This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Saudi Real Estate, Westpac Price $ Bonds

February 21, 2025

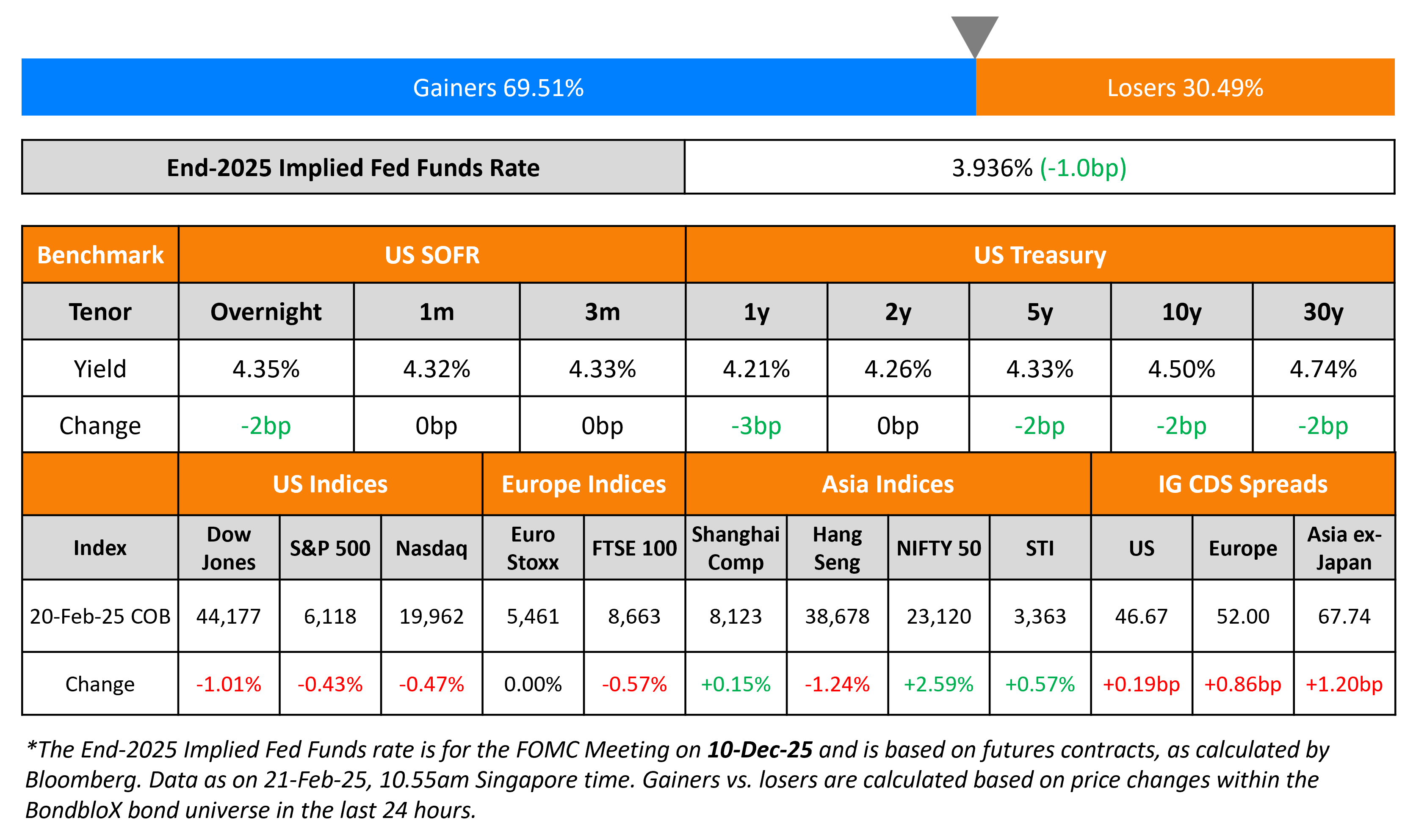

US Treasuries yields were broadly stable with the 2Y at 4.26% and 10Y at 4.5%. Initial Jobless Claims for the week came in at 219k, higher than expectations of 215k and previous figure of 213k. Fed President Raphael Bostic said that his “baseline expectation” is for two 25bp rate cuts later this year, but “the uncertainty around that is pretty significant.” Federal Reserve Governor Adriana Kugler said that inflation still has “some way to go” before reaching the Fed’s 2% target, adding that while the labor market is healthy, upside risks to inflation remain.

US equity markets saw the S&P and Nasdaq ending lower by 0.4-0.5%. Looking at credit markets, US IG and HY CDS spreads were 0.2bp and 0.7bp wider respectively. European equity markets ended lower. The iTraxx Main and Crossover CDS spreads widened by 0.9bp and 2.6bp respectively. Asian equity markets have opened broadly mixed this morning. Asia ex-Japan CDS spreads were wider by 1.2bp.

New Bond Issues

Qatar raised $3bn via a two-trancher. It raised $1bn via a 3Y bond at a yield of 4.575%, 30bp inside initial guidance of T+30bp area. It also raised $2bn via a 10Y bond at a yield of 4.951%, 35bp inside initial guidance of T+80bp area. The senior unsecured bonds are rated Aa2/AA/AA. Recently JP Morgan reclassified Qatar and Kuwait as Developed Markets, and will soon start their removal from its Emerging-Markets Bond Index (EMBI) in a phased manner.

Westpac New Zealand raised $750mn via a 5Y bond at a yield of 4.938%, 20bp inside initial guidance of T+80bp area. The senior unsecured bond is rated A1/AA-. Proceeds will be used for general corporate purposes.

Saudi Real Estate raised $2bn via a two-trancher. It raised $1bn via a 3Y sukuk at a yield of 5.068%, 30bp inside initial guidance of T+110bp area. It also raised $1bn via a 10Y sukuk at a yield of 5.479%, 37bp inside initial guidance of T+135bp area. The senior unsecured bonds are rated Aa3/A+ (Moody’s/Fitch). SRC Sukuk Limited is the Issuer with the Saudi Real Estate Refinance Company as the obligor. Proceeds will be used for general corporate purposes. The 10Y sukuk offers a pickup of 28bp over Saudi Arabia’s 5.25% 2034 sukuk, currently yielding 5.2%.

ESR REIT raised S$100mnn via a 5Y bond at a yield of 4.05%, 20bp inside initial guidance of 4.25% area. The senior unsecured bond in unrated. Proceeds will be used for refinancing group’s existing borrowings, acquisitions and/or investments of ESR-REIT plus any development and asset enhancement works initiated by it.

Kraft Heinz raised €600mn via a 8Y bond at a yield of 3.399%, 38bp inside initial guidance of MS+135bp area. The senior unsecured bond is rated Baa2/BBB/BBB. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Varanasi Aurangabad hires for $ 9NC3 bond

Rating Changes

- Moody’s Ratings upgrades Gap’s CFR to Ba2; outlook remains stable

- Moody’s Ratings downgrades Victoria’s CFR to Caa1 from B3; outlook remains negative

- Fitch Revises Outlook on Intel’s ‘BBB+’ and ‘F2’ Ratings to Negative from Stable

- Japan’s Marubeni Outlook Revised To Positive On Stronger Business Portfolio; ‘BBB+/A-2’ Ratings Affirmed

- Kotak Mahindra Bank SACP Revised Up To ‘bbb’ From ‘bbb-‘; ‘BBB-/A-3’ Ratings Affirmed With Positive Outlook

Term of the Day

Tender Offer

A tender offer is an offer made by an issuer to bondholders to buyback their bonds. In return, the bondholders could get either cash or new bonds of equivalent value at a specified price. The issuer does this to retire some of its old debt and can use retained earnings to fund the purchases without affecting the liquidity position of the company. Tender offers have a deadline date before which holders must tender their bonds back.

Talking Heads

On ‘Stagflation’ fears in US markets despite Trump’s pro-growth agenda

Jack McIntyre, Brandywine Global

“Stagflation has definitely re-emerged as a possibility because we have these policies that could hurt consumer demand even while persistent inflation limits the Federal Reserve’s ability to maneuver.”

Tim Urbanowicz, Innovator Capital Management.

“What continues to concern us more than the risk of inflation is stagflation…There is that sticky base of inflation to contend with but on top of that, tariffs have the potential to slow down the economy by becoming a tax on consumers and weighing on profits and economic growth.”

On European Bank Stocks’ Winning Streak

Jason Napier, UBS

“On a cumulative basis all banks have beat on income, 89% on pre-provision profit and 79% at the profit-before-tax level…With better revenues it’s not surprising that costs are coming in higher.”

Emmanuel Cau, Barclays

“Banks in particular have been a good example how a turnaround in macro/earnings regime and self-help (buybacks) can boost profitability and subsequently valuations…They still have considerable room to improve on their valuations.”

On US companies swapping dollar bonds into euros to lower funding costs

John Wahr, U.S. Bank

“We have seen activity in both new cross-currency swap transactions and restructurings of existing hedges, mostly USD to EUR flows associated with net investment hedging activity.”

Top Gainers & Losers 21-February-25*

Go back to Latest bond Market News

Related Posts: