This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

SMC Global Power Launches Exchange Offer, Mandate for New $ Bond

August 28, 2024

San Miguel Global Power Holdings Corp (SMC Global Power) has hired bankers for the launch of a new dollar bond offering. It has also simultaneously launched and exchange offer (more details below). If the new bonds are issued, net proceeds will be applied in following order:

- Costs and expenses related to concurrent exchange offers – including payment of accrued interest, payment of purchase price

- Toward pre-development costs of solar energy projects

As part of the all-cash exchange offer, SMC plans to exchange its USD 5.95% Perp and USD 7% Perp for an equal nominal amount of new notes.

SMC’s 5.95% Perp was trading stable at 99.8, yielding 6.3% and its 7% Perp was at 99.6, yielding 7.4%.

Go back to Latest bond Market News

Related Posts:

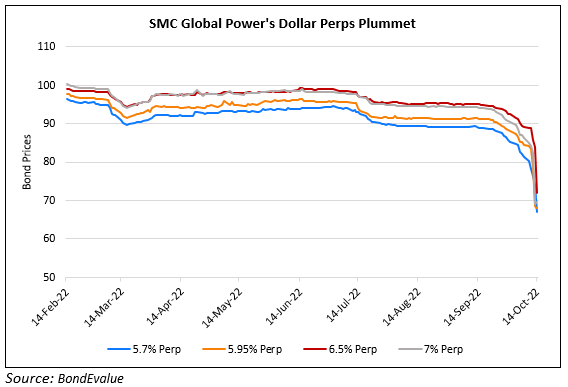

SMC Global’s Dollar Perps Drop Over 10%

October 14, 2022

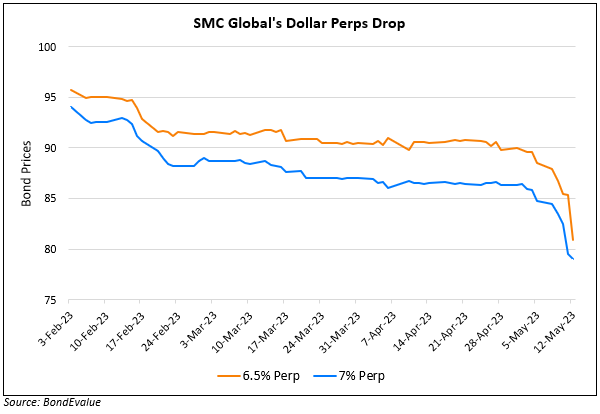

SMC Global’s Dollar Perps Drop 3-6 Points

May 12, 2023

San Miguel Said to be in Talks for $2bn Loan with Banks

October 18, 2023