This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

StarHub, BOC Dubai Launch Bonds; Markets Price 45% Chance of December Fed Cut

November 17, 2025

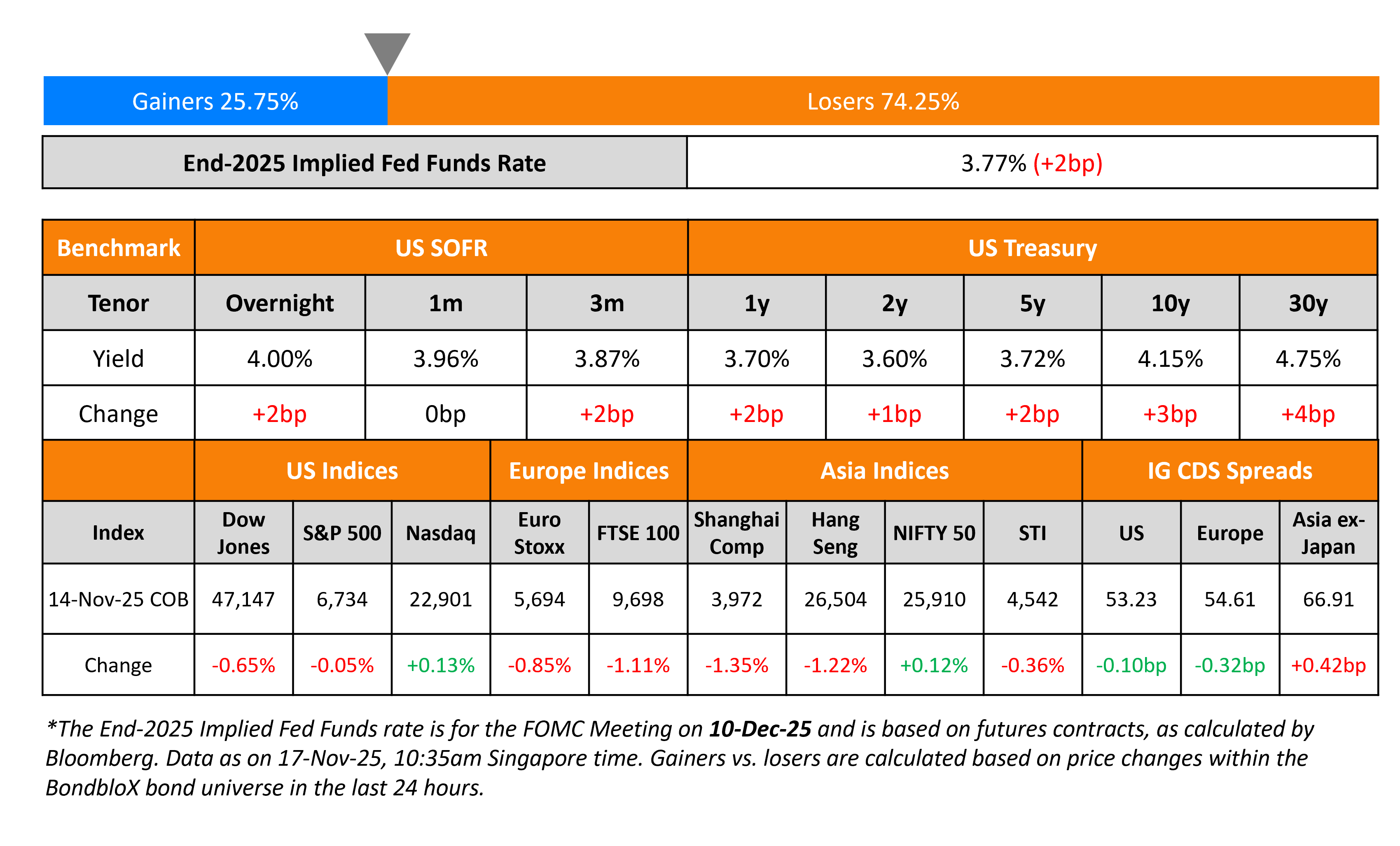

US Treasury yields were higher by 2-3bp across the curve. With the US government having reopened, NFP for September is due to be released on Thursday. Kansas City Fed President Jeff Schmid (voting member) said that he does not believe that further rate cuts will help boost the labour market, warning that it could have a larger impact on inflation. Atlanta Fed President Raphael Bostic (non-voting member) said that while he supported the recent two Fed rate cuts, he was not yet convinced about another cut in December. Markets are now only pricing-in a 45% probability of a 25bp rate cut in December as compared to nearly 65% during the same time last week.

Looking at the equity markets, the S&P closed lower by 0.1% while the Nasdaq was higher by 0.1%. US IG and HY CDS spreads were tighter by 0.1bp and 0.9bp respectively. European equity indices ended lower. The iTraxx Main CDS spreads were 0.3bp tighter and the Crossover CDS spreads were flat. Asian equity markets have opened broadly weaker today. Asia ex-Japan CDS spreads were wider by 0.4bp.

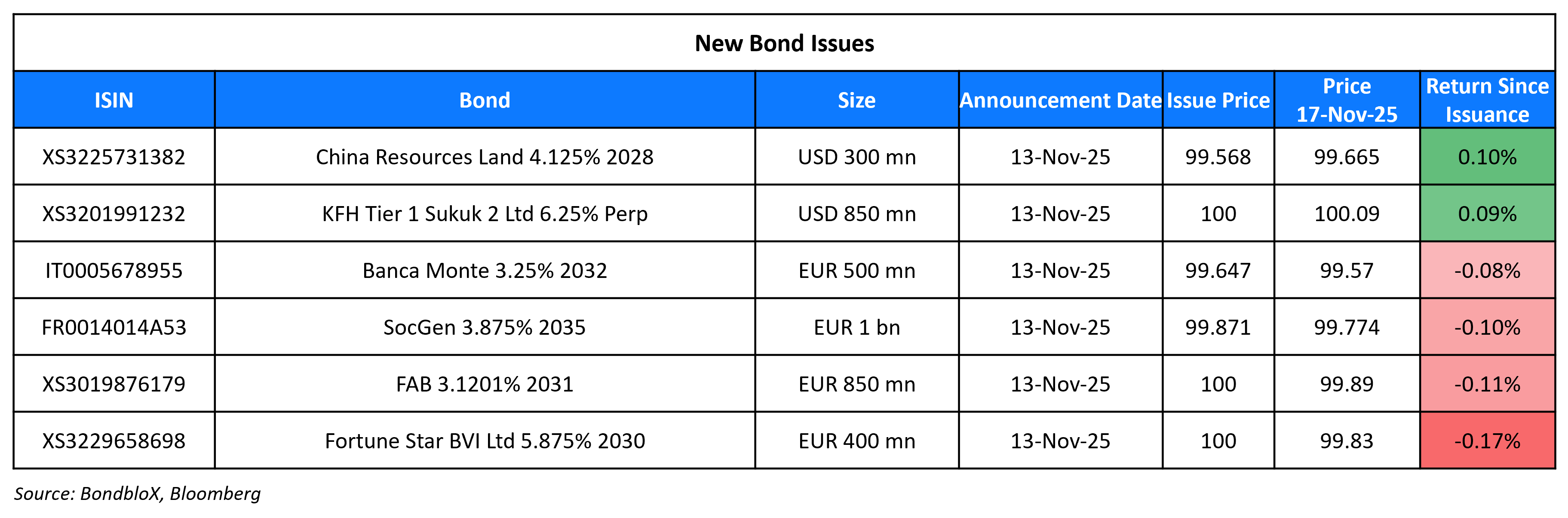

New Bond Issues

- StarHub S$ 10Y at 2.8% area

- BOC Dubai $ 3Y FRN at SOFR+100bp area

New Bonds Pipeline

- Buenos Aires investor calls

-

Bangkok Bank $ 5Y/10Y senior notes

Rating Changes

- South Africa Foreign Currency Rating Raised To ‘BB’; Local Currency Rating Raised To ‘BB+’; Outlook Positive

- Fitch Upgrades Greece to ‘BBB’; Outlook Stable

- Parkland Corp. Upgraded To ‘BB+’; Ratings Withdrawn Following Acquisition By Sunoco LP

- Nissan Motor Downgraded To ‘BB-‘ On Continuing Pressure On Profitability; Outlook Negative

- Senegal Long-Term FC Rating Lowered To ‘CCC+’ On Precarious Debt Position; Placed On CreditWatch Developing

- Inversiones Atlantida S.A. And Banco Atlantida Downgraded And Placed On CreditWatch Negative On Higher Refinancing Risk

- Moody’s Ratings downgrades LG Chem’s and LG Energy Solution’s ratings to Baa2, changes outlooks to stable

- Moody’s Ratings downgrades Mercer’s CFR to Caa1; outlook stable

- Co-operative Group Ltd. Downgraded To ‘BB-‘ On Weaker Cash Flows And Cyber Disruption; Outlook Stable

- Fitch Downgrades Petrofac to ‘D’

- Nigeria Outlook Revised To Positive From Stable; ‘B-/B’ Ratings Affirmed

- Fitch Places NIBC on Rating Watch Positive on Potential Acquisition by ABN AMRO

- Coca-Cola Consolidated Inc. Outlook Revised To Negative From Stable On Increased Leverage; Ratings Affirmed

Term of the Day: Sovereign Risk Premium

Sovereign risk premium refers to the additional implied spread that a country’s sovereign bonds offer vs. a benchmark for a particular currency. Put differently, it is the incremental return (or yield) that investors demand from a country to buy its sovereign bonds vs. the benchmark.Sovereign Risk Premium

Talking Heads

On Crowded EM Trades Drawing Warnings From Money Managers

Brendan McKenna, Wells Fargo

“Investors are too complacent on emerging markets. FX valuations, for most if not all, are stretched and not capturing a lot of the risks hovering over markets”

Anthony Kettle, RBC BlueBay Asset

“As we approach year-end, there is a risk that some investors look to take profits on what has been a successful trade in 2025”

Rohit Chopra, Lazard Asset

“From a factor perspective, lower-quality companies have been outperforming higher-quality peers. Historically, this divergence has not been sustained, suggesting the potential for a reversal”

On AI Debt Explosion Has Traders Searching for Cover

John Servidea, JPMorgan Chase & Co.

“We’re seeing renewed interest from clients in single-name CDS discussions, which had waned in recent years”

Sal Naro, Coherence Credit Strategies

“There’s a blip in the CDS market right now because of the data center build out”

On Goldman Seeing Higher Japan Bond Premium amid Fiscal Worries

“Even if the eventual outcome turns out to be less extreme than feared, the market’s heightened sensitivity around fiscal concerns suggests any path to ultimate relief could be a bumpy one”

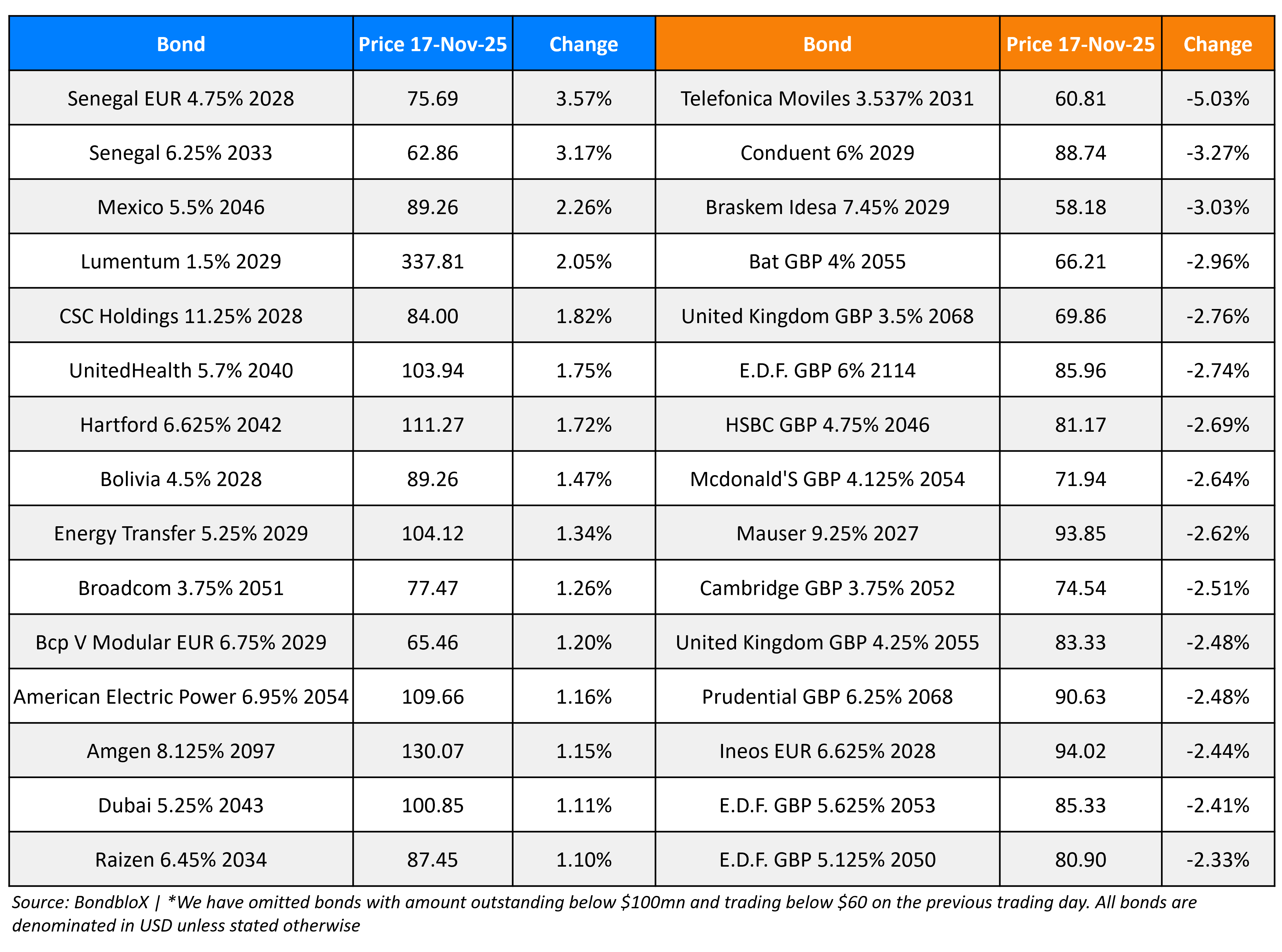

Top Gainers and Losers- 17-Nov-25*

Go back to Latest bond Market News

Related Posts: