This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

SMFG, Emirates NBD Price $AT1s; RBA Cuts Interest Rates by 25bp

February 19, 2025

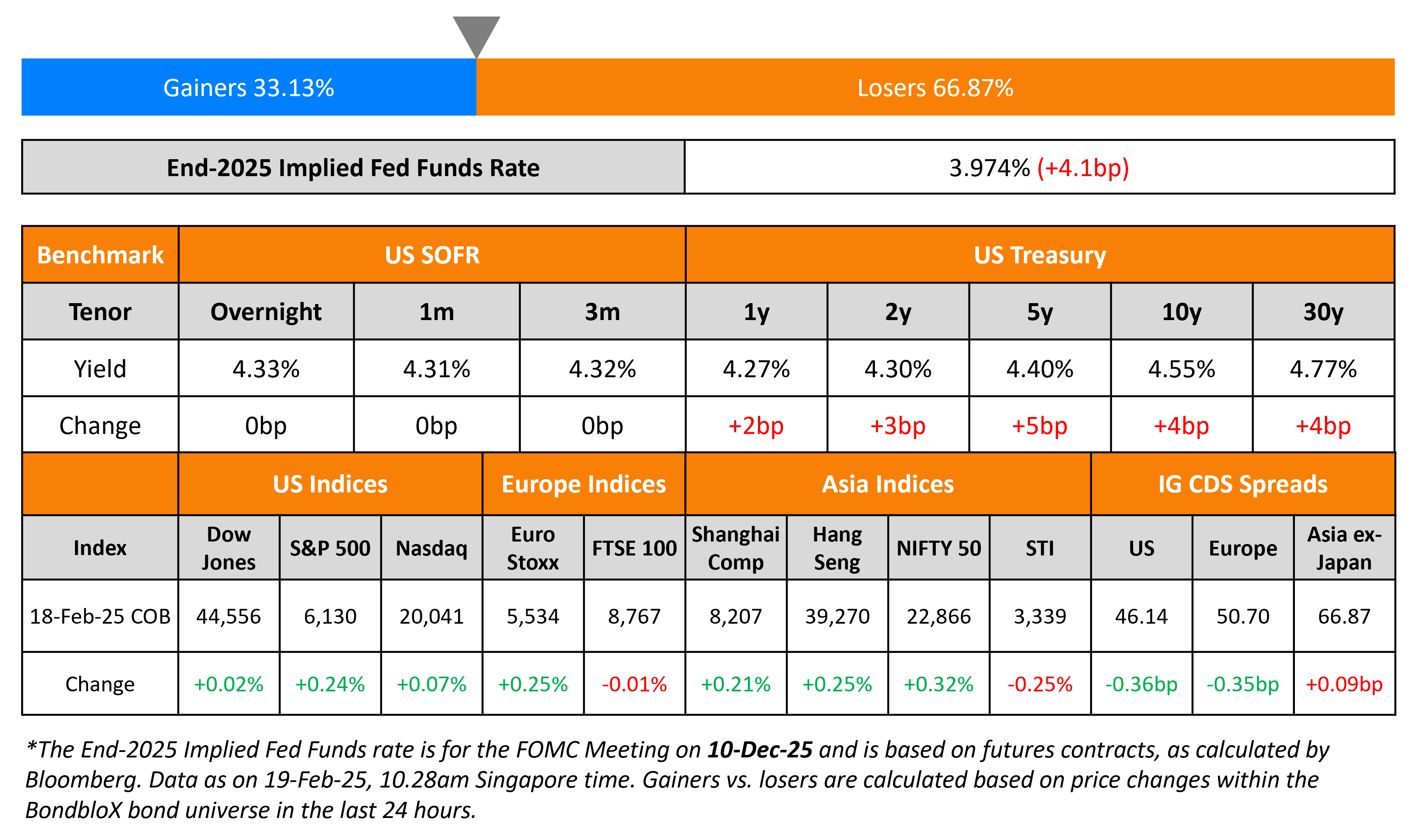

US Treasuries fell by 3-4bp across the curve yesterday. San Francisco’s Fed President Mary Daly remarked that the US economy was in good place and that policy needs to remain restrictive until further progress is seen on inflation front. She was however uncertain about more rate cuts this year. US President Donald Trump said that he intended to impose auto tariffs “in the neighborhood of 25%” and similar duties on semiconductors and pharmaceutical imports, the latest in a series of measures threatening to upend international trade.

US equity markets saw the S&P and Nasdaq ending higher by 0.2% and 0.1% respectively. Looking at credit markets, US IG and HY CDS spreads were 0.4bp and 0.8bp tighter respectively. European equity markets ended mixed. The iTraxx Main and and Crossover CDS spreads tightened by 0.4bp and 1.4bp respectively. Asian equity markets have opened broadly mixed this morning. Reserve Bank of Australia announced a 25bp rate cut, its first reduction since November 2020 pandemic. However, it sounded cautious on further easing. Asia ex-Japan CDS spreads were wider by 0.1bp.

New Bond Issues

- Lendlease S$ PerpNC3 @ 5% area

Emirates NBD raised $1bn via a PerpNC6 AT1 at a yield of 6.25%, 50bp inside initial guidance of 6.75% area. The junior subordinated bond is unrated. If not called by 25 September 2031, the coupon will reset to 6Y UST plus 183.9bp. A trigger event would occur if the CET1 Ratio of the group is less than 7%.

Sumitomo Mitsui Financial Group (SMFG) raised $1.25bn via a PerpNC10.25 AT1 at a yield of 6.452%, ~23.7bp inside initial guidance of 6.625-6.75% area. The junior subordinated notes are rated Baa3/BB+. If not called by 5 June 2035, the coupon will reset to 5Y UST plus 190bp. Net proceeds will be used by SMFG to extend a perpetual subordinated loan, intended to qualify as AT1 Capital and internal TLAC, to SMBC. SMBC intends to use the proceeds of the loan for general corporate purposes.

Hutchison Ports Holdings raised $500mn via a 5Y bond at a yield of 5.097%, 37bp inside initial guidance of T+110bp area. The senior unsecured bond is rated Baa1/A- (Moody’s/S&P). HPHT Finance Ltd. is the Issuer of the bond and Hutchison Port Holdings Trust is the guarantor. Proceeds will be used to refinance certain indebtedness and if not, general corporate purposes, including the funding of capital expenditures.

Mongolia raised $500mn via a 5Y bond at a yield of 6.625%, 50bp inside initial guidance of 7.125% area. The senior unsecured bond is rated B+/B+. It has also launched a concurrent tender offer for its 5.125% 2026s and 8.65% 2028s notes.

Greentown China raised $150mn via a tap of its 8.45% 2028 bond at a yield of 8.258%. The bond is rated B1 by Moody’s. Proceeds will be used to refinance existing indebtedness, including funding the concurrent offer to purchase.

Brazil raised $2.5bn via a 10Y bond at a yield of 6.75%, 30bp inside initial guidance of 7.05% area. The senior unsecured bond is rated Ba1/BB/BB. Proceeds will be used for repayment of outstanding federal public debt of Brazil.

Carnival raised $1bn via a 5Y bond at a yield of 5.75%, 12.5bp inside initial guidance of 5.875% area. The senior unsecured bond is rated B1/BB. Proceeds will be used to refinance $1bn of its 10.5% 2030s and reduce interest expense.

Dominican Republic raised $3bn via a two-trancher. It raised $2bn via a 12Y bond at a yield of 6.95%, 5bp inside initial guidance of low 7% area. It also raised $1bn via a 30Y bond at a yield of 7.15%, 35bp inside initial guidance of mid-7% area. The senior unsecured bonds are rated Ba3/BB/BB-. Proceeds will be used for general budgetary purposes of the government and refinancing of existing indebtedness.

Johnson & Johnson raised $5bn via a five-trancher. It raised:

BHP raised $3bn via a three-trancher. It raised:

- $1bn via a 5Y bond at a yield of 5.01%, 23bp inside initial guidance of T+85bp area

- $750mn via a 7Y bond at a yield of 5.195%, 23bp inside initial guidance of T+95bp area

- $1.25bn via a 10Y bond at a yield of 5.35%, 25bp inside initial guidance of T+105bp area

The senior unsecured bonds are rated A1/A (Moody’s/Fitch). BHP Billiton Finance USA Ltd. is the issuer and BHP Group is the guarantor. Proceeds will be used for general corporate purposes.

Energy Transfer raised $3bn via a three-trancher. It raised:

- $650mn via a 5Y bond at a yield of 5.245%,30bp inside initial guidance of T+115bp area

- $1.25bn via a 10Y bond at a yield of 5.716%, 28bp inside initial guidance of T+145bp area

- $1.1bn via a 30Y bond at a yield of 6.244%, 30bp inside initial guidance of T+175-180bp area

The senior unsecured bonds are rated Baa2/BBB/BBB. Proceeds will be used to refinance existing indebtedness, including to repay commercial paper and borrowings under revolving credit facility, and for general partnership purposes.

Uzbekistan raised €500mn via a 4Y sustainable bond at a yield of 5.1%, 40bp inside initial guidance of 5.5% area. Proceeds will be used to finance and/or refinance, in whole or in part, new and/or existing eligible SDG expenditures as outlined in The Republic of Uzbekistan’s SDG Bond Framework. It also raised $500mn via a 7.25Y bond at a yield of 6.95%, 42.5bp inside initial guidance of 7.375% area. Proceeds will be used for general budgetary purposes, including infrastructure projects. Both the senior unsecured bonds are rated Ba3/BB-.

UniCredit raised €1bn via a PerpNC6 AT1 at a yield of 5.625%, 62.5bp inside initial guidance of 6.25% area. The junior subordinated notes are rated Ba3. If not called by 3 June 2033, the coupon will reset to 5Y Mid-Swap plus 329.9bp. A trigger event would occur if the CET1 Ratio of the Issuer or Group falls below 5.125% or then minimum trigger specified.

NatWest raised €1bn via a 10NC5 Tier 2 bond at a yield of 3.723%, 30bp inside initial guidance of MS+170bp area. The subordinated bond is rated Baa1/BBB-/BBB+. The bond is callable at par on 25 February, 2030.

New Bonds Pipeline

- Varanasi Aurangabad hires for $ 9NC3 bond

- Saudi Real Estate hires for $ 3Y/10Y bond

- Sharjah Islamic Bank hires for $ 5Y Sukuk bond

- Damac hires for $ 3.5Y Sukuk bond

Rating Changes

- Moody’s Ratings upgrades Twilio to Ba2; outlook positive

- Haitong Securities And Haitong International Securities Ratings Placed On Watch Positive On Merger Progress

- Japan’s AIG General Outlook Revised To Positive On Capitalization, Liquidity, And Parent Support; ‘A+’ Ratings Affirmed

- Outlooks On Austrian Government-Related Entities Revised To Stable After Same Action On Austria; Affirmed At ‘AA+/A-1+’

Term of the Day

TLAC

Total Loss Absorbing Capacity (TLAC) is an international standard designed for banks, particularly Global Systemically Important Banks (G-SIBs) by the Financial Stability Board (FSB) in 2015 to ensure that these banks have ample equity and bail-in debt in place to minimize tax payer and government bailout mechanisms. Securities eligible under TLAC include common equity, subordinated debt, some senior debt and unsecured liabilities with a maturity greater than one year. FSB requires that 33% of TLAC be filled with debt securities and a maximum of 67% with equity.

Talking Heads

On Climbing Treasury Yields as Traders Seek Further Clues on Fed Path

Benoit Anne, MFS Investment Management

“The macro backdrop points to upside risks to US Treasury yields in the US…in particular, we have a Fed that is being priced out, inflation risks that have resurfaced, and a growth picture which remains robust.”

On Australian Yield Discount Versus US Vanishing on RBA Outlook

Prashant Newnaha, TD Securities

“With the RBA out of the way, wages and employment will be key to near-term Australian bond moves…10-year Australian notes are rich for currency-hedged investors compared with their domestic benchmarks. Together our bias is for Australian 10-year notes to underperform other markets in the near term.”

On Bond Market Volatility Driven by US Tariffs

Andrew Bailey, Bank of England

“It is what’s coming out of Washington on tariffs that is moving that term premium around, day by day and hour by hour…I do think that we’d all probably like to see less volatility on that. I do have to say that fragmentation of the world economy is negative for growth…The situation for inflation in a country that faces tariffs is actually fairly ambiguous in terms of what happens, because it depends upon trade redirection…whatever measures are taken in response…[and] upon the reaction of exchange rates.”

Top Gainers and Losers- 19-February-25*

Other News

Go back to Latest bond Market News

Related Posts: