This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

SIA Raises Funds; Pemex, South Africa, Oman Downgraded

March 30, 2020

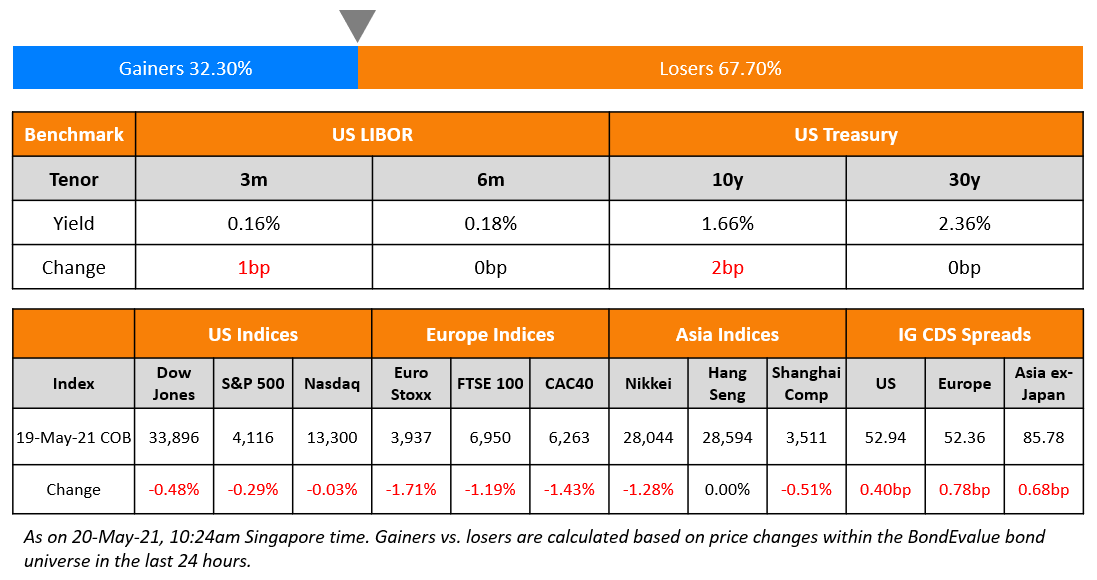

At the time of this writing, Asian equity markets were lower with Topix down 4%, Nikkei down 3.65%, Kospi down 2.35%, Hang Seng down 1.6% and Shanghai composite down 1.37%. US markets were down 1%-2% on Friday and US futures are opening down around 1% this morning. US crude oil WTI hit below $20 this morning, down 6%.

Global corporate bond issuance by investment grade companies hit the highest monthly total of $244bn since September with the US leading the way issuing $150bn and Europe raising $28bn. In fact, last Thursday saw one of the busiest days in months for the corporate bond market in the US and Europe as 34 issuers sold a combined $64.8 bn of debt. It is interesting to note that high yielders have not issued anything since early March and this is the longest lull since 2008. Asia did not see this rush to raise cash with very few new issues. A noteworthy one was a 2031 maturity 144A/Reg S issuance by Standard Chartered (SCB) at +385bps spread over treasury with a coupon at 4.644%. Previously, SCB issued a similar maturity at 4.305% in 2019 which was at +190bps spread over benchmark for comparison. Average CDS spreads in Asia ex Japan hit a high of 177.25 bps on 24 March and spent the rest of the week trending lower to 132 bps currently.

Emerging Market debt funds have also seen the worst start to the year on record outflows. The last week has seen $47.7bn in outflows which is equal to 10.2% of AUM. For comparison, outflows were 16% during the taper tantrum of 2013, 19% during the China sell-off and Greek default of 2015 and 34.5% during the GFC according to Morgan Stanley.

Mexico will Provide “Extraordinary Support” to Pemex, says S&P after cutting Ratings; US Energy Bonds Struggle

A day after cutting ratings of both Mexico and Pemex, S&P Global Ratings said that Mexico’s government will most likely prop up state oil firm Petroleos Mexicanos due to its vulnerability to low crude prices as the coronavirus hits demand. Maya crude (heavy sour crude oil grade produced in Mexico) due for delivery to the U.S. Gulf Coast plummeted to as low as $12.92 per barrel on March 18. Experts say Pemex is highly vulnerable to prices below $20 per barrel.

The US energy bond market was also not spared as nearly $110bn have fallen into distressed status, which is almost 12% of the $936bn market. Shale-oil producers particularly have been badly hit, with many struggling to break even when crude was at much higher levels. Consequently, the prices of bonds issued by many shale companies have fallen off a cliff – leading to astronomical yields. Morgan Stanley has picked shale pioneer Chesapeake Energy and Whiting Petroleum as the energy companies at greatest risk of default over the near term (meaning in less than a year). Morgan Stanley has also picked Occidental Petroleum, Apache Corp., Continental Resources, Cimarex Energy , Noble Energy, Marathon Oil and Hess Corp as fallen angels whose risk profiles are worsening. Exxon Mobil has long been considered the gold standard in the oil-and-gas credit ratings. But that changed slightly in November after S&P Global lowered the company’s rating to AA from AA+ on cash flow concerns.

Global Airlines Raise More Than $17 Billion, SIA to Raise $10.5 Billion

Airlines around the world raised $17bn in bank loans in March to shore up their finances. US carriers led the way with Delta obtaining $5.6bln, SIA securing a $2.8bn bridge loan and United Airlines raising $2.5bn. Separately, eleven other airlines including British Airways and Etihad Airways have about $8bn in combined revolving facilities that they may not yet have drawn. Singapore Airlines, which earlier announced a 96% capacity cut and called for a trading halt last week, is now seeking to raise $10.5 billion (SGD $15 billion), firstly through offering SGD $5.3 billion in new shares and up to SGD $9.7 billion of 10-year mandatory convertible bonds. Temasek Holdings will vote in favour of this arrangement and will buy all remaining shares and bonds.

Ronshine China Buys Back $61.5mn of Bonds

Ronshine China Holdings Limited has repurchased an aggregate amount of $61.5mn in the open market.

- the July 2020 Notes of US$1 million in aggregate principal amount

- the August 2021 Notes of US$35.5 million in aggregate principal amount

- the March 2022 Notes of US$12 million in aggregate principal amount

- the January 2023 Notes of US$5 million in aggregate principal amount

- the June 2023 Notes of US$8 million in aggregate principal amount

For the full story, click here.

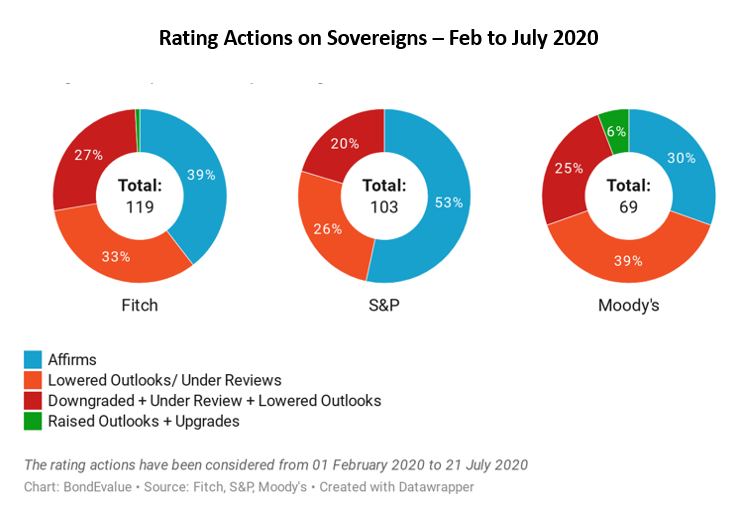

Fitch downgrades U.K; S&P Cuts Oman Deeper into Junk, lowers Kuwait, Affirms Saudi and Qatar; Moody’s cuts South Africa to Junk

Fitch lowered the UK’s rating to AA- from AA late on Friday, but the market shrugged it off as investors already anticipate a series of cuts to sovereign ratings as states ramp up spending to tackle the virus. On Friday, Moody’s downgraded South Africa’s credit rating to Ba1 (junk), piling more anguish on an economy already in recession and battered by Africa’s worst coronavirus outbreak. S&P cut Oman’s long-term foreign and local currency sovereign ratings to BB- from BB, citing higher external risks and indebtedness. S&P also cut the rating of Kuwait by one notch to AA- from AA last week as oil prices have dropped more than 40% since early March. The agency affirmed its ratings for Saudi Arabia and Qatar, rated A- and AA- respectively.

Top Gainers & Losers – 30-Mar-20*

US crude oil price falls below $20

US crude oil prices fell below $20 a barrel shortly after trading reopened on Sunday, close to the lowest level in 18 years, as traders bet production will need to shut to cope with the collapse in demand from the coronavirus pandemic. The US benchmark, known as West Texas Intermediate or WTI, hit a low of $19.92 a barrel, losing more than 6 per cent. Brent, the international benchmark, lost 6 per cent to hit a low of $23.03 a barrel, the lowest since 2002.

Oil prices have fallen by more than half in the past month as widespread lockdowns in Europe and North America have slashed oil demand by a huge amount, with analysts forecasting as much as a quarter of normal global consumption could be lost. With supplies being boosted at the same time by the price war between Saudi Arabia and Russia, traders believe the surplus could approach 25m barrels a day next month, a level that could overwhelm storage capacity worldwide within weeks.

For the full story, click here.

Goldman Sachs, Morgan Stanley to take control of China JVs

Goldman Sachs and Morgan Stanley received regulatory approval on Friday to take control of their Chinese securities joint ventures, becoming the latest foreign banks to take advantage as China opens up its financial services sector. In separate announcements on Friday night, the American banks said the China Securities Regulatory Commission had approved their bids to own majority stakes in their securities joint ventures, Goldman Sachs Gao Hua Securities Company and Morgan Stanley Huaxin Securities.

Following intense lobbying from foreign banks, China said it would raise its cap on foreign ownership limits to 51% in April 2018. The ruling allows foreign banks to compete more effectively onshore and to integrate their mainland business with their global operations. The approvals followed the Office of Financial Stability and Development Committee and the State Administration of Foreign Exchange announcing in July they would ease rules and further open up China’s financial sector a year earlier than planned.

For the full story, click here.

China’s Corporate Deleveraging Campaign May Be Set Back by Years

China’s corporate leverage is ramping up again, before borrowers had even finished working down the last surge. The campaign by policy makers to rein in the growth of debt was just approaching the four-year mark when battling the coronavirus outbreak quickly replaced all other priorities. And it was showing results: nonfinancial corporate debt last year was noticeably, if marginally, down from a 2016 peak relative to the size of the economy.

For now, China has returned to the 2008 model of opening up the credit taps, especially through state-run enterprises and local governments. The new tack also means potentially more help for private firms that would otherwise have defaulted. Investors have applauded: yields on lower rated, local government financing vehicles have come down to 2016 lows.

For the full story, click here.

Other Stories

- China Construction Bank NPL ratio falls despite shrinking net interest margin

- Sinopec posts 12.8% decline in operating cash flow and an 8.7% fall in net profit

- State Bank of India raises $100 million in green bonds

Go back to Latest bond Market News

Related Posts: