This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

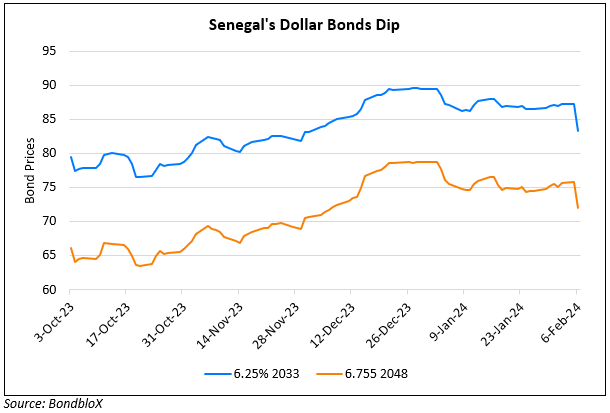

Senegal’s Dollar Bonds Trade Weaker

April 24, 2025

Senegal’s dollar bonds were trading weaker across the curve. Late last week, the IMF said that it will take until at least May, to decide whether Senegal must repay money disbursed under its earlier programme. The IMF had earlier suspended Senegal’s $1.8bn financing program in October, following an audit that uncovered significant underreporting of public finances by the previous administration. An IMF spokesperson said, “The authorities are making every effort to secure the waiver”, adding that a decision would be made depending upon them obtaining the final debt numbers and reaching an agreement with Senegal on corrective action.

Senegal’s 6.25% 2033s were down by 1.7 points, trading at 65.9, yielding 14.04%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Senegal’s Dollar Bonds Drop 4 Points on Election Postponement

February 6, 2024

Senegal’s Dollar Bonds Trend Higher on Political Developments

September 11, 2024