This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

SoftBank Launches $ Bonds; Tengizchevroil, KazMunayGas, PulteGroup Upgraded

June 30, 2025

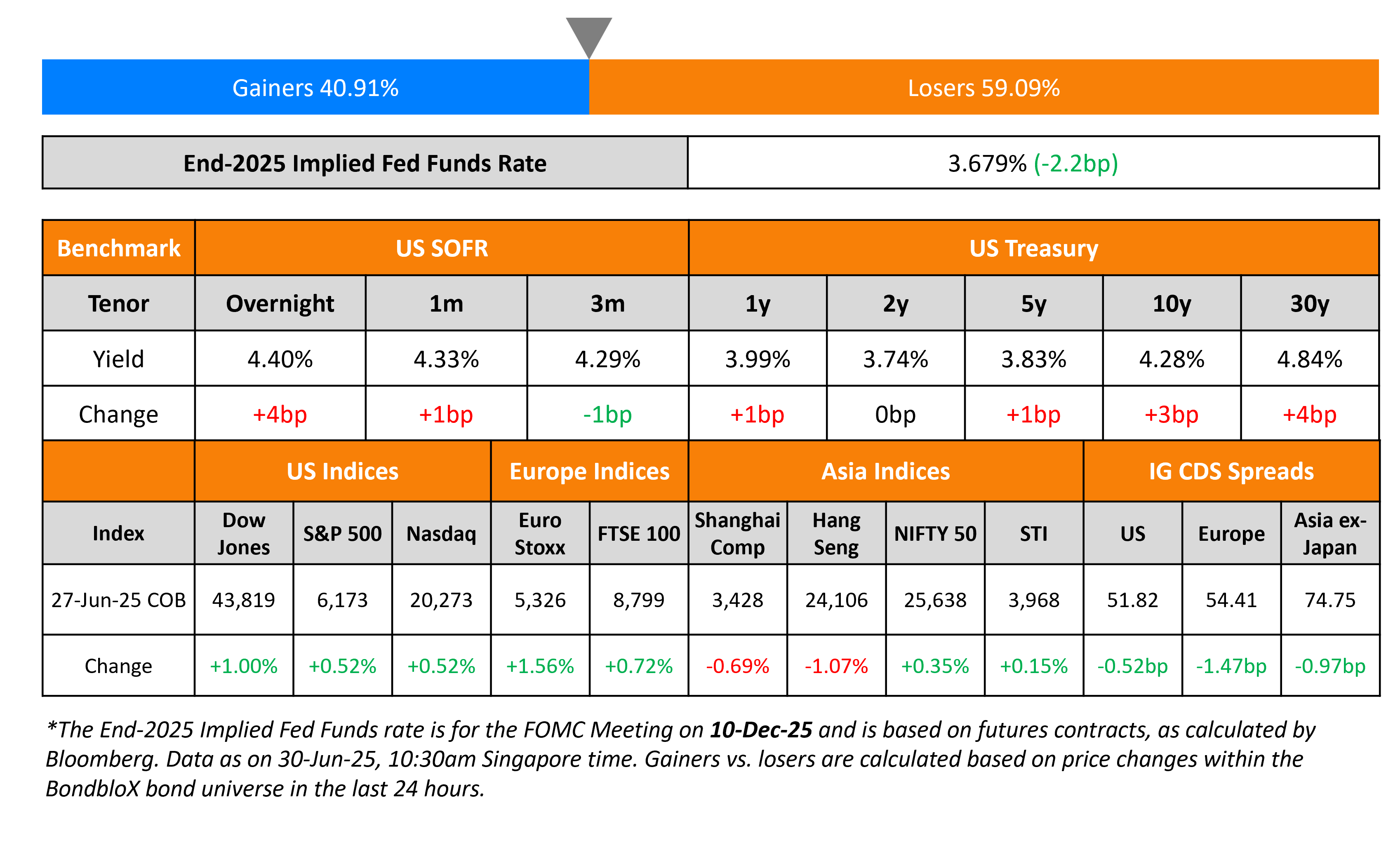

US Treasury yields were marginally higher across the curve. In geopolitical news, US President Donald Trump terminated trade talks with Canada on the back of the latter’s imposition of a digital services tax on US tech companies. Separately, the Senate voted to open debate on President Trump’s $4.5tn tax cut bill with a final vote expected to spill into Monday. On the data front, Headline PCE inflation in the US accelerated to 2.3% YoY from an upwardly revised 2.2% in April. Core PCE YoY rose by 2.7% YoY, above expectations of 2.6%. The Michigan Consumer Sentiment Index was revised higher to 60.7 in June from a preliminary of 60.5, compared to 52.2 in May. This is the first uptick in the reading in the last six months.

Looking at equity markets, the S&P and Nasdaq were both higher by 0.9% and 1.5% respectively. In credit markets, US IG CDS spreads were tigther by 0.5bp and HY CDS spreads tightened 4.1bp. European equity markets ended higher too. The iTraxx Main CDS spreads tighter by 1.5bp and Crossover CDS spreads tightened by 6.3bp. Asian equity markets have opened broadly higher today. Asia ex-Japan CDS spreads were tighter by 1bp

New Bond Issues

- Softbank $ 5Y/10Y at T+120/140bp

- SMFG $ 6NC5/6NC5 FRN/8NC7/11NC10/21NC20 at T+110-115/SOFR Equiv/125/130/130bp area

New Bonds Pipeline

- Shinhan Bank hires for $ 5Y bond

- Port of Newcastle hires for A$ 8Y/10Y bond

- Qatar Insurance hires for $ PerpNC6 bond

Rating Changes

- Tengizchevroil Upgraded To ‘BBB-‘ On Expansion Completion; Outlook Stable

- Moody’s Ratings downgrades Methanex’s CFR to Ba2; stable outlook

- KazMunayGas Upgraded To ‘BBB-‘ And ‘kzAAA’ On Stronger Metrics And Resilient Cash Flows; Outlook Stable

- PulteGroup Inc. Upgraded To ‘BBB+’ From ‘BBB’ On Solid Credit Metrics; Outlook Stable

- NES Fircroft Bondco AS Upgraded To ‘B+’ On Criteria Application; No Longer Under Criteria Observation

- Grupo Televisa S.A.B. Outlook Revised To Negative From Stable On Diminishing Subscriber Base; ‘BBB’ Ratings Affirmed

Term of the Day: Convertible Bonds

As the name suggests, convertible bonds are debt instruments issued by a company where the bonds can be converted into equity shares of the company by the bondholders at a particular ratio and at particular points in time. Thus, it is a hybrid security as it has characteristics of both debt and equity. Convertibles generally carry a lower coupons and sometimes tax advantages for the issuer.

Talking Heads

On Tariffs Threatening Fed With Real Inflation Headache – Agustin Carstens, BIS

“We were meant to have a soft landing…Then we had this very substantive period of volatility with the threat…higher inflationary pressures or deviating inflationary expectations and a slowdown in the economy…Macro-financial vulnerabilities have the potential to amplify economic developments”

On World Economy Facing Pivotal Moment – Agustin Carstens, BIS

“The global economy was at a ‘pivotal moment’, entering a ‘new era of heightened uncertainty and unpredictability’…There is also evidence that the world economy is becoming less resilient to shocks, with population ageing, climate change, geopolitics and supply chain”

On Frontier Markets Rallying Further as Risks Recede – JPMorgan

“Frontier local markets did not sell off much during the period of heightened geopolitical risks in June, and we expect that a summer of relative calm will further see them outperform… Ghana, Egypt, and Nigeria should benefit and deliver 600bp, 400bp and 200bp in rate cuts”

Top Gainers and Losers- 30-Jun-25*

Go back to Latest bond Market News

Related Posts: