This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

StanChart, Credit Agricole and Others Launch Bonds

January 7, 2025

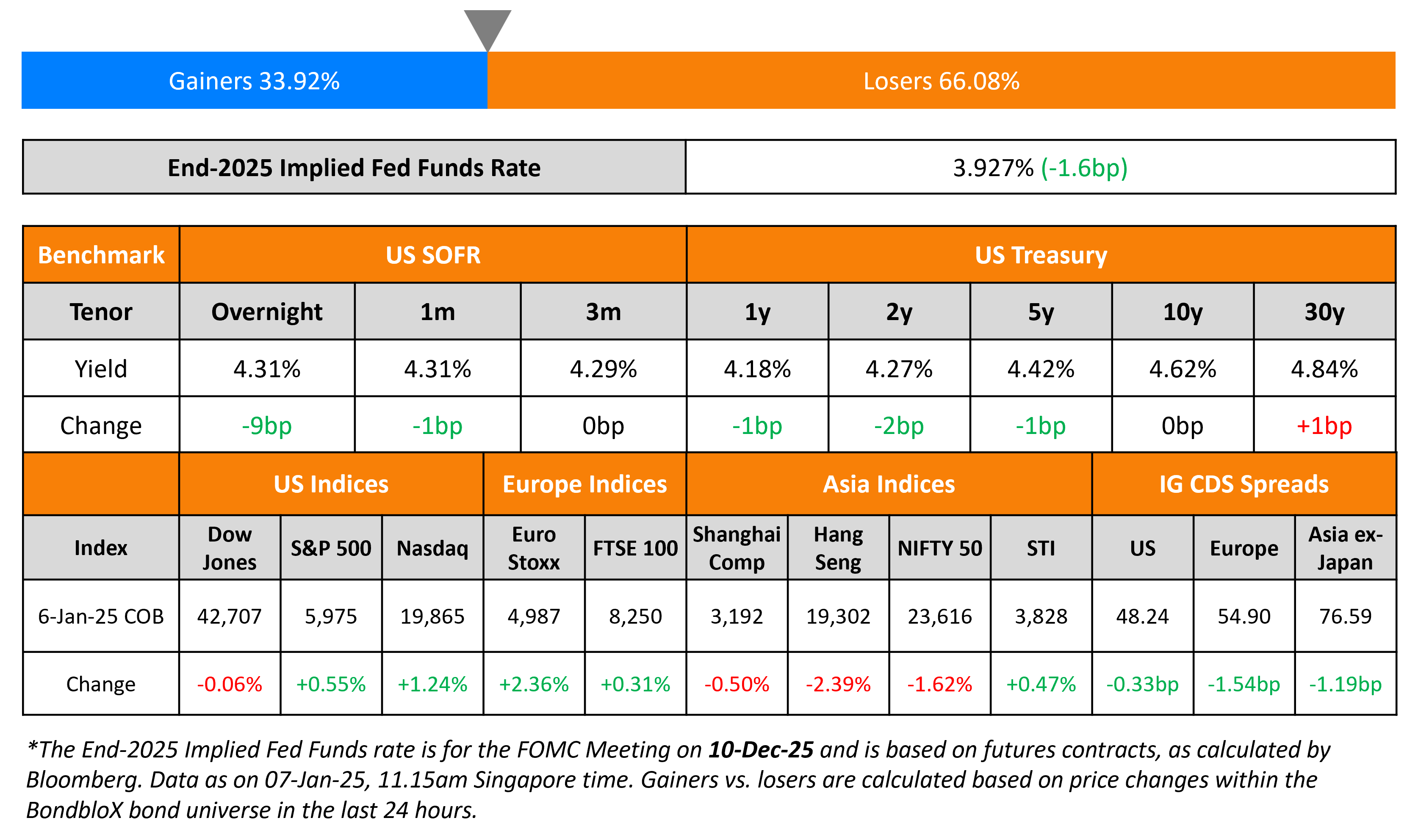

US Treasuries held steady across the curve on Monday. The final Durable Goods Orders for December came-in at -1.2%, worse than expectations of -0.5%. However, Capital Goods Orders improved 0.4%, better than expectations of 0.1%. Separately, US President-elect Donald Trump denied reports that he was planning to scale back tariffs focused on certain critical sectors.

US IG and HY CDS spreads tightened by 0.3bp and 1.8bp respectively. Looking at US equity markets, the S&P and Nasdaq closed 0.6% and 1.2% higher respectively. European equities ended higher too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 1.5bp and 8bp respectively. Asian equities have opened mixed this morning. Asia ex-Japan CDS spreads were 1.2bp tighter. In China, the Caixin Services PMI for December rose to 52.2, better than expectations of 51.4 and the prior month’s 51.5, expanding at its fastest pace since May. Borrowers from the APAC region sold the most dollar bonds since June 2024, pricing around $7bn in debt on Monday, according to Bloomberg data.

New Bond Issues

- Standard Chartered $ PerpNC7 at 7.875% area

- Credit Agricole S$ 10NC5 at 4.55% area

- Dai-Ichi Life $ PerpNC10 at 6.625% area

- Fosun Tap of 2028s at 100.125 area

- SMFG $ 5.25Y/5.25Y FRN/7Y/10Y at T+100/SOFR equiv/110/120bp area

- Clifford Capital $ 5Y at T+65bp area

.png)

EXIM India raised $1bn via a 10Y bond at a yield of 5.61%, 30bp inside initial guidance of T+130bp area. The senior unsecured notes are rated Baa3/BBB-/BBB-. Proceeds will be used (a) to provide funding for export LOC and buyer’s credit granted to overseas governments, banks, institutions and other entities (b) for loans for overseas investment and/or participation in equity of overseas JVs (c) for import of capital goods by export oriented units (d) for concessional financing schemes (e) for foreign currency loans. The bonds have a change of control (CoC) event if at any time Government of India owns (directly or indirectly) less than 51% of EXIM’s issued capital.

EDF raised $1.9bn via a three-tranche issuance. It raised:

- $700mn via a 10Y bond at a yield of 5.802%, 25bp inside initial guidance of T+145bp area. The new bonds are priced at a new issue premium of 6bp over its existing 4.75% 2035s that yield 5.74%.

- $800mn via a 30Y bond at a yield of 6.385%, 25bp inside initial guidance of T+180bp area.

- $400mn via a tap of its 6.5% 2064s at a yield of 6.535%, 25bp inside initial guidance of T+195bp area

The senior unsecured notes are rated Baa1/BBB/BBB+. Proceeds will be used for general corporate purposes.

Saudi Arabia raised $12bn via a three-trancher. It raised:

- $5bn via a 3Y bond at a yield of 5.178%, 35bp inside initial guidance of T+120bp area. The new bonds are priced at a new issue premium of 12bp over its existing 4.75% 2028s that yield 5.06%.

- $3bn via a 6Y bond at a yield of 5.44%, 30bp inside initial guidance of T+130bp area. The new bonds are priced at a new issue premium of 20bp over its existing 2.694% sukuk due 2031 that yields 5.24%.

- $4bn via a 10Y bond at a yield of 5.734%, 30bp inside initial guidance of T+140bp area

The notes are rated Aa3/A+ (Moody’s/Fitch), and received orders of over $30.5bn, ~2.5x issue size. Proceeds will be used for general domestic budgetary purposes.

Mexico raised $8.5bn via a three trancher. It raised:

- $2bn via a 5Y bond at a yield of 6.124%, 40bp inside initial guidance of T+210bp area.

- $4bn via a 12Y bond at a yield of 6.926%, 30bp inside initial guidance of T+260bp area

- $2.5bn via a 30Y bond at a yield of 7.408%, 35bp inside initial guidance of T+290bp area

The notes are rated Baa2/BBB/BBB. Proceeds will be used for general purposes.

NAB raised $2.75bn via a three-trancher. It raised:

- $750mn via a 5Y bond at a yield of 4.901%, 25bp inside initial guidance of T+75bp area.

- $750mn via a 5Y FRN at SOFR+79bp vs. initial guidance of SOFR equivalent area

- $1.25bn via a 11NC10 Tier 2 bond at a yield of 5.902%, 25bp inside initial guidance of T+155bp area

The 5Y fixed rate note and FRN are senior bank notes rated Aa2/AA-. The 11NC10 subordinated Tier 2 note is rated A3/A-/A-. Proceeds will be used for general corporate purposes.

BNP Paribas raised $2.25bn via an 8NC7 bond at a yield of 5.786%, 28bp inside initial guidance of T+155bp area. The senior non-preferred notes are rated Baa1/A-/A+.

UBS AG/Stamford CT (UBS) raised $1.25bn via a 3NC2 bond at a yield of 4.864%, 25bp initial guidance of T+85bp area. The senior unsecured notes are rated Aa2/A+/A+.

SocGen raised $2.5bn via a three-trancher. It raised:

- $500mn via a 4.25NC3.25 FRN at SOFR+141bp vs. initial guidance of SOFR equivalent area.

- $1bn via a 4.25NC3.25 bond at a yield of 5.504%, 30bp inside initial guidance of T+150bp area

- $1bn via a 8.25NC7.25 bond at a yield of 6.108%, 30bp inside initial guidance of T+190bp area

The senior non-preferred bonds are rated Baa2/BBB/A-.

Hyundai Capital America raised $2bn via a three-trancher. It raised:

- $850mn via a 3Y bond at a yield of 5.072%, 25bp inside initial guidance of T+100bp area.

- $350mn via a 3Y FRN at SOFR+92bp vs. initial guidance of SOFR equivalent area

- $300mn via a 5Y bond at a yield of 5.354%, 27bp inside initial guidance of T+120bp area

The senior non-preferred notes are rated A3/A-/A-. Proceeds will be used for general corporate purposes.

MUFG raised $2.25bn via a two-part deal. It raised $1.1bn via a 6NC5 bond at a yield of 5.197%, 22bp inside initial guidance of T+100bp area. It also raised $1.15bn via a 11NC10 bond at a yield of 5.574%, ~27.5bp inside initial guidance of T+115/120bp area. The senior unsecured notes are rated A1/A-/A-. Proceeds will be used to fund the operations of MUFG Bank Ltd., through loans that are intended to qualify as Internal TLAC debt.

China Hongqiao raised $330mn via a 3Y bond at a yield of 7.05%, 45bp inside initial guidance of 7.5% area. The senior unsecured notes are rated BB+ (Fitch). The notes are guaranteed by China Hongqiao Investment Ltd, Hongqiao Investment Hong Kong Ltd and Hongqiao HK International Trading Ltd. Proceeds will be used to refinance existing debt and for general corporate purposes.

JBS raised $1.75bn via a two-part deal. It raised $1bn via a 10Y bond at a yield of 5.974%, 30bp inside initial guidance of T+165bp area. It also raised $750mn via a 30Y bond at a yield of 6.485%, 32.5bp inside initial guidance of T+195bp area.

New Bonds Pipeline

- Aldar hires for $ 30.25NC7.25 bond

Rating Changes

-

Moody’s Ratings upgrades Frontier’s CFR to B2; Ratings remain on review for further upgrade

-

Fitch Downgrades Cone Health, NC to ‘AA-‘

-

Fitch Revises Proofpoint’s Outlook to Negative; Affirms Upsized First Lien Term Loan at ‘BB-‘/’RR3’

Term of the Day: Initial Price Guidance (IPG)

Initial price guidance (IPG) refers to the proposed yield on a new bond issue. Based on the IPG, investors will place orders with the lead managers of the new bond issue. Once the lead managers have received orders for the proposed bond, they will decide the final pricing on the bond, which in most cases will be tighter (lesser) than the IPG.

Talking Heads

On Gold Investors Staying Bullish for 2025 on Trump Volatility

Greg Sharenow, PIMCO

“We would expect that central banks and high net worth families will continue to find gold attractive”

Darwei Kung, DWS Group

“Should trade relations deteriorate with new Trump policy, we may see the equity market react negatively. Gold would be a good asset to hold to hedge against such risk”

On Wall Street Bond Bear Seeing US 10Y Yield Topping 5%

Padhraic Garvey, ING Groep NV

“We have this inflation narrative which is still north of 2.5%, we have this deficit narrative. We are quietly confident we’ll see a 5% handle. A test of 5.5% is reasonable”

On Trump’s policies may not prove inflationary, Bernanke, others say

Former Fed Chair Ben Bernanke

“Trump policies, whatever their merits on public finance grounds, probably will be modest in terms of their effect on the inflation rate.”

Christina Romer, former Obama administration adviser

“If there were an attack on Fed independence I think it would be very consequential”

Top Gainers and Losers- 07-January-25*

Go back to Latest bond Market News

Related Posts:

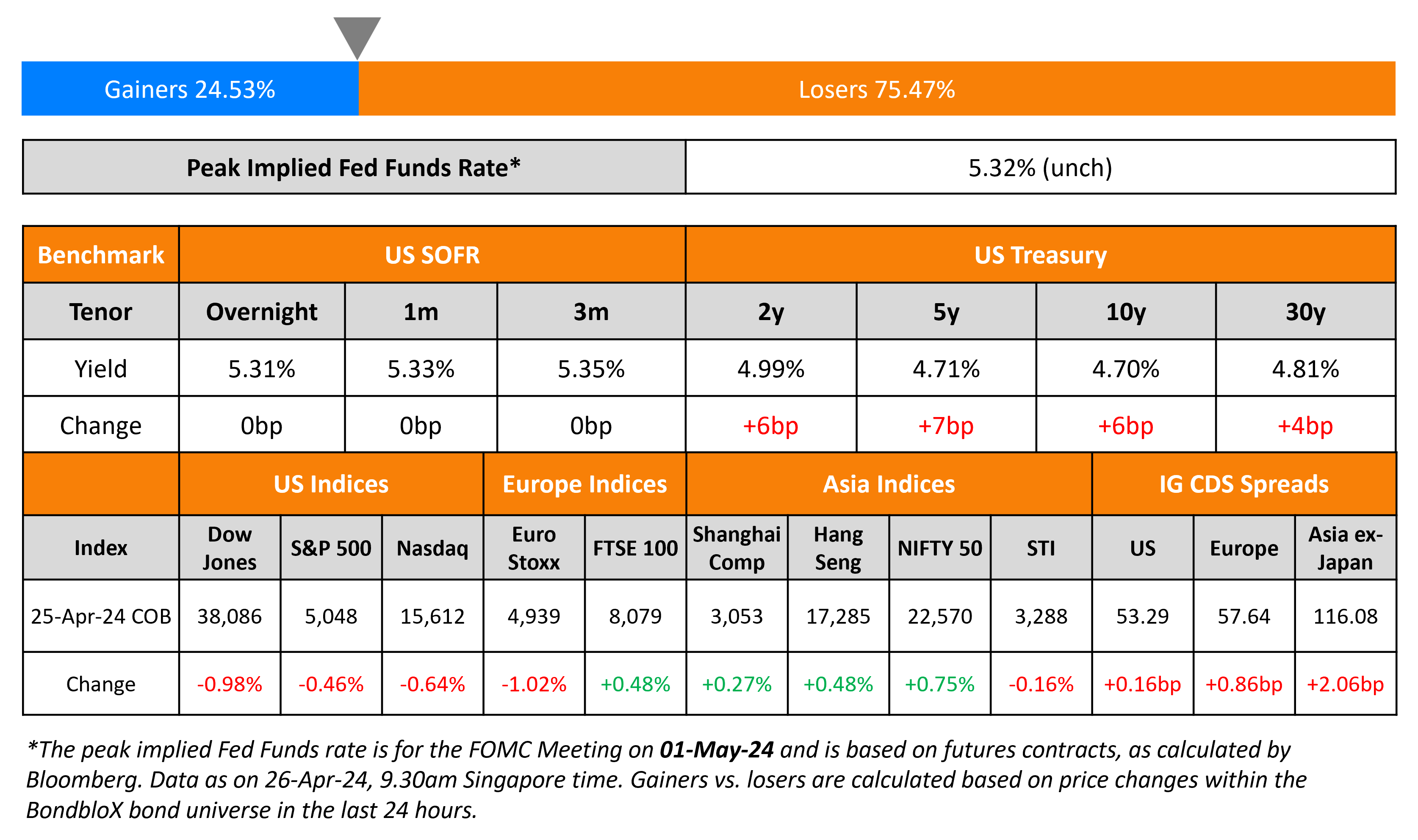

US GDP Softens; KIB Prices $ AT1

April 26, 2024

Turkey, FAB, Astrea Price Bonds; Muthoot Taps 2028s

July 10, 2024