This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

SoftBank, SMFG, ABN Amro Price $ Bonds; Fitch Change Boeing Outlook to Stable from Negative

July 1, 2025

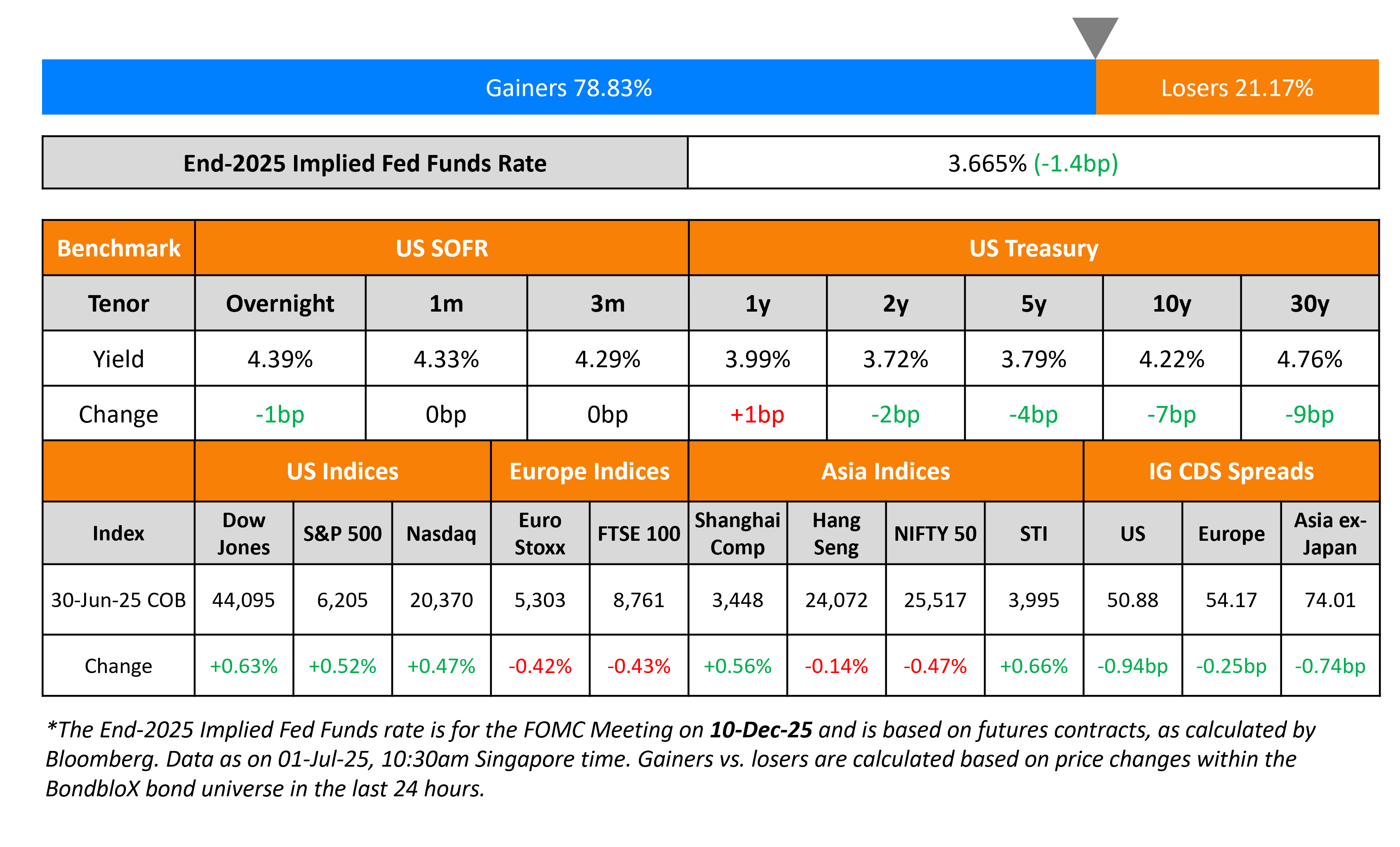

The US Treasury curve bull flattened on Monday, with the 2s10s spread down by 5bp. US Treasury Secretary Scott Bessent said that it would not make sense to increase sales of longer-term treasuries looking at current yields. He further said that he believes interest rates will fall as inflation eases.

Looking at equity markets, the S&P and Nasdaq were both higher by ~0.5% each. In credit markets, US IG CDS spreads were tighter by 0.9bp and HY CDS spreads tightened 7.2bp. European equity markets ended lower. The iTraxx Main CDS spreads tightened by 0.3bp and Crossover CDS spreads tightened by 1.7bp. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were tighter by 0.7bp. China’s Manufacturing PMI contracted for a second consecutive month, coming-in at 49.7 in June, while the Services PMI inched higher to 50.5.

New Bond Issues

- Carnival €1bn 6Y at 4.50-4.75% area

Softbank raised $1bn via a two-tranche deal. It raised $500mn via a 5Y bond at a yield of 4.699%, 30bp inside initial guidance of T+120bp area. It also raised $500mn via a 10Y bond at a yield of 5.332%, 30bp inside initial guidance of T+140bp area. The senior unsecured notes are rated BBB/BBB+. Proceeds will be used for general corporate purposes.

SMFG raised $4bn via a five-part deal.

Proceeds from the subordinated 21NC20 bond will be used to extend subordinated loans, intended to qualify as Tier 2 capital and internal TLAC. Proceeds from the other senior unsecured notes will be used to extend unsecured loans, intended to qualify as internal TLAC.

ABN Amro raised $1.5bn via a dual-trancher. It raised $750mn via a 3Y bond at a yield of 4.197%, ~22.5bp inside initial guidance of 4.70-4.75% area. It also raised $750mn via a 3Y FRN at SOFR+75bp vs. initial guidance of SOFR equivalent area. The senior preferred notes are rated Aa3/A/A+. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Shinhan Bank hires for $ 5Y bond

- Port of Newcastle hires for A$ 8Y/10Y bond

- Qatar Insurance hires for $ PerpNC6, Tier 2 bond

- RAK Bank hires for $ PerpNC6 bond

- NBK hires for $ PerpNC6 AT1 bond

Rating Changes

- Fitch Revises Boeing’s Outlook to Stable; Affirms IDR at ‘BBB-‘

- Fitch Upgrades JSC Bank Agrobank to ‘BB’; Outlook Stable

- Argentine Utility Edenor Ratings Raised To ‘B-‘ From ‘CCC+’ On Higher Rates; Outlook Stable

- Fitch Upgrades Ipoteka-Bank to ‘BB’; Outlook Stable

- Cornerstone Building Brands Inc. Downgraded To ‘B-‘ On Deteriorated Earnings; Debt Rating Lowered; Outlook Stable

Term of the Day: Subordinated Bonds

Subordinated bonds refer to bonds that rank below senior debts on the capital structure. In the event of liquidation, holders of subordinated debt would only be paid after all the senior debt is repaid. Thus, the ratings and yield of subordinated debt tend to be lower and higher respectively, to account for the greater risk associated with subordinated vs. senior debt. There are different kinds of subordinated debt that can include perpetuals/AT1 CoCos, payment-in-kind notes, mezzanine debt, convertible bonds, vendor notes etc. Subordinated debt rank higher to preferred equity and common equity in the capital structure.

Talking Heads

On Bipartisan Solution to Address US ‘Debt Bomb’ – Ray Dalio

“This would lead to an improvement in the supply/demand balance for US debt, which in turn would lower interest rates…politics have become so absolutist, they feel they can’t go down this obviously best path”

On Rather Buying Stocks Than Long-Dated Debt – Rick Rieder, BlackRock

“The book value of my equities is going to be up 19% – I compound that over two years or I buy the long-bond under 5%…I’ll take the equity, particularly growth equity”

On Pulling Forward Fed Rate-Cut Forecast to September – Goldman Sachs

“We think the odds of a cut in September are somewhat above 50% because we see several routes to get there…Fed leadership shares our view that tariffs will only have a one-time price level effect…If there is any insurance motive for cutting, it would be most natural to cut at consecutive meetings, as in 2019”

Top Gainers and Losers- 01-Jul-25*

Go back to Latest bond Market News

Related Posts: