This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

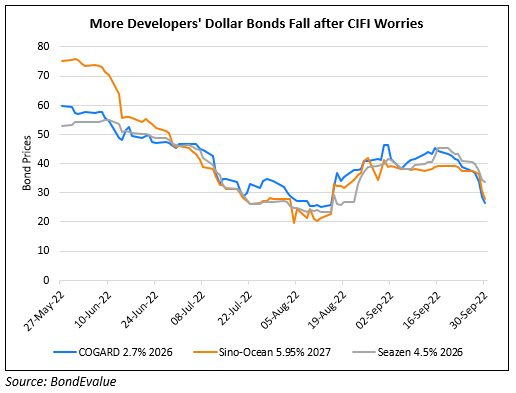

Sino-Ocean Creditors Balk at It’s UK Restructuring Strategy

September 25, 2024

Sino-Ocean Group is facing creditor concerns over its restructuring strategy involving UK courts, aimed at avoiding an unfavorable ruling following a liquidation lawsuit from bondholders in Hong Kong. A judge has adjourned a related hearing until December 23 to assess Sino-Ocean’s plans for simultaneous restructuring processes in both Hong Kong and the UK. The company is attempting to settle terms with Class A loan creditors under Hong Kong law, while leveraging UK insolvency practices that allow approval of debt terms as long as they’re approved by at least one creditor class and meet certain conditions. Sino-Ocean said that over 75% of a lender group holding loans has agreed to the restructuring proposal, which would convert $5.6bn in debt into $2.2bn of new debt and other securities. However, other creditor groups’ support levels are below 20%. Concerns about transparency and equitable treatment among different creditor classes have been raised, with implications that this case could influence other Chinese developers considering similar restructuring paths. A UK court hearing is scheduled for October 18, with another in Hong Kong on October 31.

Sino-Ocean’s dollar bonds continue to trade at 6-7 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts: