This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

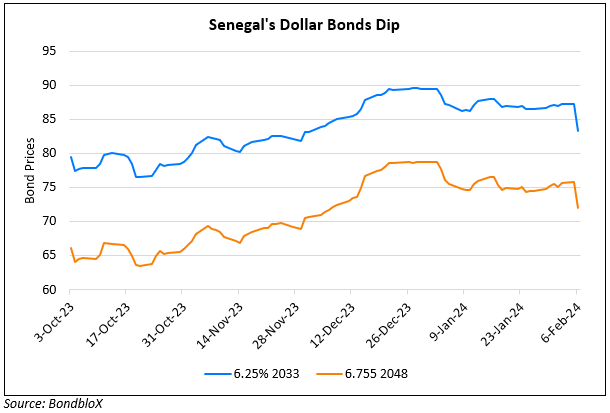

Senegal’s Dollar Bonds Drop as Prime Minister Pledges Energy Cost Cut

October 29, 2025

Senegal’s dollar bonds fell by over 1.5 points across the curve, after its Prime Minister Ousmane Sonko said that the government would lower the public’s electricity and fuel costs. Reuters reports that investors were concerned about the government’s commitment to social spending being at odds with its goals for fiscal sustainability. The pledge to reduce energy costs implies maintaining or increasing subsidies, essentially contradicting pressure from the IMF for Senegal to reduce the significant amount it spends on such subsidies. The timing is important, as an IMF mission is currently in Dakar discussing a new loan program for the country. Prime Minister Sonko, however, stated that the government is redirecting the budget toward addressing social concerns, having performed a “rigorous budgetary arbitration” to create fiscal space. He added that the administration is focused on strengthening economic independence and reducing reliance on external financing for major projects.

Senegal’s EUR 4.75% 2028s fell by 1.9 points to trade at 83.7, yielding 20.1%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Senegal’s Dollar Bonds Drop 4 Points on Election Postponement

February 6, 2024

Senegal’s Dollar Bonds Trend Higher on Political Developments

September 11, 2024