This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

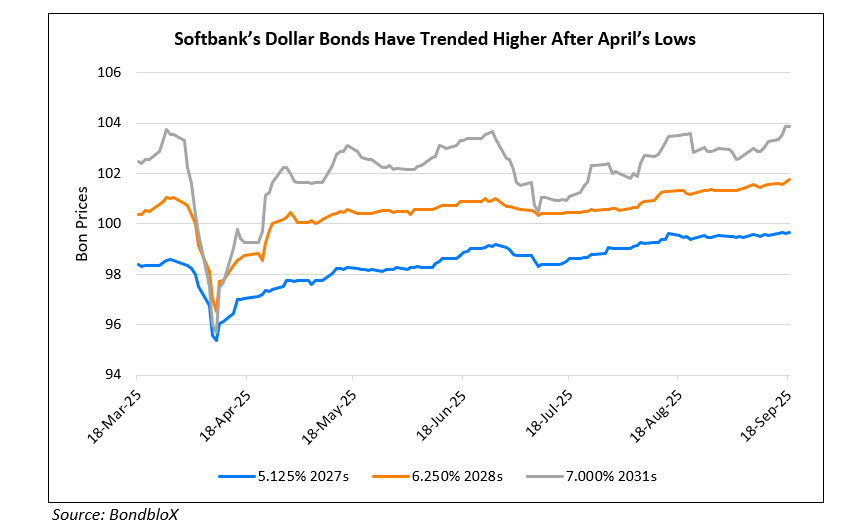

SoftBank Upgraded to Ba2 by Moody’s on Lower Leverage

September 18, 2025

SoftBank was upgraded to Ba2 from Ba3 by Moody’s, as the rating agency cited lower leverage, reduced secured debt, and progress in asset sales. Moody’s estimates that SoftBank’s market value-based leverage has improved to ~23% as of June 2025, down from the high-30s to low-40% range previously. SoftBank has fully divested its Alibaba stake and used the proceeds to settle forward contracts. Moody’s noted that they were considering these forward contracts as debt for SoftBank earlier. Separately, SoftBank’s secured debt at the holding company level at the end of 1H2025 has reduced to 20% from 50% YoY.

Moody’s highlighted that the current rating is underpinned by SoftBank’s significant investment portfolio, including listed marketable investments. SoftBank’s listed assets account for about 70% of its total portfolio value, it added. Moody’s said that governance risks have now eased after the last 12–18 months of disciplined financial management. However, it cautioned that SoftBank remains exposed to event risks from large transactions and continues to show weak interest coverage. Liquidity pressures seen in mid-2025 have been offset by bond issuances and asset sales, giving the company coverage for about two years of maturities.

SoftBank’s 4.625% 2028s were up by 0.2 points and currently trade at 98.0, yielding 5.4%.

For more details, click here.

Go back to Latest bond Market News

Related Posts: