This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

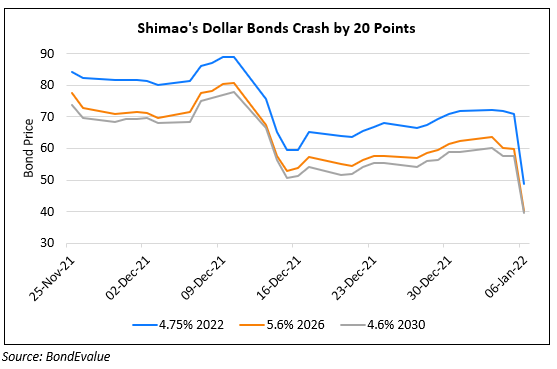

Shimao Secures Creditors’ Backing for Restructuring

February 25, 2025

Chinese property developer Shimao Group has secured backing from 98.75% of its creditors to restructure approximately $11.04bn in offshore debt. This follows a trend of restructuring efforts by other troubled developers, such as Sunac China, which reduced its onshore debt earlier this year, and CIFI Holdings, which reached an agreement on its offshore debt. Shimao, which had been in negotiations since defaulting in 2022, presented bondholders with four restructuring options: short-term notes, long-term notes, zero-coupon mandatory convertible bonds, or a fixed combination of these. The company’s restructuring plan, originally announced in March last year, aims to address about $11.7bn in debt, including bonds and other credit facilities. Despite initial opposition from major bondholders, the plan now enjoys overwhelming creditor support. The scheme will be reviewed by a court on March 13 for approval.

Shimao’s dollar bonds are trading at deeply distressed levels of 5-6 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts: