This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

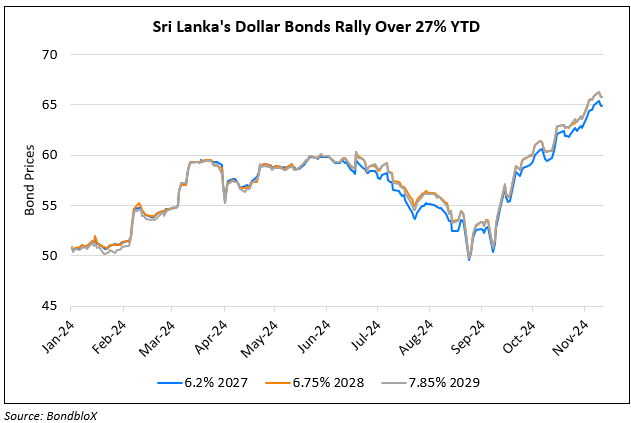

Sri Lanka Begins $12.6bn Offshore Debt Swap Restructuring

November 27, 2024

Sri Lanka launched the planned debt restructuring offer for $12.6bn of its dollar bonds, as per a statement. Bondholders can tender their existing bonds in exchange for new longer-dated notes, with a haircut of 27% on the nominal amount of existing notes. A creditor committee holding 40% of the notes has expressed support for the offer. The exchange offer expires on December 12, with results to be announced four days later. This transaction marks a significant step in Sri Lanka’s debt overhaul, following its default in 2022, and aims to restore access to international markets. The country recently secured initial approval for the upcoming tranche of $330mn from the IMF, as part of the $3bn bailout, which is expected to reduce debt servicing costs by up to $9.5bn over the program’s duration. Sri Lanka’s dollar bonds have returned over 27% this year, and are trading between 63-66 cents per dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts: