This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Scotiabank, HPE, Uber, PIF Price $ Bonds

September 9, 2025

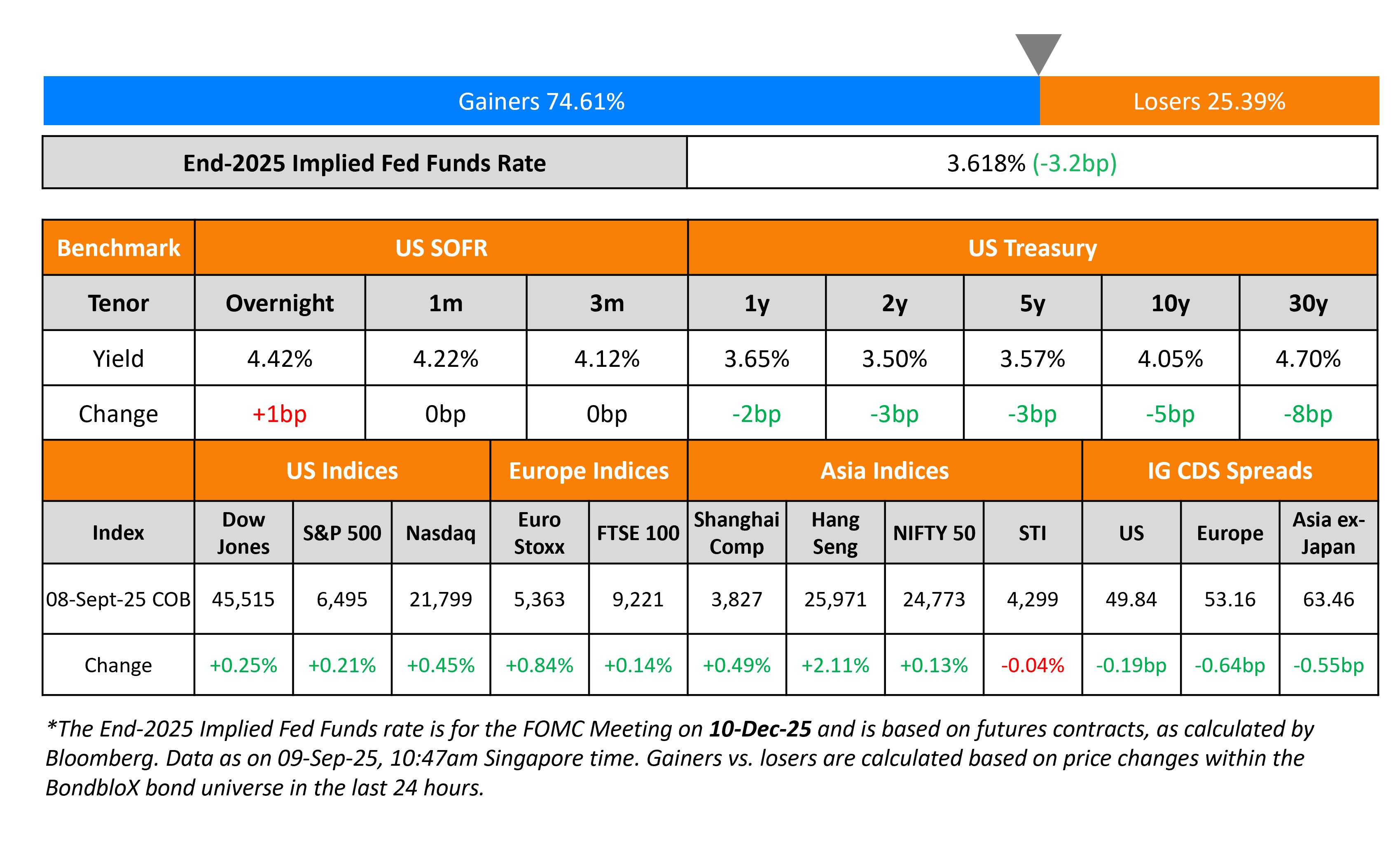

US Treasury yields eased further by 3-5bp across the curve. There was no major data point released yesterday and the market continues to await the PPI and inflation print tomorrow and Thursday respectively before the Fed meets later this month. Markets are fully pricing-in a 25bp rate cut in September and ~70bp in combined rate cuts by the end of the year. Looking at US equity markets, the S&P and Nasdaq were up by 0.2% and 0.5% respectively. US IG CDS spreads were tighter by 0.2bp while HY CDS spreads were wider by 0.4bp. In Europe, the French government lost a confidence vote yesterday, pushing the country deeper into political crisis. This was anticipated by the markets and France’s long-dated government bonds continued to trade weaker. European equity markets ended lower. The iTraxx Main CDS spreads were 0.6bp tighter while the Crossover spreads were 2.4bp tighter.

In Asia, the Japanese yen strengthened and the Nikkei continued to climb higher following Prime Minister Shigeru Ishiba’s decision to step down over the weekend. Indonesia`s Finance Minister Sri Mulyani Indrawati was removed and replaced with Prabowo favored economist, Purbaya Sadewa. According to analysts, this could test the country’s fiscal discipline and may lead to capital flight from the nation. Asian equity markets have opened broadly higher today. Asia ex-Japan CDS spreads were 0.6bp tighter.

New Bond Issues

- KDB $ 5Y at SOFR MS+68bp area

Bank of Nova Scotia (Scotiabank) raised $2.25bn via a three part deal. It raised:

- $800mn via a 3NC2 bond at yield of 4.043%, 27.5bp inside initial guidance of T+75-80bp area

- $600mn via a 3NC2 FRN at SOFR+76bp, vs. initial guidance of SOFR equivalent area

- $850mn via a 6NC5 bond at a yield of 4.338%, 25.5bp inside initial guidance of T+100-105bp area

The senior unsecured bonds are rated A2/A-/AA-. Proceeds will be used for general corporate purposes.

Westpac New Zealand raised $750mn via a 5Y bond at a yield of 4.218%, 20bp inside initial guidance of T+85bp area. The senior unsecured bond is rated A1/AA-/A+ (Moody’s/S&P/Fitch). Proceeds will be used for general corporate purposes.

Well Fargo raised $4bn via a three-part offering. It raised:

- $1.5bn via a 4NC3 bond at a yield of 4.078%, 28bp inside initial guidance of T+90bp area

- $750mn via a 4NC3 FRN at a yield of SOFR+88bp, vs. initial guidance of SOFR equivalent area

- $1.75bn via a 11NC10 bond at a yield of 4.892%, 30bp inside initial guidance of T+115bp area

The senior unsecured bonds are rated A1/BBB+/A+.

Danske bank raised $750mn via a 6NC5 bond at a yield of 4.42%, 22.5bp inside initial guidance of T+105-110bp area. The senior non-preferred bond is rated Baa1/A-/A+. Proceeds will be used for general corporate purposes.

Uber raised $2.25bn via a two-part offering:

- $1bn via a long 5Y bond at a yield of 4.173%, 30bp inside initial guidance of T+90bp area

- $1.25bn via a 10Y bond at a yield of 4.847%, 30bp inside initial guidance of T+110bp area.

The senior unsecured notes are rated Baa1/BBB/BBB+ and have a change of control put at 101. Proceeds will be used for general corporate purposes, including the repayment of certain outstanding indebtedness.

Hewlett Packard Enterprise Co (HPE) raised $2.9bn via a four-trancher. It raised:

The senior unsecured bonds are rated Baa2/BBB/BBB+. Proceeds will be used for general corporate purposes, which may include, among other uses, repaying certain indebtedness of HPE and its subsidiaries, including Juniper.

Capital One raised $2.75bn via a two-part offering:

- $1.25bn via a 6NC5 bond at a yield of 4.493%, 28bp inside initial guidance of T+120bp area

- $1.5bn via a 11NC10 bond at a yield of 5.197%, 30bp inside initial guidance of T+145bp area

The senior unsecured bonds are rated Baa1/BBB/A-. Proceeds will be used for general corporate purposes.

PIF raised $2bn via a 10Y bond at a yield of 5.003%, 25bp inside initial guidance of T+120bp area. The senior unsecured bond is rated Aa3/A+ (Moody’s/Fitch) and received orders of over $7.5bn, ~3.75x issue size. Proceeds will be used for general corporate purposes.

New Bond Pipeline

- Al Rajhi hires for $ 10.5NC5.5 Tier 2 Sukuk bond

- Omniyat hires for $ Long 3Y bond

- EU hires for € 5Y/30Y bond

Rating Changes

- Moody’s Ratings upgrades PEMEX’s ratings to B1; stable outlook

- Howmet Aerospace Inc. Upgraded To ‘BBB+’ On Better-Than-Expected Credit Metrics; Outlook Stable

- Moody’s Ratings upgrades InPost’s ratings to Ba1 following proposed bond refinancing; outlook stable

- Sinochem Hong Kong Downgraded To ‘BBB+’ On Weakened Group Status; Outlook Stable

- Fitch Revises Volcan’s Outlook to Positive; Affirms IDRs at ‘B-‘

- Pitney Bowes Inc. Outlook Revised To Positive From Stable On Improved Credit Metrics; ‘B+’ Rating Affirmed

Term of the Day

Senior Non-Preferred (SNP) Bond

Senior non-preferred (SNP) notes are type of debt security that banks issue as part of their Tier 3 capital. These bonds have an inherent bail-in feature where in the case of bankruptcy, creditors holding these notes may be subject to conversion into shares. In a liquidation scenario, SNP bonds are ranked higher than Subordinated Bonds. However, they rank inferior to Senior Preferred Bonds or Senior Unsecured Bonds.

Talking Heads

On Fed Rate Cuts Leading to Steeper Yield Curve – DoubleLine Capital

“It potentially extends this runway for risk assets, credit assets to continue to trade at very rich valuations… clearest expression of these issues are likely a lower dollar and a steepening curve… going to be difficult for the 10-year to get down to that 3%”

On Expecting Half-Point Fed Rate Cut Next Week – Standard Chartered

“We think the August labor-market data has opened the door to a ‘catch-up’ 50-basis point rate cut at the September FOMC meeting just as it did this time last year… we expect preliminary revisions to employment data for April 2024 to March 2025 (due next week) to support our 50-bps call”

On Stocks at Risk of ‘Sell the News’ Drop on Fed Interest-Rate Cut – JPMorgan Traders

“This current bull market feels unstoppable with new support forming as former tent poles weaken… could turn into a ‘Sell the News’ event as investors pullback

Top Gainers and Losers- 09-Sep-25*

Go back to Latest bond Market News

Related Posts: