This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

SEB Prices $AT1; SM Energy Upgraded to BB

October 29, 2024

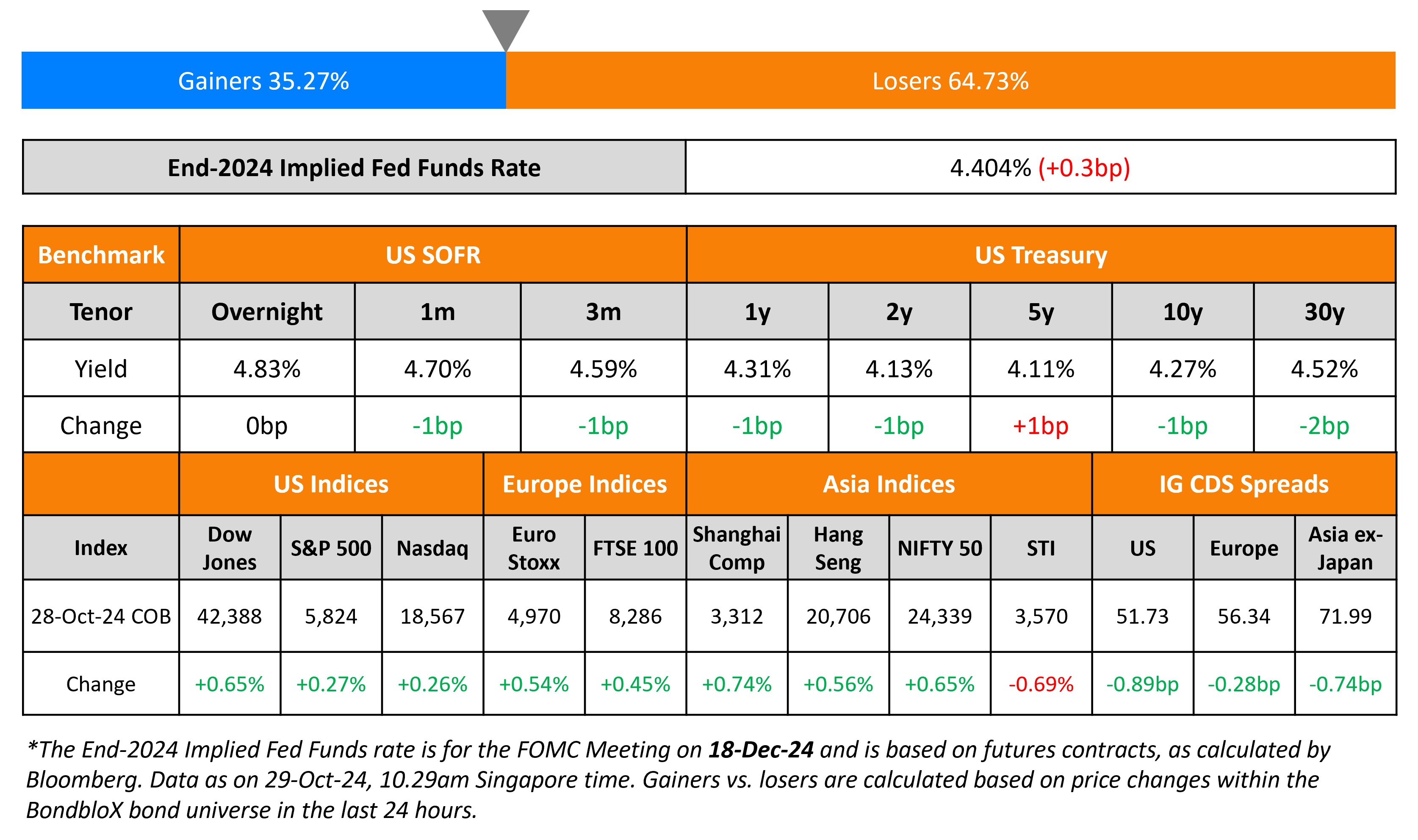

US Treasury yields remained broadly stable across the curve. The 2Y and 5Y auctions saw a weak demand which suggests that investors are anxious of the supply for the next financing quarter. Both the 2Y and 5Y auctions drew higher than anticipated yields at 4.13% and 4.138% respectively. The anxiety is largely due to the uncertainty in the outlook for additional Fed rate cuts, and the upcoming US election where neither candidate is poised to effectively address the ballooning fiscal deficit. US IG and HY CDS spreads tightened by 0.9bp and 5.5bp respectively. Looking at US equity markets, both the S&P and Nasdaq closed higher by 0.3%.

European equity markets also ended higher. Looking at Europe’s CDS, the iTraxx Main and Crossover spreads tightened by 0.3bp and 2.2bp respectively. Asian equity indices have opened broadly lower today morning. Asia ex-Japan IG CDS spreads tightened by 0.7bp.

New Bond Issues

-

Hyundai Capital America $ 3Y/3Y FRN at T+100bp/SOFR Equivalent

Republic of Colombia raised $3.64bn via a two-part offering. It raised $2bn via a 12Y bond at a yield of 7.8%, 35bp inside initial guidance of 8.15% area. It also raised $1.64bn via a 30Y bond at a yield of 8.5%, 30bp inside initial guidance of 8.8% area. The senior unsecured bonds are rated Baa2/BB+/BB+. Proceeds will be used for general budgetary purposes and liability management transactions, which may include payment of the purchase price for all or a portion of its 4.5% 2026s and 3.875% 2027s.

Skandinaviska Enskilda Banken Ab (SEB) raised $500mn via a PerpNC7 AT1 at a yield of 6.75%, 50bp inside initial guidance of 7.25% area. The junior subordinated notes are rated Baa3/BBB+ (Moody’s/Fitch). If the bond is not called on 4 November, 2031, then the coupon resets to 5Y SOFR plus 312.7bp. The trigger event occurs if the CET1 ratio of the bank and the Group falls below 5.125% and 8% respectively. The bond was priced 45bp wider to Svenska 4.75% Perp (callable in March 2031) which currently yields 6.3%.

Aeromexico raised $1.1bn via a two-part deal. It raised $500mn via a 5NC2 bond at a yield of 8.25%, 12.5bp inside initial guidance of 8.375% area. It also raised $610mn via a 7NC3 bond at a yield of 8.625%, 12.5bp inside initial guidance of 8.75% area. The senior secured bonds are unrated. The guarantors of the bond include Aerovías de México, Aerolitoral, Aerovías Empresa de Cargo, and PLM Permier. The bonds have a 10% special call at 103 per year during non-call period. Proceeds will be used for general corporate purposes and to refinance the company’s existing 2027s senior secured notes and to pay related fees and expenses.

New Bond Pipeline

- Tata Capital hires for $ bond

Rating Changes

- Fitch Upgrades SM Energy Company’s Long-Term IDR to ‘BB’; Outlook Stable

- Moody’s Ratings upgrades Aeromexico to Ba3 and assigns Ba3 to its proposed notes; stable outlook

- Perenti Ltd. Upgraded To ‘BB+’ On Solid Operational Performance And Supportive Financial Policies; Outlook Stable

- Moody’s Ratings upgrades Antero’s senior notes to Ba1, affirms other ratings

- Moody’s Ratings downgrades Eramet’s ratings to Ba3; outlook negative

- Moody’s Ratings downgrades Service Properties Trust’s CFR to B3, outlook remains negative

- Fitch Revises EDF’s Outlook to Negative on Sovereign Action; Affirms IDR at ‘BBB+’

- Moody’s Ratings has changed The Dow Chemical Company’s outlook to negative from stable; Baa1 ratings affirmed

Term of the Day

Bond Vigilantes

Coined by Edward Yardeni, ‘Bond Vigilantes’ are bond market players who sell bonds in large quantities pushing up interest rates if they believe that the government isn’t protecting the currency. For example, if inflation rises, deficits grow, or a country’s creditworthiness is at risk, the bond vigilantes sell government bonds, which would lead to rising yields and therefore a higher borrowing cost for the government. Episodes of bond vigilantes selling bonds have been seen in the 1980s during the Clinton administration and also during the Obama administration as per Bloomberg. Bond vigilantes are said to have come back as the 10Y yield has risen.

Talking Heads

On El Salvador’s Bonds Rally Being Over – Morgan Stanley

Morgan Stanley has turned neutral on El Salvador debt, arguing that there’s little room for gains after a 20% rally in recent months. They removed the bank’s “like” call on the Central American nation’s debt, according to a note published Monday.

On Bond Vigilantes Mustering as US, UK Prep Debt Sales – Ed Yardeni, Yardeni Research

“It’s a conceivable scenario that the bond vigilantes are definitely mounting up. There’s no discussion by either candidate about doing anything to reduce the deficit to deal with the debt, to deal with the exploding net interest expense of the government.”

“The reality is that the dollar has actually strengthened at the same time the bond yield has gone up. I wouldn’t get too excited about the bond yield going up to 5% but it’s certainly looking more realistic than it was a few weeks ago.”

On Treasury Likely to Keep Debt Plans in Place Before US Elections – Padhraic Garvey, ING

“I don’t think there should be any big surprises. What we’re looking at here is the maintenance of really elevated issuance numbers.”

Top Gainers & Losers 29-October-24*

Go back to Latest bond Market News

Related Posts: