This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

SoftBank, BAT, Turk Telekom, GM Fianncial and others Price $ Bonds

October 23, 2025

US Treasury yields were stable across the curve on Wednesday. The US Treasury’s 20Y auction saw solid demand with a bid-to-cover of 2.73x, similar to the previous auction, and an indirect take-up of 63.6%. Separately, a White House official said that the current administration was considering a plan to curb an array of software-powered exports to China, from laptops to jet engines.

Looking at equity markets, the S&P and Nasdaq closed 0.5% and 0.9% lower. The US IG and HY CDS spreads widened by 0.3bp and 2bp respectively. European equity indices ended mixed. The iTraxx Main and Crossover CDS spreads were 0.5bp and 2.3bp wider respectively. Asian equity markets have opened broadly lower again today. Asia ex-Japan CDS spreads were 2.8bp tighter.

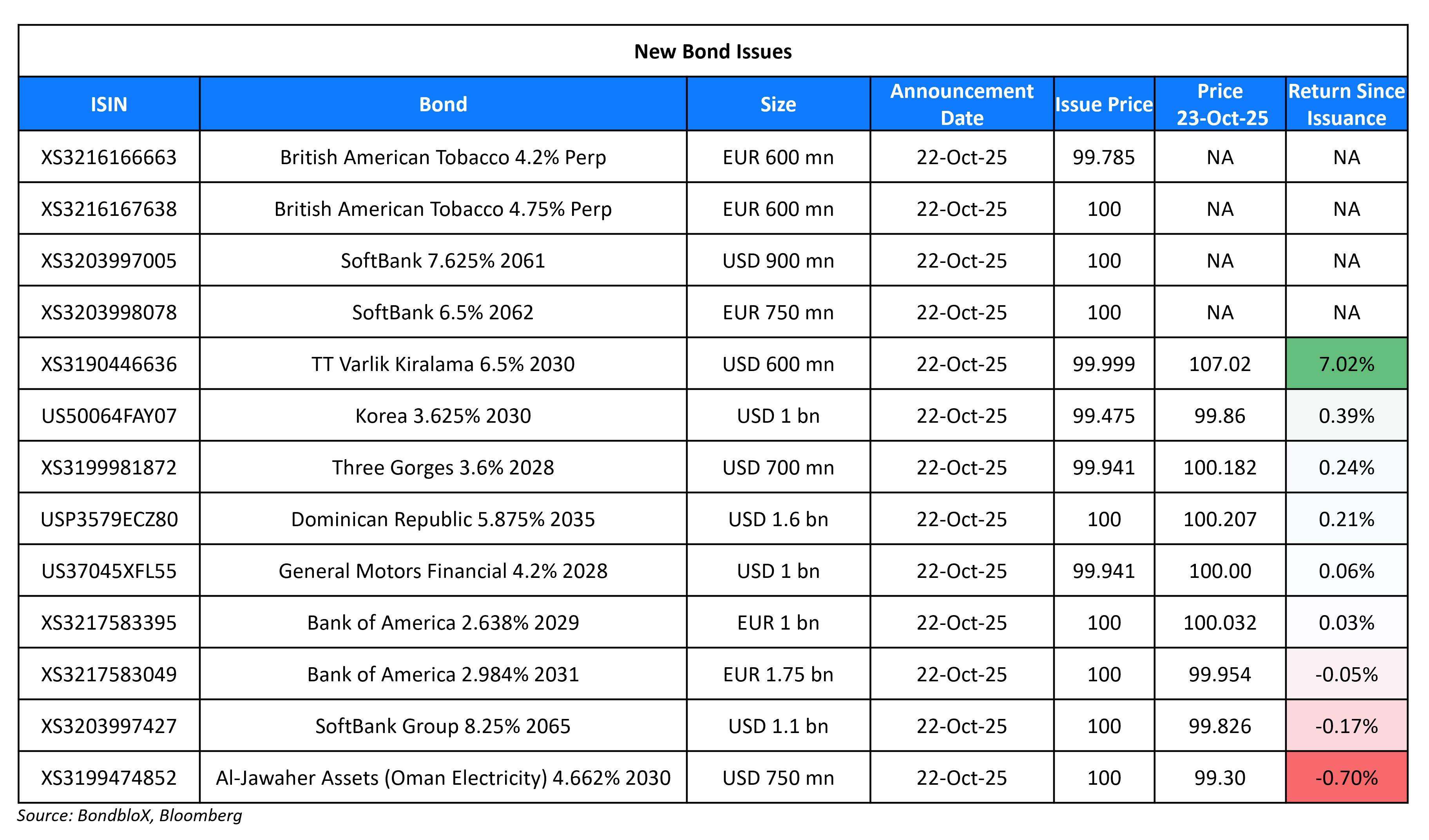

New Bond Issues

-

Deyang Development $ 5Y green at 5.5% area

- Shangrao Investment $ 3Y at 5.1% area

SoftBank raised ~$2.9bn via a dual-currency hybrid three-tranche deal. It raised:

- $900mn via 35.5NC5.5 hybrid bond at a yield of 7.625%, ~31.25bp inside initial guidance of 7.875-8.00% area. If not called by 29 April 2031, the coupon will reset to the US 5Y Treasury yield plus 407bp in addition to a coupon step-up of 25bp. If not called by 28 April 2046, the coupon will step-up by 30bp over the reset formula. If not called by 28 April 2051, the coupon will step-up by 100bp over the reset formula.

- $1.1bn via a 40NC10 hybrid bond at a yield of 8.25%, ~31.25bp inside initial guidance of 8.50-8.625% area. If not called by 29 October 2035, the coupon will reset to the US 5Y Treasury yield plus 429.5bp in addition to a coupon step-up of 25bp. If not called by 29 October 2050, the coupon will step-up by 30bp over the reset formula. If not called by 29 October 2055, the coupon will step-up by 100bp over the reset formula.

- €750mn via a 37NC7 hybrid bond at a yield of 6.50%, ~37.5bp inside initial guidance of 6.75-7.00% area. If not called by 29 October 2032, the coupon will reset to the 5Y Swap Rate plus 421bp in addition to a coupon step-up of 25bp. If not called by 29 October 2047, the coupon will step-up by 30bp over the reset formula. If not called by 29 October 2052, the coupon will step-up by 100bp over the reset formula.

The subordinated notes are rated B+ (S&P). Proceeds will be used for general corporate purposes, including primarily new investments, repayment of borrowings and maintanenance of its cash position.

British American Tobacco (BAT) raised €1.2bn via a two-tranche hybrid deal. It raised:

- €600mn via PerpNC5.25 hybrid bond at 4.25%, 50bp inside initial guidance of 4.75% area. If not called by 30 January 2031, the coupon will reset to the 5Y Swap rate plus 196.1bp. If not called by 30 January 2036, the coupon will step-up by 25bp over the reset formula mentioned. If not called by 30 January 2051, the coupon will step-up by 100bp over the reset formula.

- €600mn via a PerpNC8 hybrid bond at a yield of 4.75%, 50bp inside initial guidance of 5.25% area. If not called by 30 January 2031, the coupon will reset to the 5Y Swap rate plus 228.4bp. If not called by 30 January 2038, the coupon will step-up by 25bp over the reset formula mentioned. If not called by 30 January 2053, the coupon will step-up by 100bp over the reset formula.

The subordinated notes are rated Baa3/BBB-/BBB (Moody’s/S&P/Fitch), and received orders of nearly €8.6bn, 7.2x issue size. Proceeds will be used for general corporate purposes – this includes buying back its outstanding 3% Perp callable in 2026 via a tender offer and other debt repayments.

Turk Telekom raised $600mn via a 5Y sukuk at a yield of 6.5%, 50bp inside initial guidance of 7.0% area. The senior unsecured note is rated BB/BB- (S&P/Fitch), and received orders of $1.6bn, 2.7x issue size. Proceeds will be used for general corporate purposes.

Oman Electricity Transmission raised $750mn via a 5Y green sukuk at a yield of 4.662%, 35bp inside initial guidance of T+145bp area. The senior unsecured note is rated Ba1/BB+ (Moody’s/Fitch). Proceeds will be used to finance and/or refinance, eligible projects under its green framework..

General Motors Financial raised $1bn via a 3Y bond at a yield of 4.221%, 32bp inside initial guidance of T+110bp area. The senior unsecured notes are rated Baa2/BBB/BBB (Moody’s/S&P/Fitch) and the proceeds will be used for general corporate purposes.

Three Gorges raised $700mn via a 3Y bond at a yield of 3.621%, 64bp inside initial guidance of T+70bp area. The senior unsecured note is rated A1 (Moody’s). The bond has a change of control put at 101. Proceeds willl be used to refinance existing debt.

Dominican Republic raised $1.6bn via a 10Y bond at a yield of 5.875%, inside initial guidance of 6% area. The senior unsecured notes are rated Ba1/BB/BB- (Moody’s/S&P/Fitch). Proceeds will be used for general budgetary purposes of the government.

BofA raised €2.75bn via a two-tranche deal. It raised €1bn via a 4NC3 FRN at 3m Euribor + 60bp, 20bp inside initial guidance of 3m Euribor+80bp area. It also raised €1.75bn via a 6NC5 bond at a yield of 2.984%, 28bp inside initial guidance of MS+100bp area. The senior unsecured notes are rated A1/A-/AA- (Moody’s/S&P/Fitch), and received orders of nearly €5.2bn, ~1.9x issue size.

The Republic of Korea raised $1bn via a 5Y bond at a yield of 3.741%, 5bp inside initial guidance of T+22bp area. The senior unsecured note is Aa2/AA/AA- (Moody’s/S&P/Fitch). Net proceeds will become part of the Foreign Exchange Stabilization Fund established and managed under the Korean Foreign Exchange Transactions Act.

New Bonds Pipeline

-

Hon Hai € 6Y offering

-

Pershing Square $ 7Y investor calls

Rating Changes

- Fitch Downgrades Ambipar’s IDR to ‘D’ Fitch Affirms Ukreximbank at ‘CCC’; Upgrades VR to ‘ccc-‘

- NVIDIA Corp. Outlook Revised To Positive On Strong AI Momentum And Sustained Market Leadership, Ratings Affirmed

- Orion SA Outlook Revised To Negative On Unsupportive Market Conditions; ‘BB’ Ratings Affirmed

Term of the Day: Samurai Bonds

Samurai bonds are yen-denominated bonds issued by foreign entities in Japan. These bonds, which are subject to bond market regulations in Japan, are issued by foreign countries and corporations to attract Japanese investors. Another reason to issue Samurai bonds is to capitalize on lower interest rates in Japan compared to the issuer’s local market.

South Korea priced about JPY 110bn ($723mn) equivalent in Samurai bonds.

Talking Heads

On Seeing Fiscal Risks Pushing Japan 30-Year Yield to New High

Claire Huang, Amundi Investment Institute

“There’s concern about fiscal discipline, especially in the medium term… wouldn’t say that it’s a very rosy picture for the super-long end, or that its selloff has completely ended… Assuming a scenario that dollar-yen pair breaks above 155 and trades in a range of 155-160, the BOJ is very likely to hike”

On Private Credit Set to Produce Lower Returns – Sixth Street

“Private credit can disappoint, maybe there are managers that will disappoint given the proliferation of the asset class”… banks are “trying to protect their big profit pool on high-yield, leveraged loan underwriting”

On Brazil Sees Corporate Credit Meltdowns as Isolated, Not Systemic

Sergey Dergachev, Union Investment Privatfonds

“As of now, we feel that cases like Ambipar, Braskem, and Raizen have been idiosyncratic, and we do not see risk of broader contagion to the Brazilian corporate credit situation”

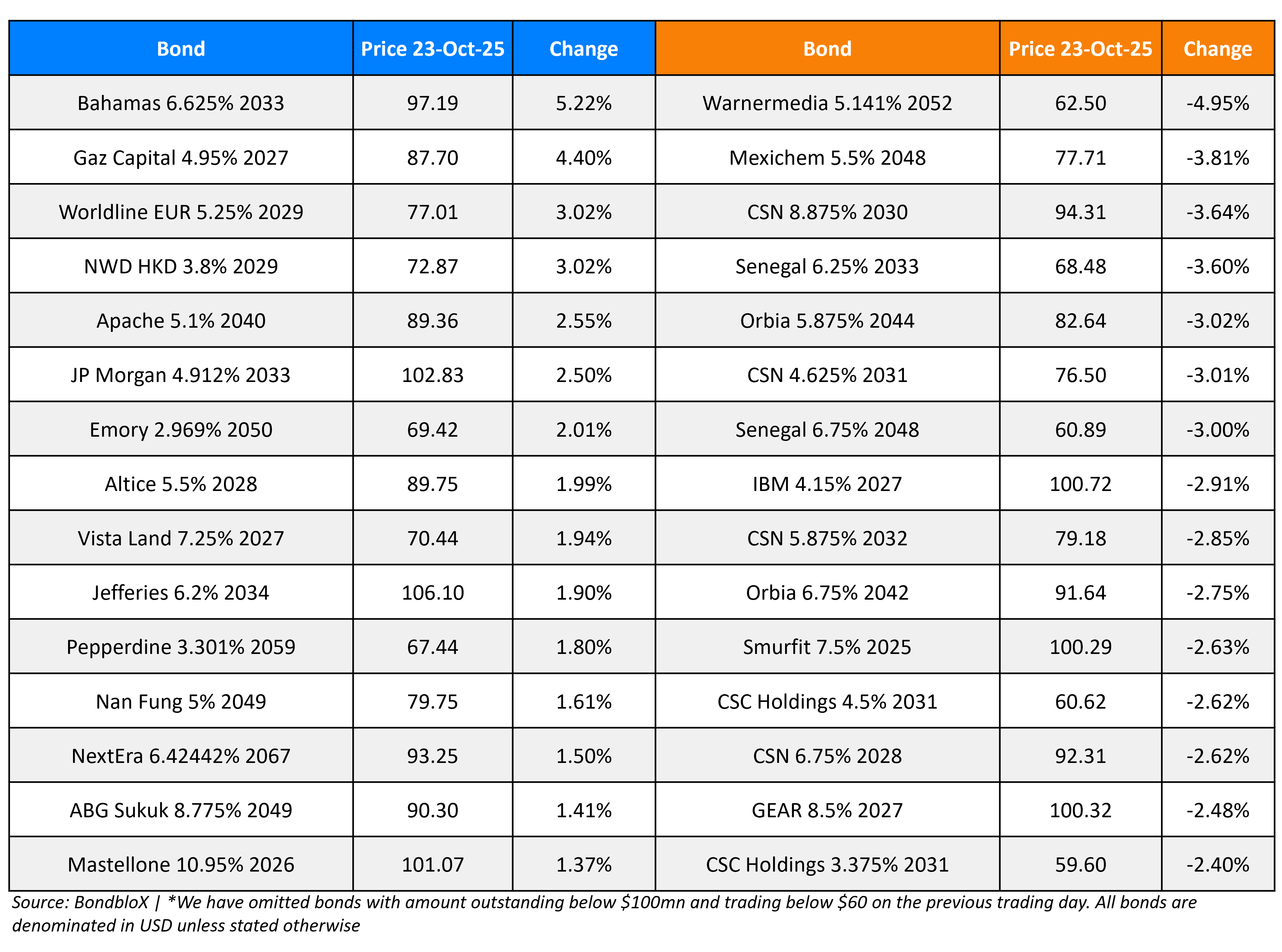

Top Gainers and Losers- 23-Oct-25*

Go back to Latest bond Market News

Related Posts: