This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

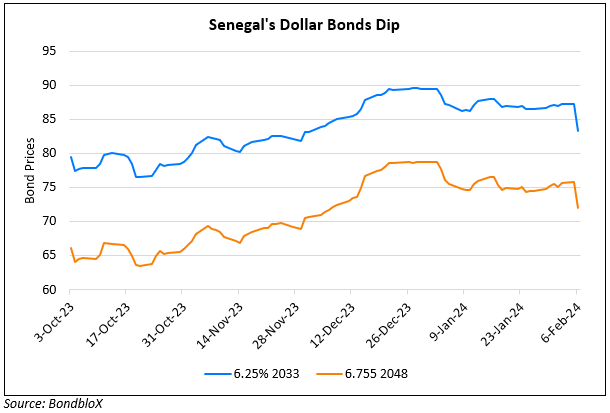

Senegal’s Dollar Bonds Continue to Slip on Credit Downgrade and Liquidity Concerns

October 14, 2025

Senegal’s dollar bonds continued to slip after Moody’s downgraded country’s long-term foreign-currency rating to Caa1 from B3 on Friday. The rating agency highlighted elevated risks to fiscal consolidation trajectory and government liquidity. Though Moody’s expects Senegal to eventually secure IMF support without the need for debt restructuring, its confidence in that scenario has waned. Earlier, the IMF had suspended Senegal’s $1.8bn program in October, after it found out that the previous administration had misreported debt and budget deficit data. Separately, Senegal raised XAF 450bn ($795mn) via a regional bond sale. The bond was sold on the West African UMOA-Titres market and exceeded the initial target of XAF 300bn ($530mn) , as per the finance ministry’s statement.

Senegal’s 6.25% 2033s have dropped by ~3 points over the last week and trade at 71.2 cents on the dollar yielding 12.9%.

For more details, click here.

Go back to Latest bond Market News

Related Posts:

Senegal’s Dollar Bonds Drop 4 Points on Election Postponement

February 6, 2024

Senegal’s Dollar Bonds Trend Higher on Political Developments

September 11, 2024