This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

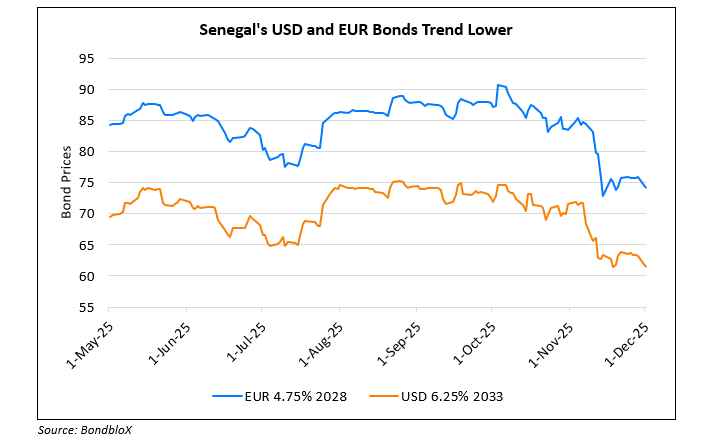

Senegal’s Dollar Bonds Drop on Finance Minister’s Comments Regarding Liquidity

December 1, 2025

Senegal’s offshore bonds fell by ~1.5 points across the curve following comments from its Finance Minister Cheikh Diba. He said that Senegal does not fundamentally face an issue with long-term solvency, however, regarding liquidity, they would require financing assistance. He also added that talks with the IMF were progressing positively. The country’s financial stress began last year after the discovery of $7bn in hidden debt from the previous government, which led the IMF to suspend a prior $1.8bn funding package. Senegal is actively engaging with the IMF for a new facility, navigating disagreements on technical criteria and adjustment measures. The government is implementing strategies to replace “high-risk debts” with more favorable terms and is committed to fiscal discipline. Diba stated the goal is to reduce the fiscal deficit significantly from an estimated 13.4% of GDP at end-2024 to 5.3% by 2026, and further to the regional target of 3% by 2027. Importantly, the country recently ruled out talks of a debt restructuring, signaling an intent to honor its obligations to investors.

Go back to Latest bond Market News

Related Posts:

Credit rating boost for Ireland & Portugal: EU inches towards recovery

September 20, 2017

China Refutes S&P Downgrade Action

September 26, 2017

Mongolia’s Credit Ratings Upgraded to B3 by Moody’s

January 19, 2018