This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sea of Red as Risk-Off Takes Centre-Stage

April 4, 2025

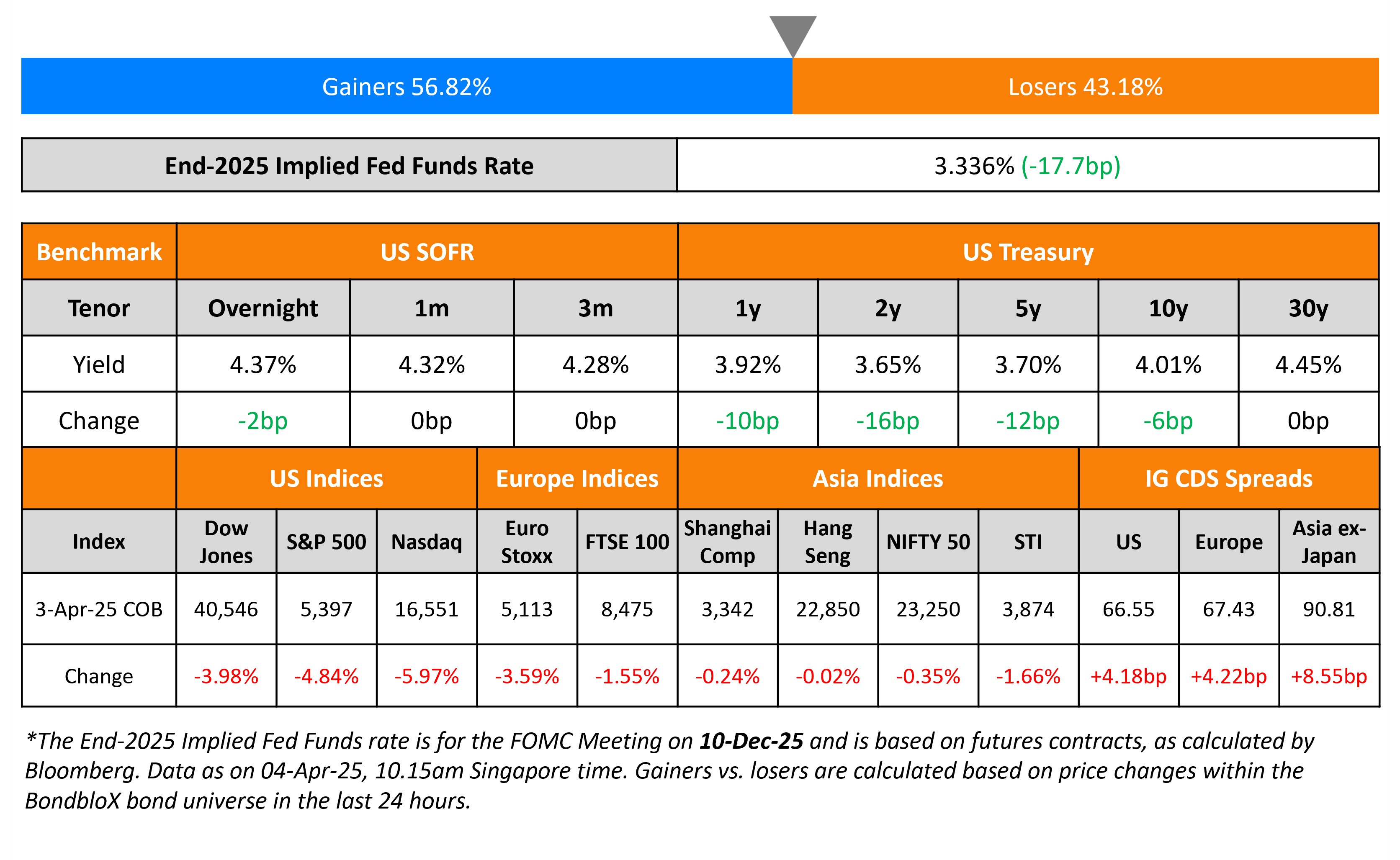

Global markets witnessed a sea of red as the risk-off sentiment led by the tariff imposition saw a bid for haven assets like US Treasuries and gold. On the back of this, US Treasury yields dropped across the curve, with the curve bull steepening – the 2Y yield fell 16bp and the 10Y fell 6bp. The ISM Services PMI for March came-in at 50.8 lower than expectations of 52.9. This was its lowest reading since June 2024, holding just above expansionary territory. Market have reacted pessimistically and are pricing-in the possibility of about 100bp in rate cuts by end-2025.

US equity markets ended sharply lower, with the S&P and Nasdaq down 4.8% and 6% respectively, the largest single day loss since the pandemic. Credit gauges took a beating as well, particularly junk bonds – US IG and HY CDS spreads widened by 4.2bp and 27bp respectively. European equity markets were sharply lower too. The iTraxx Main and Crossover CDS spreads widened by 4.2bp and 19bp respectively. Asian equity markets have opened in the red this morning. Asia ex-Japan CDS spreads were wider by 8.6bp.

New Bond Issues

Rating Changes

- Fitch Upgrades LATAM Airlines to ‘BB’; Outlook Remains Positive

- Meituan Upgraded To ‘A-‘ From ‘BBB+’ On Strong Business Momentum; Outlook Stable

- Fitch Upgrades British Airways Plc to ‘BBB’; Outlook Stable

- Fitch Downgrades China to ‘A’; Outlook Stable

- Fitch Downgrades Stellantis to ‘BBB’; Outlook Stable

- Fitch Downgrades Sunnova’s IDR to ‘C’ on Missed Interest Payment

- Philip Morris International Outlook Now Positive On Strong Growth Momentum Supporting Deleveraging; Affirmed At ‘A-/A-2’

- Fitch Puts PizzaExpress on Rating Watch Negative on Likely Distressed Debt Exchange

Term of the Day: Risk-Off

Risk-off is an indication of global market sentiment wherein investors switch out from risky assets (i.e. risk-off) into safer assets on the back of increased uncertainty. This can be due to geopolitical risk, poor economic data or a crisis. Most typically, during a risk-off environment, US Treasuries and gold tend to perform better as they are considered safe haven assets. On the other hand, risk-on indicates positive investor sentiment wherein investors switch into risky assets (i.e. risk-on) from safer assets on improved prospects of economic growth. This can be due to improved political environment, strong economic data, strong corporate earnings, or a recovery from a crisis.

Talking Heads

On Seeing the Fed Delivering One Interest-Rate Cut in 2025 – Mohammed El-Erian

Fed is “inherently dovish”… market is too optimistic that new tariffs will result in a “Thatcher-Reagan moment where we go through disturbances, we rewire the economies and we come out with a streamlined government.

On Emerging economies bracing for Trump tariff ‘turning point’

Gary Tan, Allspring Global Investments

“If the tariffs remain as it is, we definitely need to think about the structural, export-oriented growth story for EM”

JPMorgan

“The shock to sentiment and capital flows is likely to endure and requires higher risk premia… If this model is broken, then definitely we have to reconsider how, basically, you invest in EM for growth”

On US 10-Year Yield Drops Below 4% for First Time Since Trump Won

Kathleen Brooks, XTB

“The bond market is a big winner… Central banks are likely to step up to ease some of the pain from the US’s new global trade policy”

Jack McIntyre, Brandywine Global Investment

“The odds of recession are increasing given the timing of tariffs and tax policy. Meanwhile, monetary and fiscal policy are both restrictive — as are lower equity prices”

Top Gainers and Losers- 04-April-25*

Go back to Latest bond Market News

Related Posts: