This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

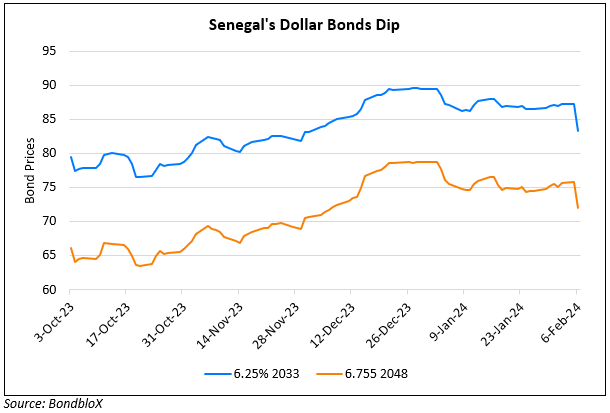

Senegal Dollar Bonds Drop as Debt Servicing Costs are Said to Worsen by 11%

October 23, 2025

Senegal’s 2026 debt-service bill is expected to be 11% steeper than previously forecast after several billions of dollars in unreported liabilities under the former government were uncovered. The Finance Ministry projects debt servicing costs at CFA 5.49tn ($9.7bn) in 2026, up 11% from its prior estimate. Total debt service payments over the next three years are expected to exceed earlier forecasts be more than fourfold, reaching CFA 14.9tn ($26.5bn), according to the documents posted on the Budget Directorate’s website. A review of Senegal’s finances by President Bassirou Diomaye Faye’s administration earlier this year found that the previous government hid $7bn of borrowing, prompting the IMF to suspend a $1.8bn program for the country. Over 40% of Senegal’s gross government debt is denominated in foreign currencies, according to S&P. Senegal intends to rapidly conclude a new IMF program as talks continue with a delegation from the multilateral lender in Dakar this week.

Senegal’s 6.25% 2033s have dropped 5 points since the beginning of October to 69.10 on the dollar yielding 13.50%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Senegal’s Dollar Bonds Drop 4 Points on Election Postponement

February 6, 2024

Senegal’s Dollar Bonds Trend Higher on Political Developments

September 11, 2024