This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

SMFG, Toyota Launch $ Bonds; FOMC Minutes Continue to Indicate Hawkish Stance

July 6, 2023

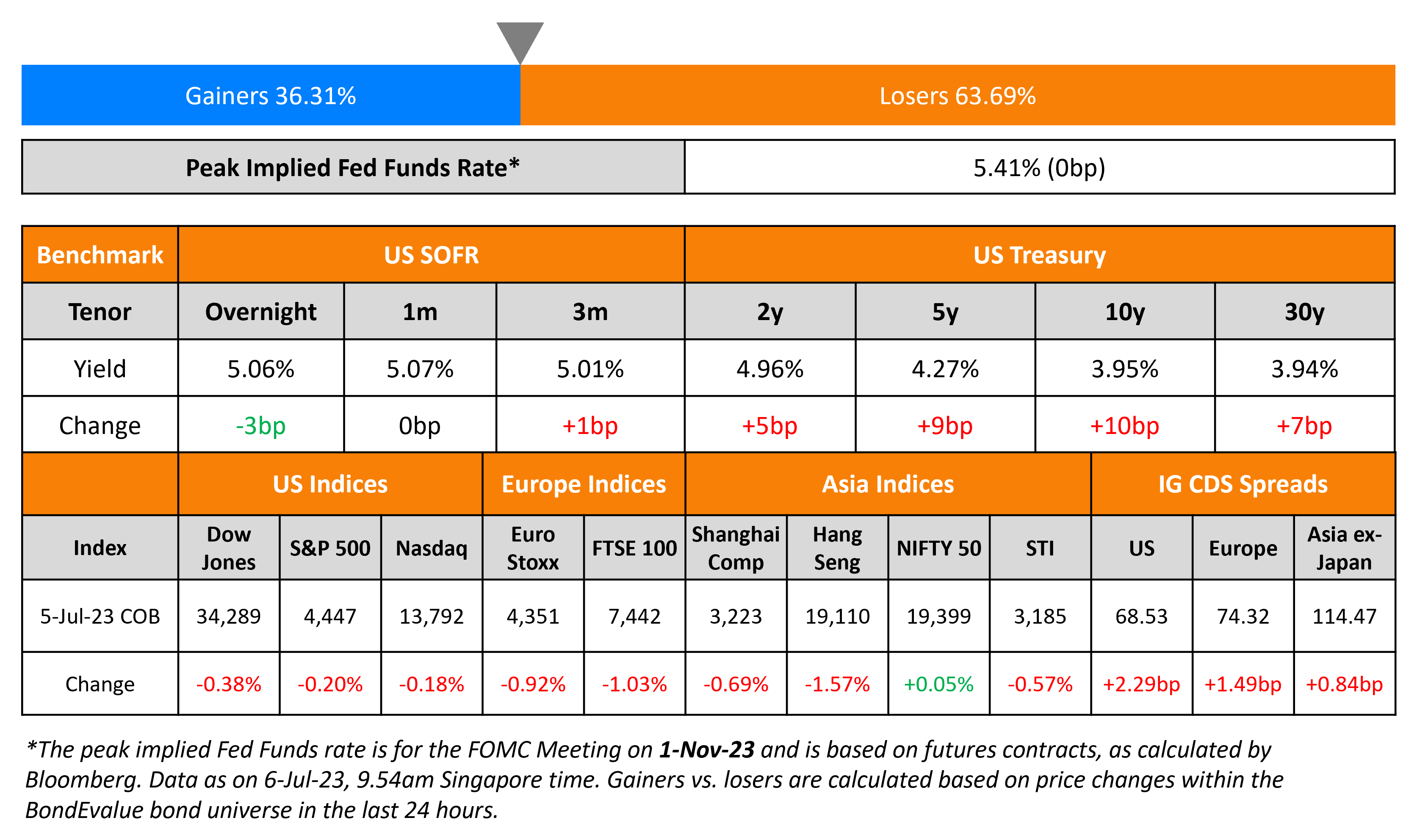

US Treasury yields higher across the curve led by the long-end with the 10Y yield up 10bp as US markets opened following a holiday a day prior. The FOMC June minutes noted that the US Federal Reserve is likely to resume raising rates after “almost all” members agreed to pause keep rates on hold last month. Broadly, the Fed minutes continued to indicate its hawkish stance towards interest rates. The peak Fed Funds rate was unchanged at 5.41%. US hard data was mixed with factory orders rising 0.3% in May, lower than expectations of 0.8%. However, durable and capital goods orders were higher than expectations at 1.8% and 0.7%. US equity indices were lower with the S&P and Nasdaq down ~0.2%. US IG and HY CDS spreads widened 2.3bp and 8.9bp respectively.

European equity indices closed lower with European main CDS spreads wider by 1.5bp and Crossover CDS wider by 7bp. Asia ex-Japan CDS spreads were 0.8bp wider and Asian equity markets have opened lower today. China’s services sector expanded lower than expected in June – the Caixin services PMI came at 53.9, below May’s 57.1, the slowest pace in five months.

New Bond Issues

- SMFG $ 3Y Fixed-to-FRN/ 5Y /7Y/ 10Y/ 20Y at T+140/165/185/195/225bp area

- Toyota $ 3Y/5Y/10Y Sustainability at T+80/100/135bp

Nomura raised $1.5bn via a two-part issuance of total loss-absorbing capacity (TLAC) (Term of the Day, explained below) bonds. It raised $900mn via a 5Y bond at a yield of 6.07%, 32bp inside initial guidance of T+215bp area. The new bonds offer a new issue premium of 10bp over to its existing 2.172% 2028s that yield 5.97%. It also raised $600mn via a 10Y bond at a yield of 6.087%, 30bp inside initial guidance of T+245bp area. The new bonds offer a new issue premium of 12.7bp over its existing 6.181% 2033s that yield 5.96%. The bonds have expected ratings of Baa1/BBB+. Proceeds will be used for loans to the issuers’ subsidiaries, which will use such funds for their general corporate purposes.

Korea East-West Power raised $350mn via a 5Y bond at a yield of 5.176%, 37bp inside initial guidance of T+135bp area. The senior unsecured bonds have expected ratings of Aa2/AA- (Moody’s/Fitch). Proceeds will be used for general corporate purposes including repayment of existing debt, and capital expenditures, particularly with respect to the generation of LNG-powered energy and renewable energy. However, such proceeds will not be used for any purpose related to the construction of new coal-fired power generation units

New Bond Pipeline

- Shinhan Financial hires for $ 5Y social bond

Rating Changes

- Fitch Downgrades Sri Lanka’s Long-Term Local-Currency IDR to ‘C’

Term of the Day

TLAC

Total Loss Absorbing Capacity (TLAC) is an international standard designed for banks, particularly Global Systemically Important Banks (G-SIBs) by the Financial Stability Board (FSB) in 2015 to ensure that these banks have ample equity and bail-in debt in place to minimize tax payer and government bailout mechanisms. Securities eligible under TLAC include common equity, subordinated debt, some senior debt and unsecured liabilities with a maturity greater than one year. FSB requires that 33% of TLAC be filled with debt securities and a maximum of 67% with equity.

Talking Heads

On Leverage Creeping Back Into Corporate Credit – Citi

“The first signs of a re-leveraging cycle have surfaced in the US high-grade market. If recent history is a guide, the trend is not our friend… Corporate fundamentals are beginning to deteriorate as the economic environment becomes more challenging yet remains broadly healthy… Cracks are beginning to show”

On Hedge Fund King Street Raising Funds for ‘Slow-Motion Car Crash’ in Credit

Brian Higgins, Founder, King Street

“This market is a slow-motion car crash. There are opportunities in terms of new lending, a bit of a walk-don’t-run”

Damien Bisserier, managing partner at Evoke Advisors

Treading water last year was good given the challenging market, and I hope that puts them into a position to take advantage of what should be a pretty attractive environment for what they do”

On Bets on ‘Year of the Bond’ Persist in Face of Still-Hawkish Fed

Jack McIntyre, PM at Brandywine

“There was a lot of talk about the year of the bond, but don’t be surprised if it’s the year of the coupon”

Roger Hallam, global head of rates at Vanguard Asset Management

“The bonds-are-back narrative still holds — they have attractive coupons and fixed income offers ballast to a portfolio, and as you saw in March, if things go badly, bonds can rally a lot… Cash yields are not durable. And a change in the macro environment means you don’t have high returns locked in.”

On Multi-asset investing: bonds are about more than just diversification

Tara Jameson, a multi-asset manager at Schroders

“We’ve gotten very used to bonds being a very good diversifier for multi-asset portfolios. That’s actually not the only role that they can play in a portfolio. They’re actually there as well as an income generator… In the world we’re in today, I’d probably say the role of bonds right now is possibly more about that income element and the yield that they offer to a portfolio rather than the diversification argument.”

Top Gainers & Losers – 06-July-23*

Go back to Latest bond Market News

Related Posts: