This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

SGX Launches S$ 3Y at 3.6% area

February 19, 2024

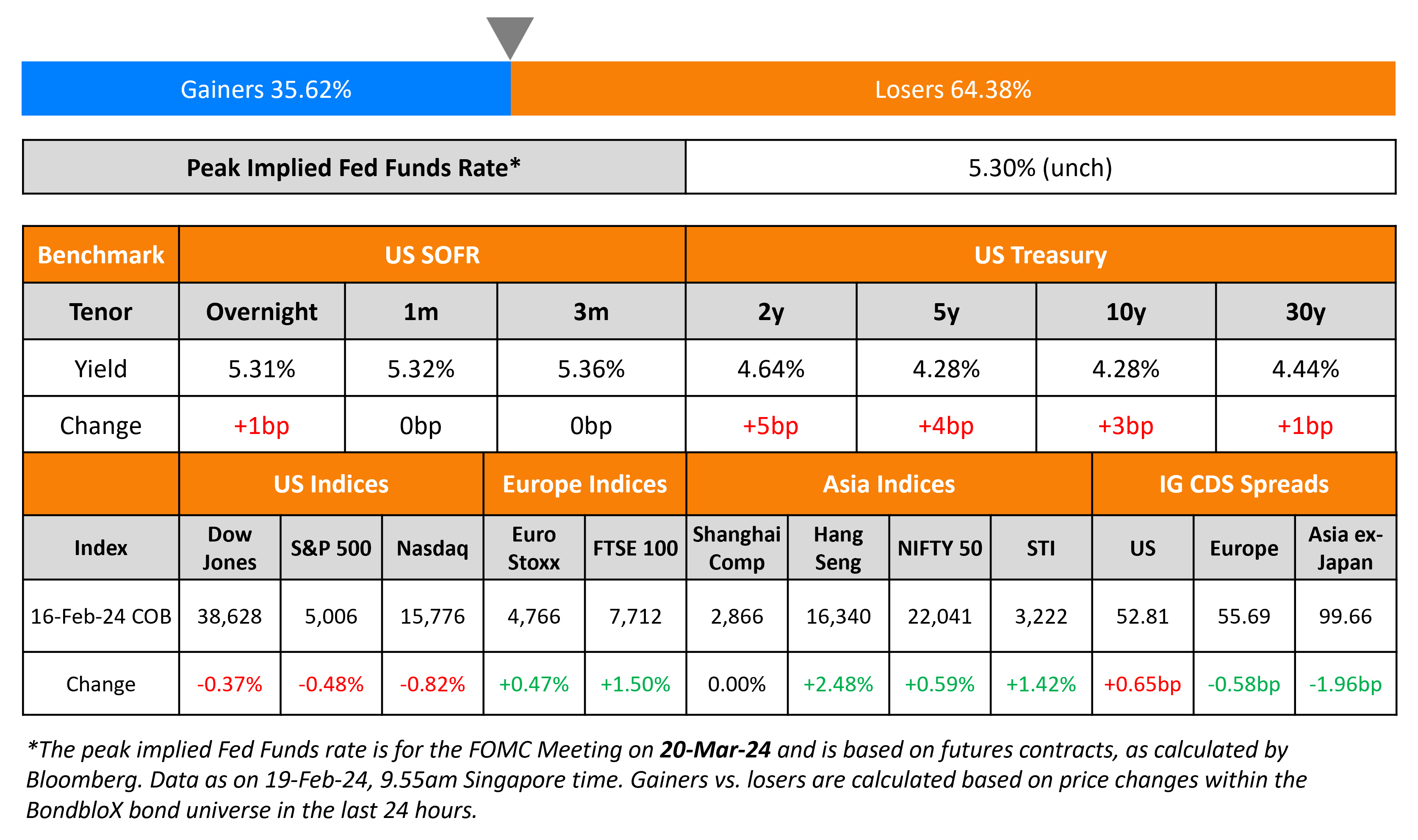

US Treasury yields ticked higher by 3-5bp on Friday. US PPI rose in January by more than forecast, thanks to a jump in costs of services. PPI for final demand increased rose 0.9% YoY and also exceeded forecasts of a 0.6% rise. Looking at credit markets, US IG and HY CDS spreads widened 0.7bp and 5bp respectively. S&P and Nasdaq fell 0.5-0.8%.

European equity markets ended higher. Credit markets in the region saw the European main CDS spreads tighten by 0.6bp and crossover spreads tighten by 6.2bp. Asian equity markets have opened mixed today. Asia ex-Japan IG CDS spreads tightened by 2bp.

New Bond Issues

- SGX S$ 3Y at 3.6% area

New Bond Pipeline

- Del Monte Philippines hires for $ Perp

- Daewoo Engineering & Construction hires for S$ bond

- Greenko Mauritius hires for $ bond

Rating Changes

- Fitch Upgrades Hyundai Motor and Kia to ‘A-‘; Outlook Stable

- Moody’s upgrades Novartis’ rating to Aa3 and changes its outlook to stable

- Crocs Inc. Upgraded To ‘BB’ On Continued Outperformance And Debt Reduction, Outlook Stable

- Fitch Downgrades CLISA to ‘RD’; Upgrades to ‘CC’ on Conclusion of Consent Solicitation

- Enviva Inc. Downgraded To ‘D’ On Failure To Make Interest Payment

Term of the Day

Subordinated Bonds

Subordinated bonds refer to bonds that rank below senior debts on the capital structure. In the event of liquidation, holders of subordinated debt would only be paid after all the senior debt is repaid. Thus, the ratings and yield of subordinated debt tend to be lower and higher respectively, to account for the greater risk associated with subordinated vs. senior debt.

There are different kinds of subordinated debt that can include perpetuals/AT1 CoCos, payment-in-kind notes, mezzanine debt, convertible bonds, vendor notes etc. Subordinated debt rank higher to preferred equity and common equity in the capital structure.

Talking Heads

On Latin America’s Troubled State Companies Lure Bond Investors

Peter Varga, a senior portfolio manager at Erste Asset Management

“The government won’t want to make a political crisis. Nobody is interested in that… cheaper to kick down the can on the road, so they’ll always help a bit just to avoid default”

Philip Fielding, co-head of EM at Mackay Shields

“These entities are really quite bizarre… quite an unusual monster that sits atop of an otherwise quite normal, investment-grade sovereign”

On CRE More ‘Urgent’ for Fed Than Capital Rules – Larry Summers, Fmr. US Treasury Secy

“Regulators are right to be concerned about commercial real estate… chronic problem in banking is a failure to pay attention to the market value of assets… there isn’t always a liquid market for properties… much more productive for our central bank to be focused on the question of real estate portfolios in the banks they supervise”

On Fed signaling ‘patience’ on rate cuts as data disappoints

San Francisco Fed President Mary Daly

“It has not shaken my confidence we are going the right direction. It’s about how quickly are we going to go there… We will need to resist the temptation to act quickly when patience is needed and be prepared to respond agilely as the economy evolves… have to be patient and let’s not get too far ahead”

Top Gainers & Losers- 19-February-24*

Go back to Latest bond Market News

Related Posts: