This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

StanChart Launches $ AT1, QBE Launches Tier-2

November 4, 2025

US Treasury yields eased by 2-3bp on Friday. The ISM Manufacturing Index fell to 48.7 in October, worse than expectaitons of 49.5 and the prior month’s 49.1 print. This was its eighth consecutive reading in contractionary territory. Several Fed speakers came out with their views on monetary policy. Fed Governor Lisa Cook said that she considers the December’s FOMC meeting to be a “live” one, and will be data dependent. San Francisco Fed’s Mary Daly said that she supported last week’s rate cut and will “keep an open mind” regarding the December meeting. Chicago Fed President Austan Goolsbee said that he was undecided going into the December meeting, but that his “threshold for cutting is a little bit higher than it was at the last two meetings”.

Looking at equity markets, the S&P and Nasdaq ended higher by 0.2% and 0.5%. The US IG and HY CDS spreads widened by 0.7bp and 2.4bp respectively. European equity indices ended mixed. The iTraxx Main CDS spreads were 0.4bp wider while the Crossover CDS spreads were flat. Asian equity markets have opened lower today. Asia ex-Japan CDS spreads were nearly unchanged.

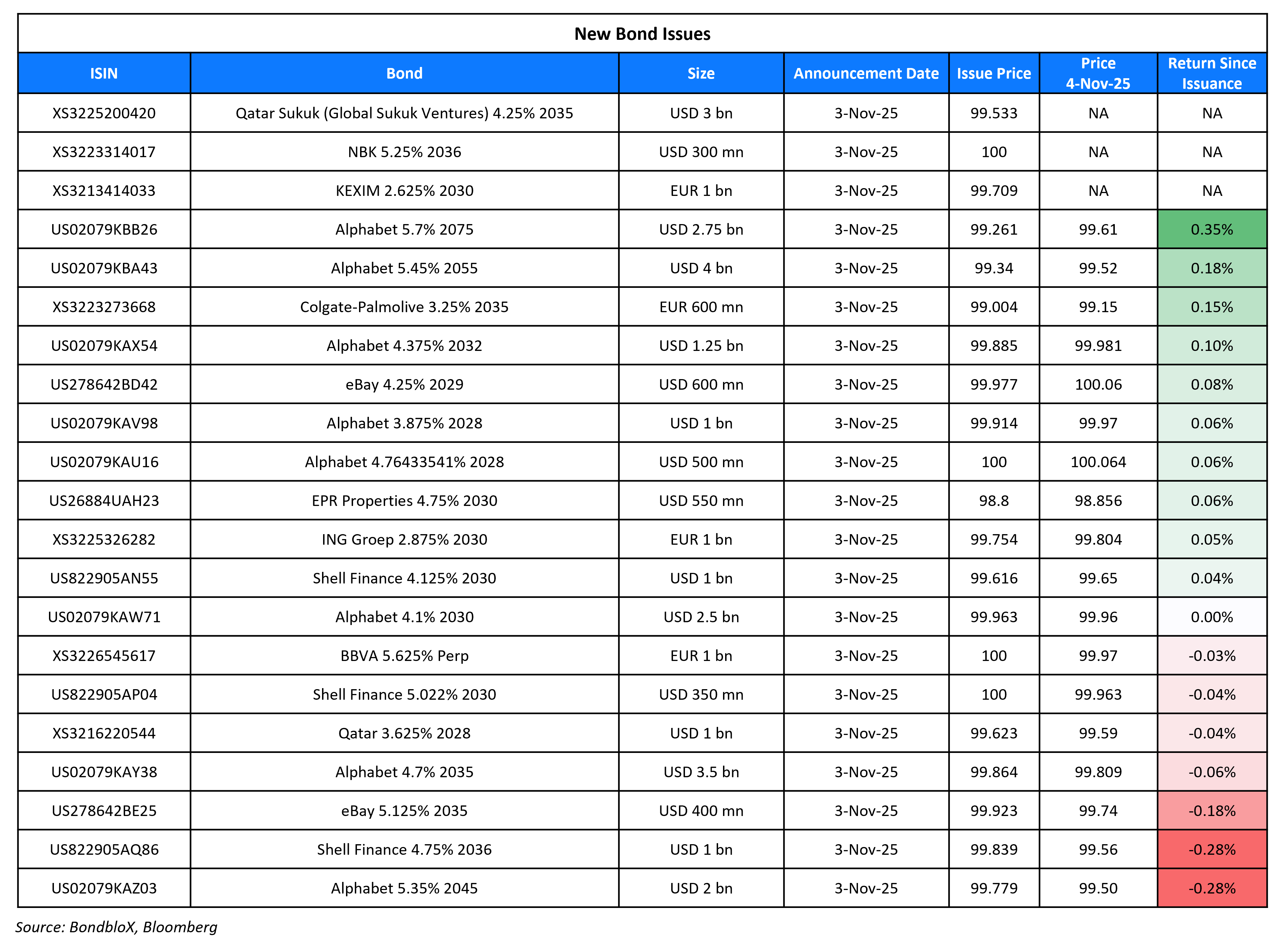

New Bond Issues

- QBE Insurance $ 12NC7 Tier-2 at T+170bp area

BBVA raised €1bn via a PerpNC7 AT1 bond at a yield of 5.745%, 38bp inside initial guidance of 6.125% area. The junior subordinated preferred note is rated Ba1/BB+ (Moody’s/Fitch). if not called by 11 November 2032, the coupon will reset to the 5Y Mid-Swap plus 324.6bp. Net proceeds will be used for general corporate purposes. A trigger event will occur if the CET1 ratio of the bank falls below 5.125%.

Qatar raised $4bn via a two-part offering. It raised $1bn via a 3Y bond at a yield of 3.759%, 30bp inside initial guidance of T+45bp area. It also raised $3bn via a 10Y sukuk at a yield of 4.308%, 35bp inside initial guidance of T+55bp area. The senior unsecured notes are rated Aa2/AA/AA (Moody’s/S&P/Fitch). The issuer of the sukuk is Global Sukuk Ventures QPJSC.

UBS raised $3.25bn via a two-part offering. It raised $2bn via a 8NC7 bond at a yield of 4.844%, 25bp inside initial guidance of T+120bp area. It also raised $1.25bn via a 21.5NC20.5 bond at a yield of 5.528%, 28bp inside initial guidance of T+115bp area. The senior unsecured bonds are rated A2/A-/A.

National Bank of Kuwait (NBK) raised $300mn via a 10.5NC5.25 Tier-2 bond at a yield of 5.25%, 40bp inside initial guidance of T+190bp area. The subordinated note is unrated.

Ebay raised $1bn via a two-trancher. It raised $600mn via a 3Y bond at a yield of 4.259%, 30bp inside initial guidance of T+95bp area. It also raised $400mn via a 10Y bond at a yield of 5.135%, 22bp inside initial guidance of T+125bp area. The senior unsecured notes are rated Baa1/BBB+ (Moody’s/S&P). Proceeds will be used for general corporate purposes, which may include capex, share repurchases, repayment of other debt and possible acquisitions.

Colgate Palmolive raised €600mn via a 10Y bond at a yield of 3.369%, 25bp inside initial guidance of MS+70/75bp area. The senior unsecured notes are rated Aa3/A- (Moody’s/S&P). Proceeds will be for general corporate purposes, including the repayment of commercial paper.

Shell raised $2.35bn via a three-tranche offering. It raised:

- $1bn via a 5Y bond at a yield of 4.211%, 30bp inside initial guidance of T+80bp area

- $350mn via a 5Y FRN at SOFR+78bp, inline with initial guidance of SOFR+78bp area

- $1bn via a 10Y bond at a yield of 4.771%, 28bp inside initial guidance of T+95bp area

The senior unsecured notes are rated Aa2/A+/AA- (Moody’s/S&P/Fitch) and the proceeds will be used for general corporate purposes.

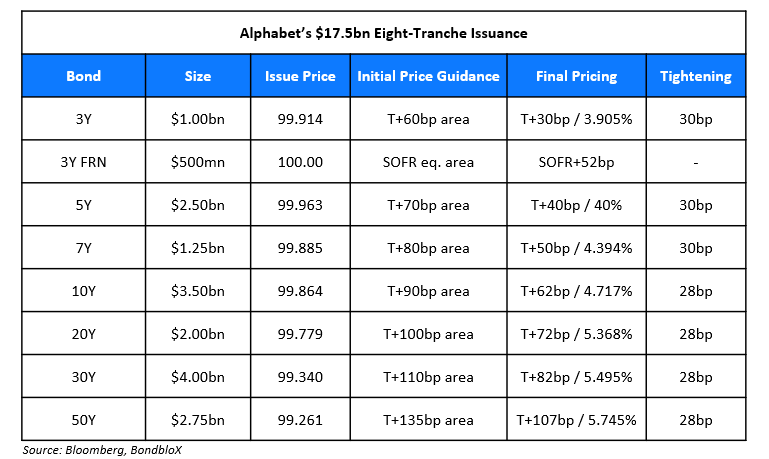

Alphabet raised $17.5bn via an eight-trancher.

The senior unsecured bonds are rated Aa2/AA+. Proceeds will be used for general corporate purposes, which may include the repayment of outstanding debt.

New Bonds Pipeline

- Standard Chartered $ PerpNC10 AT1

- China $4bn capped 3Y/5Y bonds

- Santos Finance $ 10Y bond

- Hong Kong CNH/HKD/EUR/USD Digitally Native Green Notes

- Sharjah Islamic Bank $500mn 5Y WNG bond

- Alinma Bank Tier-2 $ sukuk

Rating Changes

- Moody’s Ratings upgrades JPMorgan Chase’s long-term deposit rating to Aa1, outlook stable

- Fitch Upgrades Sekerbank to ‘B+’; Outlook Stable

- Fitch Upgrades Anadolubank to ‘B+’; Outlook Stable

- Moody’s Ratings upgrades OTP banka d.d.’s ratings, outlook changed to stable

- Neptune Bidco US Inc. Outlook Revised To Positive On Increasing Product Adoption, Rating Affirmed

- Moody’s Ratings changes Permian Resources’ outlook to positive, affirms Ba1 CFR

- Moody’s Ratings affirms SierraCol’s B1 ratings, outlook revised to negative

Term of the Day: Significant Risk Transfer (SRT)

A Significant Risk Transfer (SRT) is a transaction where banks can deleverage their balance sheet by buying protection on diversified loan portfolios, so that they can release regulatory capital or manage risk. This is typically achieved by selling notes linked to a pool of loans that also include a credit derivative. Selling SRTs may help avoid using less investor friendly measures like dividend cuts, stopping share repurchases or raising new equity to boost regulatory capital levels.

Talking Heads

On investors underpricing risks to AI-fueled rally in S&P

Bridgewater CIOs

“US equities are priced as though the favorable conditions that lifted all companies, not just tech, will persist… The growth expectations discounted today are about as optimistic as they’ve been in nearly 100 years, with the brief exception of the dot-com bubble… Despite the many potential sources of volatility in the world today, market measures of risk remain unfazed”

David Spreng, Runway Growth Capital

“AI infrastructure, including chips, buildings, routers and other networking gear, will become obsolete as the technology advances rapidly… don’t think that AI infrastructure is a good bet from a venture debt perspective right now. The risks are not symmetrical”

On ECB Urging Caution on Synthetic SRTs in Securitization Overhaul

“A freeze in the synthetic securitization market would expose banks to higher capital requirements than they had anticipated when originating the loans”

On Supreme Court having to deal with Trump’s tariffs

Bill Canady, OTC Industrial Technologies

“We just have to hang on and navigate our way through this so we don’t all go broke in the short run”

Scott Bessent, US Treasury Secretary

“You should assume that they’re here to stay. Those of you who got a good deal should stick with it.”

Tim Brightbill, Washington

“This administration is committed to tariffs as a cornerstone of economic policy, and companies and industries should plan accordingly”

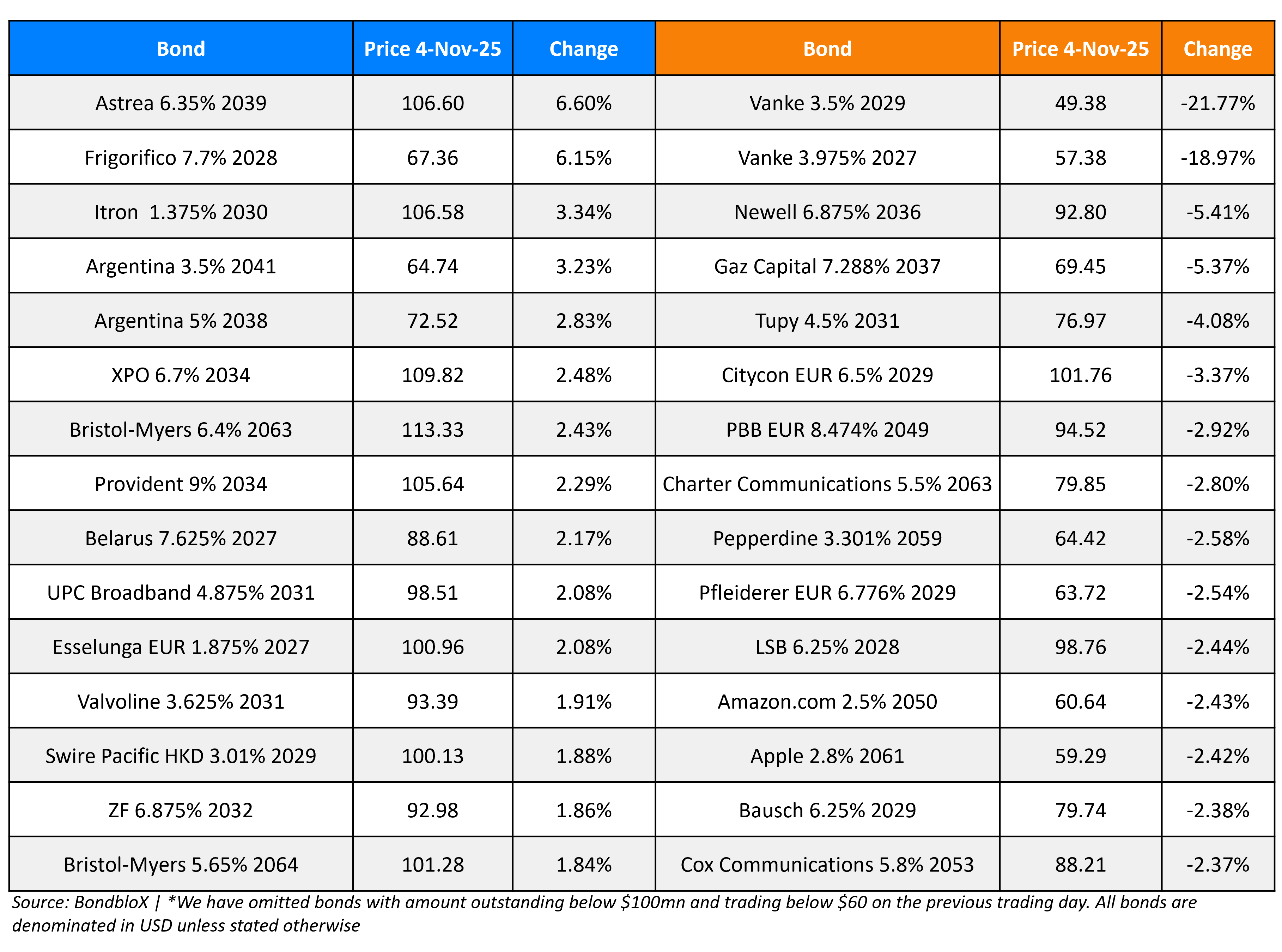

Top Gainers and Losers- 04-Nov-25*

Go back to Latest bond Market News

Related Posts: