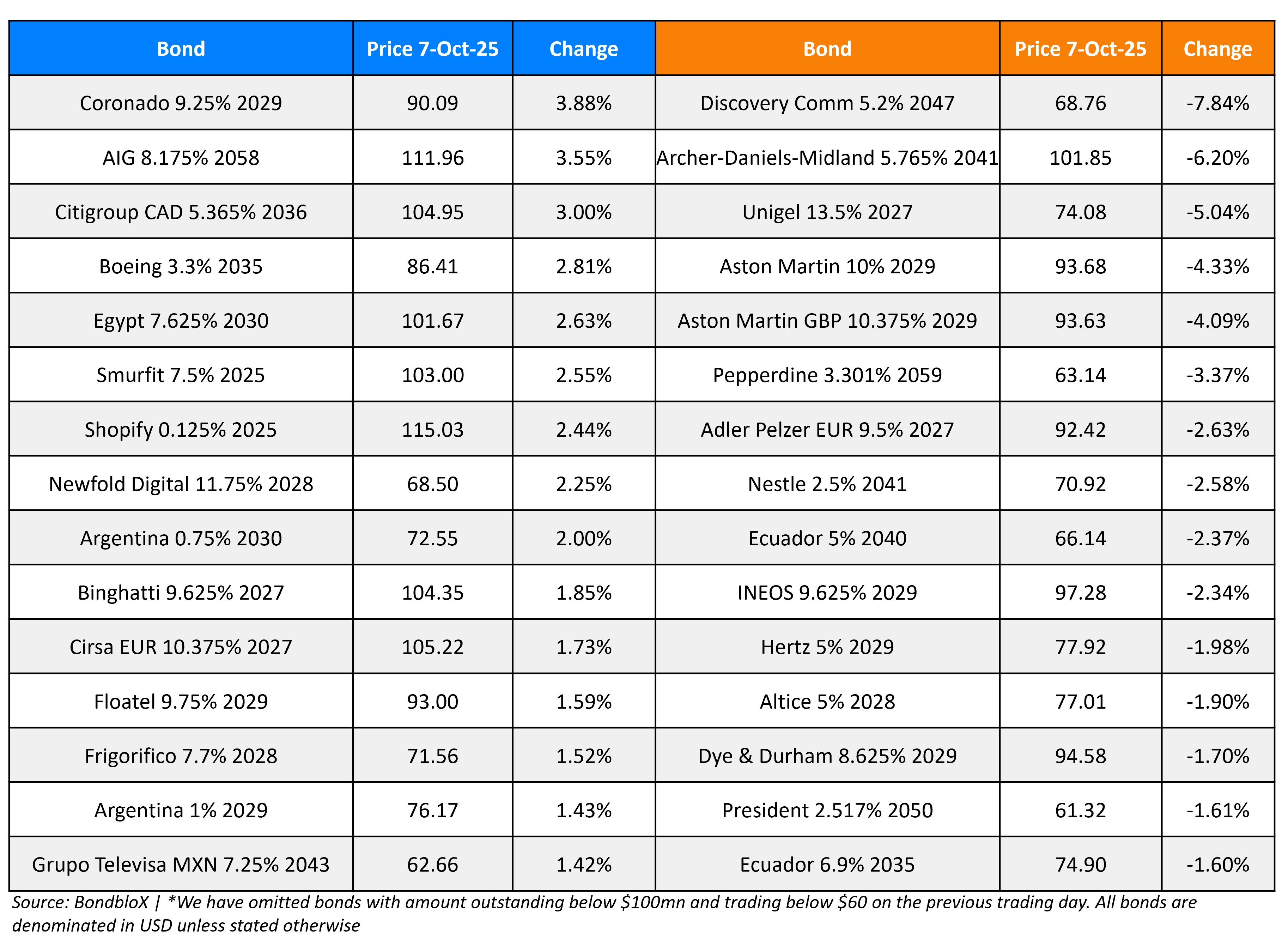

Top Gainers and Losers- 07-Oct-25*

Go back to Latest bond Market News

Related Posts: