This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

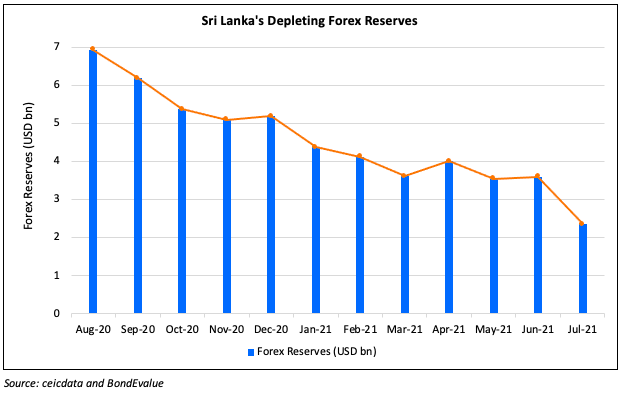

Sri Lanka’s Forex Reserves Fall to Lowest Levels in 12 Years

August 19, 2021

Sri Lanka’s foreign reserves fell 32% after repaying its offshore bond last month, according to data published by Sri Lanka’s Central bank on Friday. With the repayment of its $1bn 6.25% 2021s the nation’s forex dipped to a 12Y low of $2.4bn in July from $3.6bn in the previous month, according to CEIC data.

The island nations dwindling reserves led Moody’s to put the sovereign’s rating under review for downgrade last month. It was downgraded to CCC+ by S&P, to CCC by Fitch and to Caa1 by Moody’s late last year. Despite the hardships, the nation has met all its debt obligations till now by tapping its friendly nations including China, India and South Korea to spur up its liquidity. The opening up of the economy and tourism is likely to boost the reserves of the nation in the future. The nation has also undertaken many steps including raising $600mn-700mn through forex surrenders. The sovereign has the following offshore debt repayments till 2023:

- $500mn 5.75% 2022s due in Jan 2022 that are trading at 93.38, yielding 23.63%

- $1bn 5.875% 2022s due in July 2022 that are trading at 80.9, yielding 31.62%

- $1.25bn 5.75% 2023s due in Apr 2023 that are trading at 68.5, yielding 31.62%

Go back to Latest bond Market News

Related Posts: