This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

SMC, QNB, Morgan Stanley Price Dollar Bonds; US Retail Sales Beats Expectations

July 18, 2025

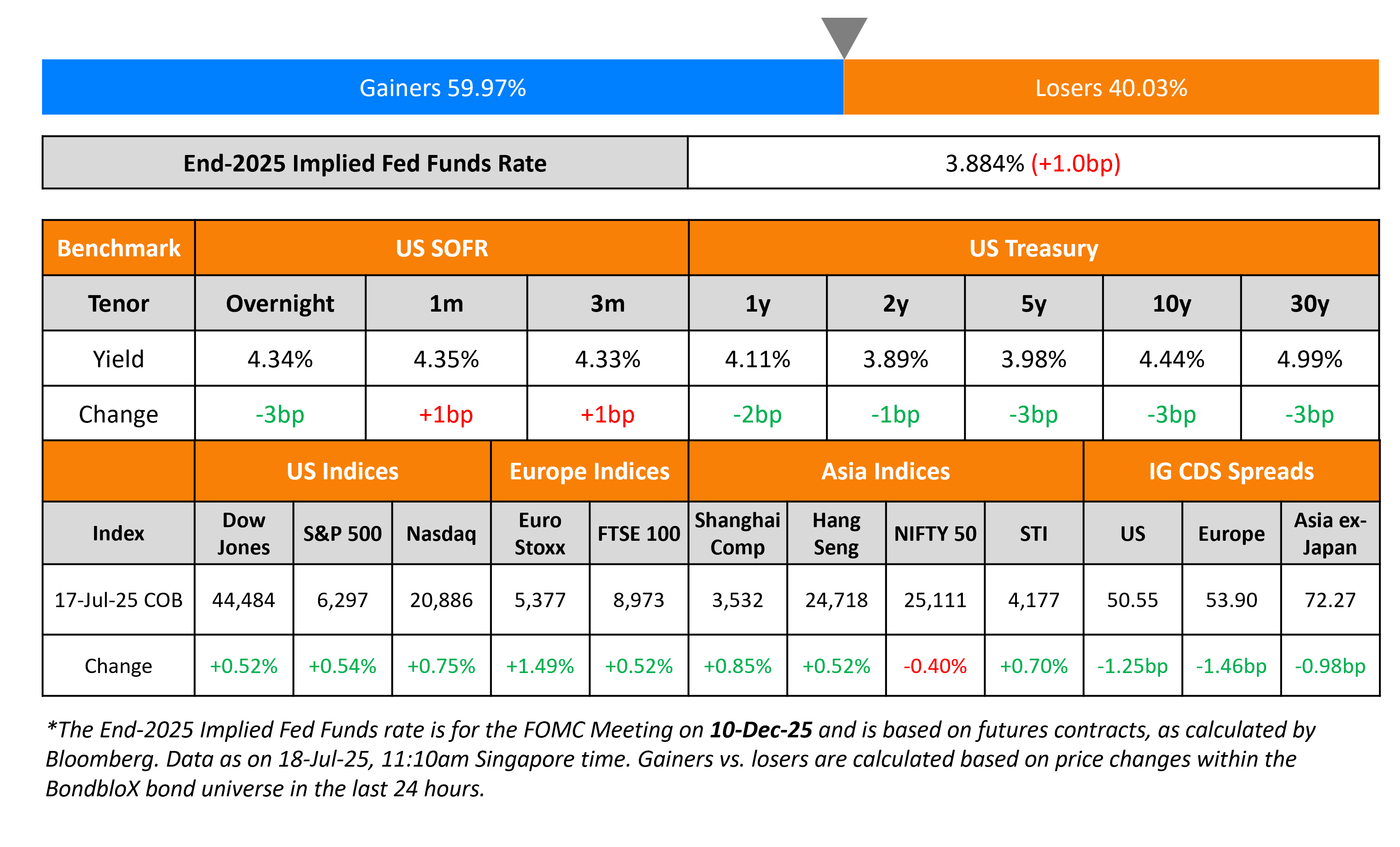

US Treasury yields eased by ~3bp on Thursday. US Retail Sales for June rose by 0.6% MoM vs. expectations of 0.1% and the prior month’s -0.9% reading. Core Retail Sales also rose by 0.6% vs. expectations of 0.3% and the prior month’s revised reading of 0%. New York Fed President John Williams said that it is “entirely appropriate” for the Fed to maintain its current modestly restrictive monetary policy stance. Similarly, Fed Governor Adriana Kugler justified keeping interest rates on hold after the recent inflation data.

Looking at US equity markets, the S&P and Nasdaq were up by 0.5% and 0.8% respectively, closing at record highs. US IG and HY CDS spreads tightened by 1.3bp and 8.4bp respectively. European equity markets ended lower. The iTraxx Main CDS spreads tightened by 1.5bp and Crossover CDS spreads tightened by 6.5bp. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were tighter by 1bp.

New Bond Issues

San Miguel Global Power Holdings raised $400mn via a PerpNC5 bond at a yield of 8.95%. If not called by 24 April 2030, the coupon will reset to the US 5Y Treasury yield plus 494.5bp. There is also an additional coupon step-up of 250bp if the bond is not called due to a reference indebtedness default event or upon the occurrence of any of a Change of Control event. If this is remedied, the the coupon step-up will be removed from the subsequent distribution date. The notes have a dividend pusher and a dividend stopper. A reference indebtedness default event would occur if the Issuer defaults on its outstanding PHP 10bn 8.0288% Series M bonds due 2032. The new bond is priced at a new issue premium of 34bp over its 8.125% Perp callable in December 2029, that currently yields 8.61%. Net proceeds will be used primarily for costs and expenses related to (a) its concurrent exchange offer and (b) issuance of additional new securities. Any remaining proceeds may be used for (a) purchase, repurchase and/or redemption of all remaining outstanding securities under its exchange offers (b) pre-development costs of solar and hydro energy projects (c) capex for BESS projects.

QNB raised $1bn via a 5Y bond at a yield of 4.678%, 30bp inside initial guidance of T+100bp area. The senior unsecured notes are rated Aa3/A+/A+, and received orders of over $3bn, 3x the issue size.

Morgan Stanley Private Bank raised $6bn via a three-part deal. It raised:

- $2bn via a 3NC2 bond at a yield of 4.466%, 28bp inside initial guidance of T+75bp area

- $1bn via a 3NC2 FRN at SOFR+77bp vs. initial guidance of SOFR equivalent

- $3bn via a 6NC5 bond at a yield of 4.734%, 20bp inside initial guidance of T+95bp area

The senior bank notes are rated Aa3/A+/AA-. Proceeds will be used for general corporate purposes.

Rating Changes

-

Unigel Participacoes S.A. Downgraded To ‘CC’ From ‘CCC’ On Potential Standstill Agreement; Outlook Negative

-

Moody’s Ratings upgrades illimity’s long-term deposit and senior unsecured ratings, outlook stable

-

Nippon Steel Downgraded To ‘BBB’ From ‘BBB+’ On Financial Burden Of U.S. Steel Acquisition; Outlook Negative

Term of the Day: Guaranteed Bonds

A guaranteed bond is a type of bond that has a guarantee wherein interest and principal payments will be made by a third party if the issuer defaults. The third party/guarantor could be the parent company or a JV, an insurance company, government based entity etc. Since the bond is guaranteed, the risks in investing in the bond are lower vs. non-guaranteed bonds and thus generally offer lower yields. From the issuer’s perspective, this also eases the cost of raising debt, though it is partially offset by paying some premiums to the guarantor.

Talking Heads

“I’m not aware of any economist anywhere near the mainstream who is supporting anything like 1% rates in the current environment…might create some temporary boom in the economy, but would do so at the cost of a massive inflation psychology.”

On Powell Drama Is Dollar Headwind – George Saravelos, Deutsche Bank

“it will act as a big headwind both to the dollar and to fixed income, until it gets resolved one way or another… As we get closer to the date when Powell anyways is closer to leaving, that at least should remove some of the extreme tail risk, and the risk of institutional duress for the Fed”

On Fed Independence Is ‘Essential,’ But Limited – Kevin Marsh

“History tells us that the independent operations in the conduct of monetary policy is essential…But that doesn’t mean the Fed is independent in everything else it does”

Top Gainers and Losers- 18-Jul-25*

Go back to Latest bond Market News

Related Posts: