This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sembcorp, Santander Launch S$ Bonds; Muthoot Launches $ Bond

October 16, 2024

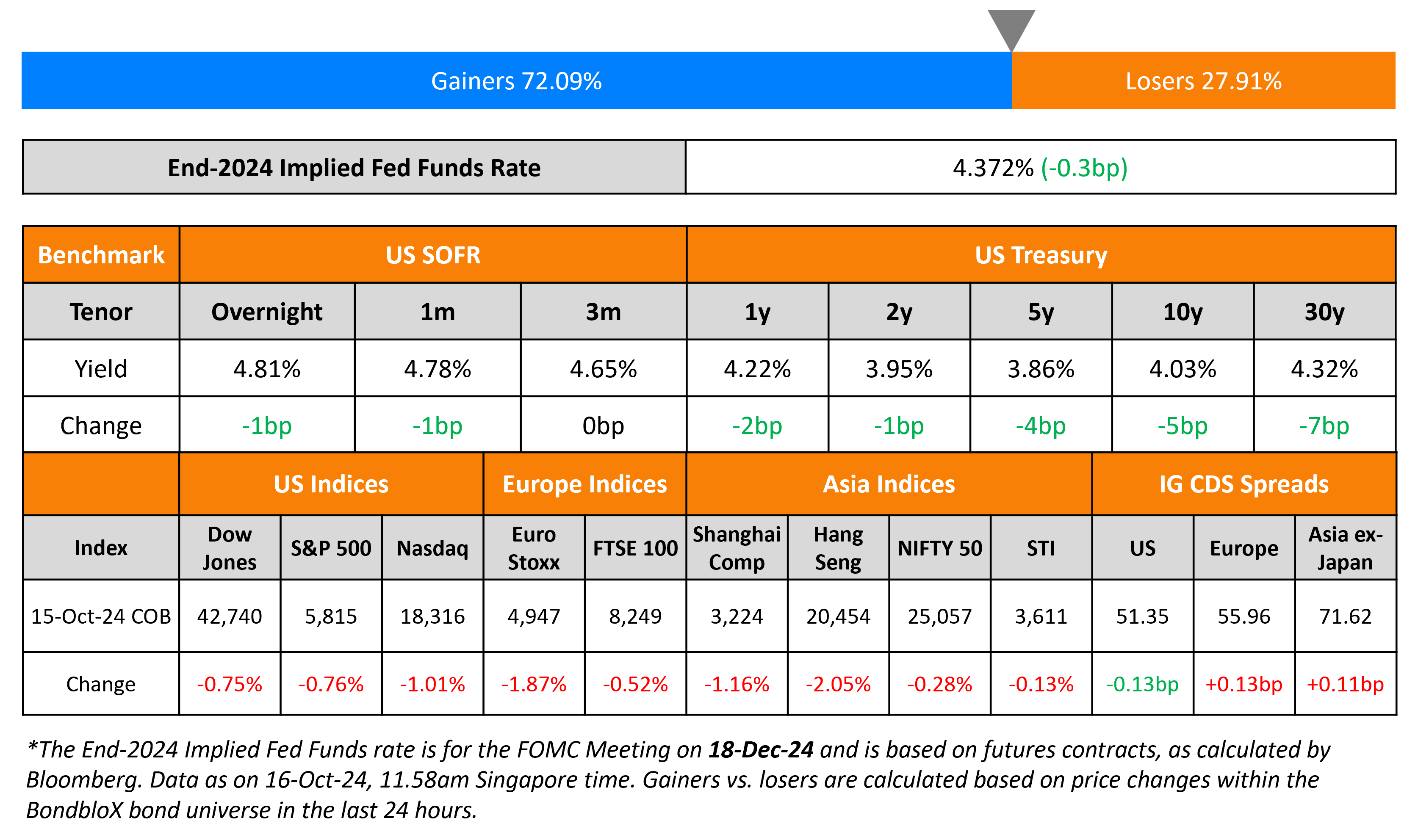

The US Treasury yield curve bull flattened, with 5Y and 10Y yields down by 4-5bp while the short-end remained steady. The Empire Manufacturing Index for October came at -11.9, lower than the surveyed 3.6 and the prior month’s 11.5 prints. Separately, Atlanta Fed President Raphael Bostic said that he expects employment and growth to stay robust in the US even as the economy slows down. He added that he was also confident about inflation heading towards 2%. US IG CDS spreads tightened by 0.1bp and HY spreads tightened 0.7bp. US equity markets sold-off with the S&P and Nasdaq both closing lower by 0.8% and 1% respectively.

European equities closed lower too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.1bp and 0.2bp respectively. Asian equities have opened mixed this morning. Asia ex-Japan IG CDS spreads were 0.1bp wider.

New Bond Issues

- Sembcorp S$ 12Y Green at 3.9% area

-

Santander S$ 6NC5 at 3.8% area

- Muthoot $ 4.5Y at 6.7% area

.png)

JPMorgan raised $8bn via a four-part deal.

The senior unsecured notes are unrated. Proceeds will be used for general corporate purposes. The new 4NC3 bond is priced inline with its existing 4.323% 2028s that currently yields 4.50%. The new 6NC5 note is priced 7bp tighter to its existing 4.565% 2030s that yield 4.67%. The new 11NC10s are priced roughly inline with its existing 5.294% 2035s that yield 4.99%.

Power Construction Corp of China raised $300mn via a PerpNC5 bond at a yield of 4.65%, 40bp inside initial guidance of 5.05% area. The subordinated notes are rated BBB by Fitch. The issuer is Sepco Virgin Ltd and the guarantor is Power Construction Corp of China, rated Baa1/BBB+/A- (Moody’s/S&P/Fitch). The coupons are fixed until 21 October 2029 and if not called by then, reset to the 5Y US Treasury yield plus 76.6bp. The notes also have a coupon step-up of 300bp prior to first reset date only, upon the occurrence of a change of control (CoC), breach of covenant or relevant debt default events if not redeemed/remedied by the issuer. The notes have a CoC put at 101 before the first call date, and at par thereafter. Proceeds will be used to repay the offshore debt.

Korea Land & Housing Corp raised $500mn via a 3Y bond at a yield of 4.421%, 30bp inside initial guidance of T+85bp area. The senior unsecured notes are rated Aa2/AA. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- China Huadian hires for $ PerpNC3 bond

Rating Changes

-

Fitch Upgrades Bupa Finance Plc’s IDR to ‘A’; Affirms IFS Ratings; Outlook Stable

-

Fitch Upgrades Barbados to ‘B+’; Outlook Stable

-

Apache Corp. Upgraded To ‘BBB-‘ On Improving Financial Metrics; Outlook Stable

-

The Toronto-Dominion Bank Downgraded To ‘A+/A-1’ On Anti-Money Laundering Deficiencies; Outlook Is Stable

Term of the Day

Debt Service Coverage Ratio (DSCR)

Debt Service Coverage Ratio (DSCR) is a credit metric used to understand how easily a company’s operating cashflow or EBITDA can cover its annual interest and principal obligations. The ratio shows how much profit a company makes for every dollar it uses to pay off its debts. The ratio is typically calculated as: (EBITDA)/(Principal+Interest).

Talking Heads

On Defending Tariff Plan While Pressing for More Fed Influence – Donald Trump

“It’s going to have a massive effect, positive effect… We’re all about growth. We’re going to bring companies back to our country… If you’re a very good president with good sense, you should be able to at least talk to him (Jerome Powell).”

On Bearish Rate Bets Handing Win to Brazil’s Battered Hedge Funds

Legacy Capital

“The weaknesses of local economic policy are becoming increasingly evident”

Ace Capital

Positioned for higher short-term inflation breakeven and higher short-term interest rates in local markets… bullish bet on the real

Adam Capital

Holds positions that gain from rising rates in Brazil and is also betting on the devaluation of the real.

On Wall Street banks boosted by deal fees as Fed rate cuts, buoyant markets stoking confidence

Dave Ellison, a portfolio manager at Hennessy Funds which holds stocks of the six large banks

“The big banks have been beating estimates with help from investment banking revenue which is a big diversifier and advantage compared to smaller or mid-sized banks”

Goldman Sachs CFO, Denis Coleman

“We are seeing increased client demand for committed acquisition financing which we expect to continue on the back of increasing M&A activity”

Top Gainers and Losers- 16-October-24*

Go back to Latest bond Market News

Related Posts: