This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

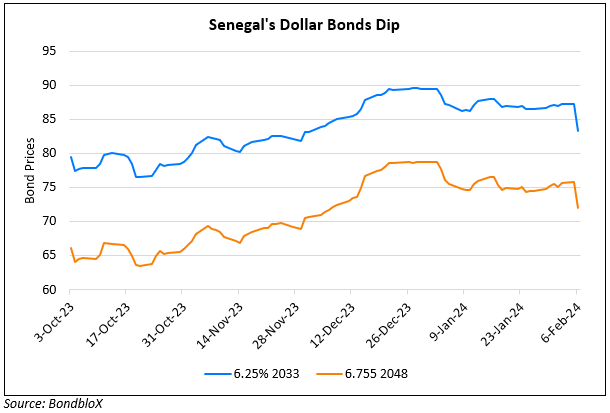

Senegal Rules Out Debt Restructuring Post Audit; Downgraded to B3

February 24, 2025

Senegal’s Finance and Budget Minister, Cheikh Diba, reassured international investors that the country will not restructure its debt, but instead will manage its liabilities to meet debt maturities. During a private call, Diba stated that Senegal is exploring alternative financing options, such as sukuk issuances and loans backed by development banks, to cover potential delays in a new IMF program. He emphasized the country’s strong liquidity position and a target to finalize a new IMF deal by June after a previous $1.8bn program was suspended. Diba also highlighted planned reforms in the energy sector and efforts to manage public debt. Also, the sovereign was downgraded by a notch to B3 from B1 by Moody’s. The downgrade follows significantly weaker fiscal metrics revealed by Senegal’s Court of Auditors, which reported central government debt at nearly 100% of GDP in 2023, much higher than previously reported. These discrepancies indicate governance issues and expose Senegal to greater risks than previously anticipated. Moody’s also has a negative outlook on Senegal reflecting concerns about the fiscal trajectory and government liquidity, with challenges ahead in meeting financing needs.

Senegal’s 6.75% 2048s jumped by ~2 points on Friday and currently trades at 69.5, yielding 10.27%

For more details, click here

Go back to Latest bond Market News

Related Posts:

Senegal’s Dollar Bonds Drop 4 Points on Election Postponement

February 6, 2024

Senegal’s Dollar Bonds Trend Higher on Political Developments

September 11, 2024