This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

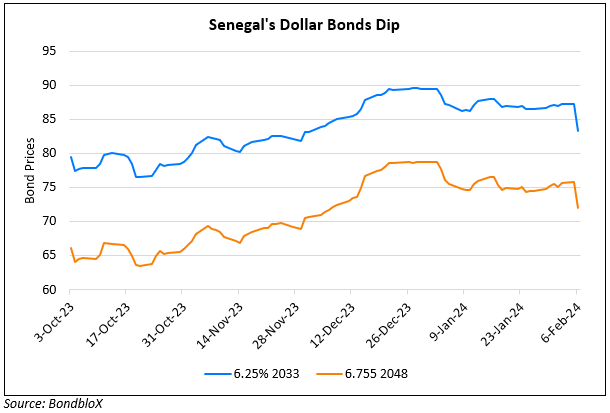

Senegal Likely Faces Delay in IMF Talks for Financing

March 25, 2025

The IMF said that it was “trying to move as fast as possible” to restart talks with Senegal as it awaits more clarity on the nation’s misreported data. The IMF had earlier suspended Senegal’s $1.8bn financing program in October, following an audit that uncovered significant underreporting of public finances by the previous administration. The government had hoped to begin discussions for a new IMF program by April and secure funding by June. However, the IMF will not set a date for talks until the full assessment of the misreported data is completed. To briefly recap, the findings saw that Senegal’s debt-to-GDP and fiscal deficit were understated significantly, leading to further downgrades in its credit ratings by Moody’s and S&P. The IMF is focused on understanding the situation and developing measures to prevent future issues, including Senegal’s practice of borrowing directly from commercial banks. The IMF will also decide whether Senegal needs to repay part of the $700mn already disbursed under the previous program.

Senegal’s 6.25% 2033s were down by 1 point, trading at 76.38, yielding 11.13%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Senegal’s Dollar Bonds Drop 4 Points on Election Postponement

February 6, 2024

Senegal’s Dollar Bonds Trend Higher on Political Developments

September 11, 2024