This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Shui On Land Launches $ Bond

January 19, 2026

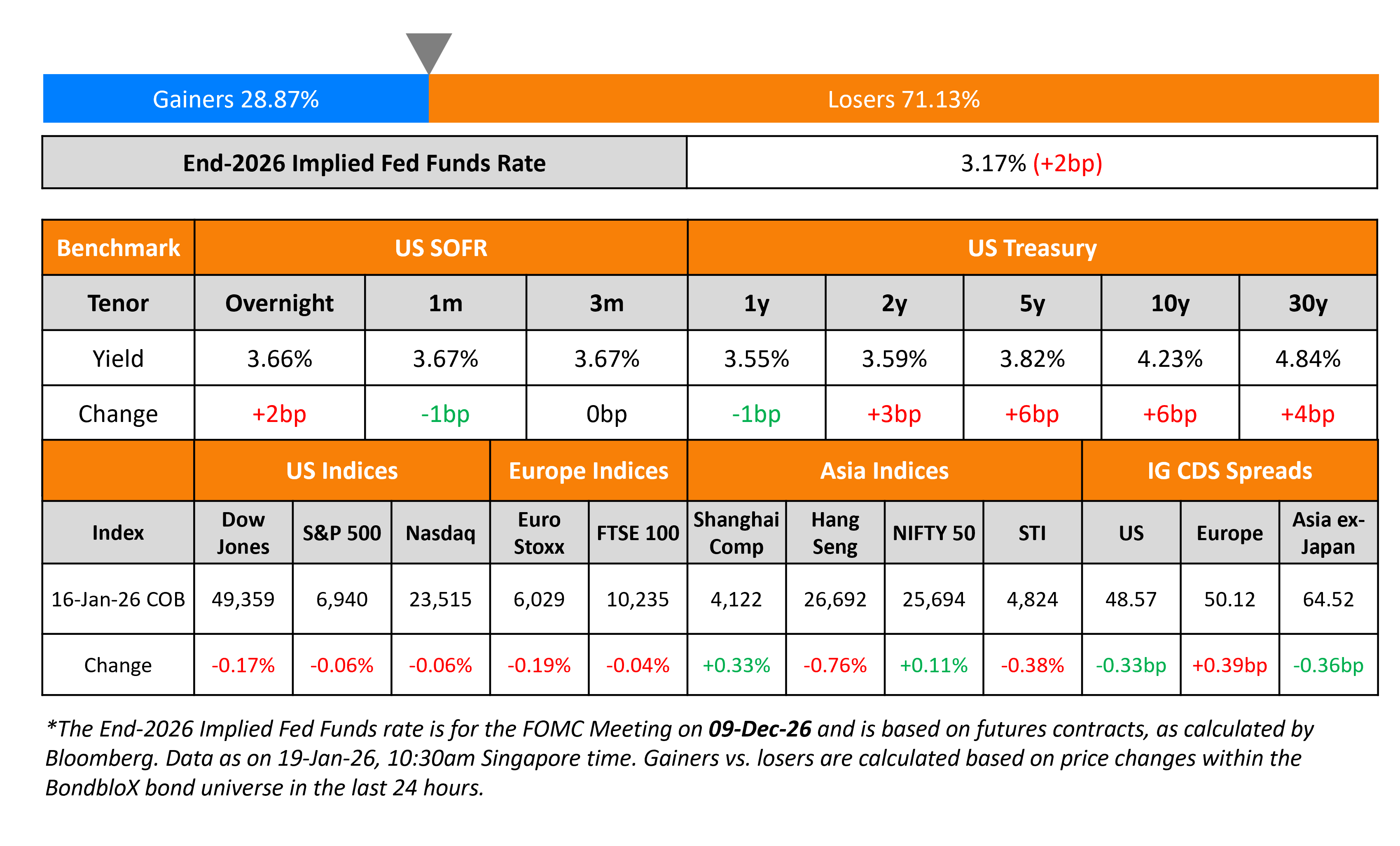

The US Treasury yield curve steepened, with the 10Y rising by 6bp while the 2Y yield was up by 3bp. Fed Vice-Chairman Phillip Jefferson said that the central bank’s current monetary policy stance was well-positioned, near the level that neither slows nor stimulates the economy. Separately, Fed Vice Chair for Supervision Michelle Bowman said that the Fed should be ready to adjust policy to bring it closer to neutral.

Looking at US equity markets, the S&P and Nasdaq ended lower by about 0.1% each. US IG CDS spreads tightened by 0.3bp and HY CDS spreads were tighter by 3.2bp. European equity indices ended lower too. The iTraxx Main CDS spreads were 0.4bp wider and the Crossover CDS spreads were 1.5bp wider. Asian equity markets are trading weaker this morning. Asia ex-Japan CDS spreads were tighter by 0.4bp. Separately, gold and silver prices continue to surge to all-time highs amid geopolitical tensions.

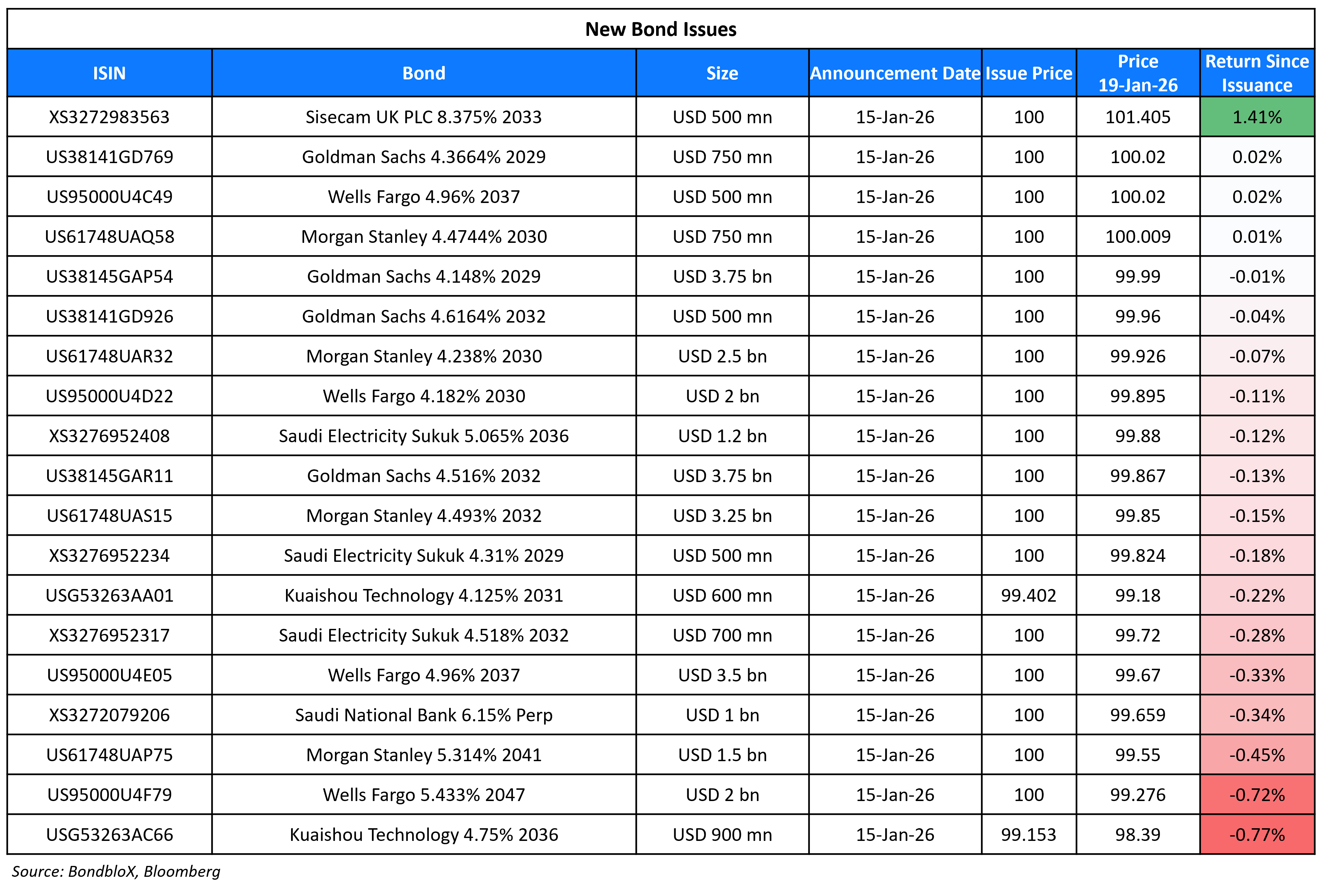

New Bond Issues

- Shui On Land $ 3NC1.5 at 10.625% area

New Bonds Pipeline

-

China Oil & Gas $ bonds

-

MTR inaugural A$ green 5Y & 12Y Kangaroo bond

Rating Changes

- Fitch Upgrades Bolivia to ‘CCC’

- Husky Technologies Ltd. Upgraded To ‘B+’ Following Acquisition By CompoSecure Holdings; Ratings Subsequently Withdrawn

- Fitch Downgrades Wanda Commercial and Wanda HK to ‘RD’; Upgrades to ‘CC’

- Fitch Revises Armenia’s Outlook to Positive; Affirms at ‘BB-‘

Term of the Day: Kangaroo Bonds

Kangaroo bonds are bonds issued in Australia by non-Australian issuers denominated in Australian Dollars. These bonds give foreign issuers access to another country’s capital markets and helps them diversify their capital base and could reduce borrowing costs. Although, the currency risk is borne by the issuer. MTR has launched a kangaroo bond offering.

Talking Heads

“Absent a clear and sustained improvement in labor-market conditions, we should remain ready to adjust policy to bring it closer to neutral… should also avoid signaling that we will pause without identifying that conditions have changed”

On Wall Street Giving Trump the All-Clear to Push Disruptive Agenda

Mark Malek, Siebert Financial

“The president is very much using the markets as a scorecard right now, and that scorecard — from the president’s point of view — says he’s winning… expect the unexpected”

Jack McIntyre, Brandywine Global Investment Management

“We are seeing growth without inflation pressures. The economy is on solid footing at a time when inflation is still behaving… suspect there’s a little bit of FOMO going on”

On ‘Absolutely, Positively No Chance’ on Fed Chair Job – Jamie Dimon, JPMorgan

“Chairman of the Fed, I’d put in the absolutely, positively no chance, no way, no how, for any reason… I would take the call”

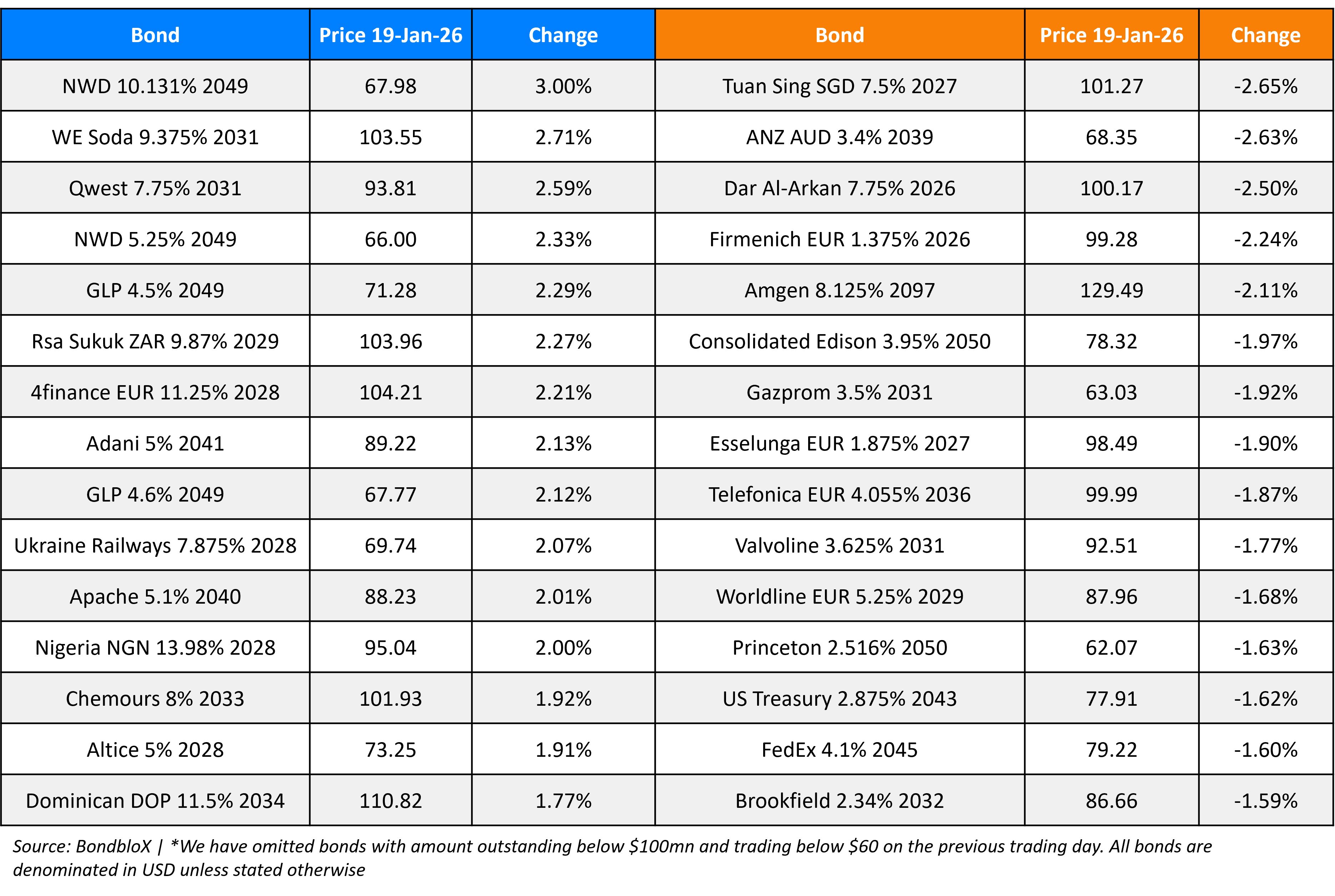

Top Gainers and Losers- 19-Jan-26*

Go back to Latest bond Market News

Related Posts: