This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Saudi Aramco Launches $ 5Y/10Y Sukuk; Shriram and Credit Agricole Price $ Bonds

September 25, 2024

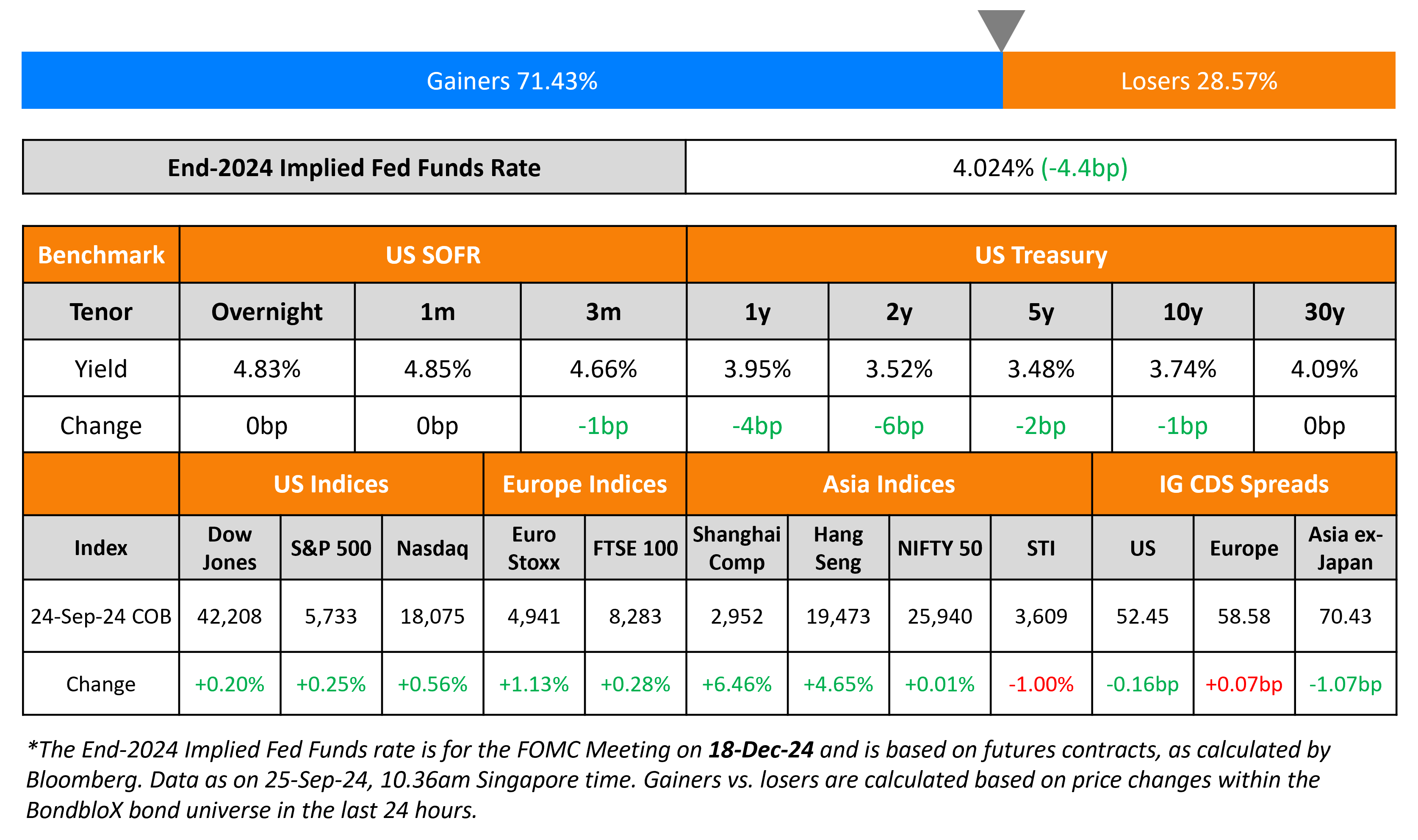

US Treasuries yields inched lower for shorter tenors while longer term yields held largely steady. This comes after a solid 2Y auction that was held yesterday. The auction saw a bid-to-cover ratio of 2.59x, and an indirect acceptance rate of 67.6%. The 2Y yield fell by 4.9bp and now sits at 3.52%. In other news, Fed Reserve Governor Michelle Bowman also remarked on the rate cut decision last week. She said that the Fed should go about the cuts at a “measured pace”, amid lingering inflation risks and the lack of significant weakening in the labour market. Markets are now pricing in close to 80bp in cuts by end of this year as per the end-2024 Future Fed Funds Rate. US IG and HY CDS tightened by 0.2bp and 2.4bp respectively. Looking at US equity indices, the S&P and NASDAQ closed higher by 0.25% and 0.2% respectively.

European equity markets ended higher too. Looking at Europe’s CDS spreads, the iTraxx Main spreads and Crossover spreads were wider by 0.1bp and 1bp respectively. Asian equity indices have opened broadly higher this morning. Asia ex-Japan IG CDS spreads tightened by 1.1bp.

New Bond Issues

-

Saudi Aramco $ 5Y/10Y Sukuk at T+120/135bp area

-

China € 3Y/7Y at MS+45/65bp area

Shriram Finance raised $500mn via a 3.5Y bond at a yield of 6.15%, 35bp inside initial guidance of 6.5% area. The senior secured social bond is expected to be rated BB/BB (S&P/Fitch). The bonds are secured against a specified pool of receivables exclusively earmarked for this issuance. The bond’s maintenance covenant include (i) Security coverage ratio >= 1 and (ii) Security at all times to consist of standard assets (excludes NPAs of over 12 months). The bond was priced at a new issue premium of 22bp compared to its 6.625% 2027s which currently yields 5.93%. Proceeds will be used in accordance with issuer’s social finance framework and for onward lending and other activities as may be permitted by RBI ECB guidelines.

Credit Agricole raised $1.25bn via a PerpNC10 AT1 bond at a yield of 6.7%, 55bp inside initial guidance of 7.25% area. The junior subordinated note is expected to be rated BBB-/BBB (S&P/Fitch). Below you can see its comparison with other similar AT1s.

A trigger Event will occur if Issuer’s CET1 ratio falls to or below 5.125% or if the Group’s CET1 ratio falls to or below 7.0%.

Public Utilities Board raised S$325mn via a 7Y Green bond at a yield of 2.502%, 4.8bp inside initial guidance of 2.55% area. The senior unsecured bond is unrated. Proceeds will be used for financing or refinancing new or existing eligible green projects under PUB’s green financing framework (“Eligible Green Projects”).

Qatar International Islamic Bank raised $300mn via a PerpNC5.5 Tier 1 Sukuk bond at a yield of 5.45%, 55bp inside initial guidance of 6%-6.125%. The junior subordinated bond is unrated. The bond is callable from 2 October 2029 to 2 April 2030, and any interest payment date thereafter. If not called by 2 April 2030, the coupon resets to 5Y US Treasury plus 187bp.

Meituan raised $2.5bn via a two-part offering. It raised $1.2bn via a 3.5Y bond at a yield of 4.614%, 30bp inside initial guidance of T+145bp area. It raised $1.3bn via a 5Y bond at a yield of 4.746%, 35bp inside initial guidance of T+160bp area. The senior unsecured bonds are expected to be rated Baa2/BBB+/BBB. Proceeds will be used for refinancing existing offshore indebtedness.

New Bonds Pipeline

- Turkey hires for $ 10Y bond

- Riyad Bank hires for $ PerpNC5.5 AT1 Sukuk bond

Rating Changes

- Fitch Upgrades Votorantim’s IDRs to ‘BBB’; Outlook Stable

- Moody’s Ratings upgrades BRF’s ratings to Ba2; outlook changed to stable

- Fitch Downgrades Azul’s Ratings to ‘CCC’

- Fitch Downgrades TalkTalk to ‘RD’

- Fitch Downgrades Empire Resorts’ IDR to ‘B-‘; Maintains Negative Watch

- Mexican Chemical Producer Cydsa Outlook Revised To Stable From Positive On Slower Deleveraging; ‘BB/B’ Ratings Affirmed

Term of the Day

Tender Offer

A tender offer is an offer made by an issuer to bondholders to buyback their bonds. In return, the bondholders could get either cash or new bonds of equivalent value at a specified price. The issuer does this to retire some of its old debt and can use retained earnings to fund the purchases without affecting the liquidity position of the company. Tender offers have a deadline date before which holders must tender their bonds back.

Talking Heads

On Tightening of Spreads For Boeing’s Bonds

Matt Woodruff, analyst at Credit Sights

“For Boeing specifically, the market believes it will issue equity following the strike, and that could potentially keep the agencies happy with BBB- rating. We believe it is not clear Boeing will be able to issue enough equity to make the agencies happy, though.”

On Non-inversion of Yield Curve Across the World

Alberto Gallo, the chief investment officer and co-founder of Andromeda Capital Management.

“The curve steepening is a global phenomenon that could be even more pronounced in the US.”

Pooja Kumra, head of European rates strategy at Toronto-Dominion Bank

“German curves are seeing a strong correlation with US curves where the only trade is steepeners. So we doubt the steepening move will see any pause in the near term.”

On ECB Rate Cuts Through First Half of 2025

Klaas Knot, ECB Governing Council member

“I don’t expect interest rates to return to the extremely low levels we saw before the pandemic. Interest rates in Europe will simply keep falling as we become more and more convinced that the 2% inflation target is within reach.”

Top Gainers & Losers 25-September-24*

Go back to Latest bond Market News

Related Posts:

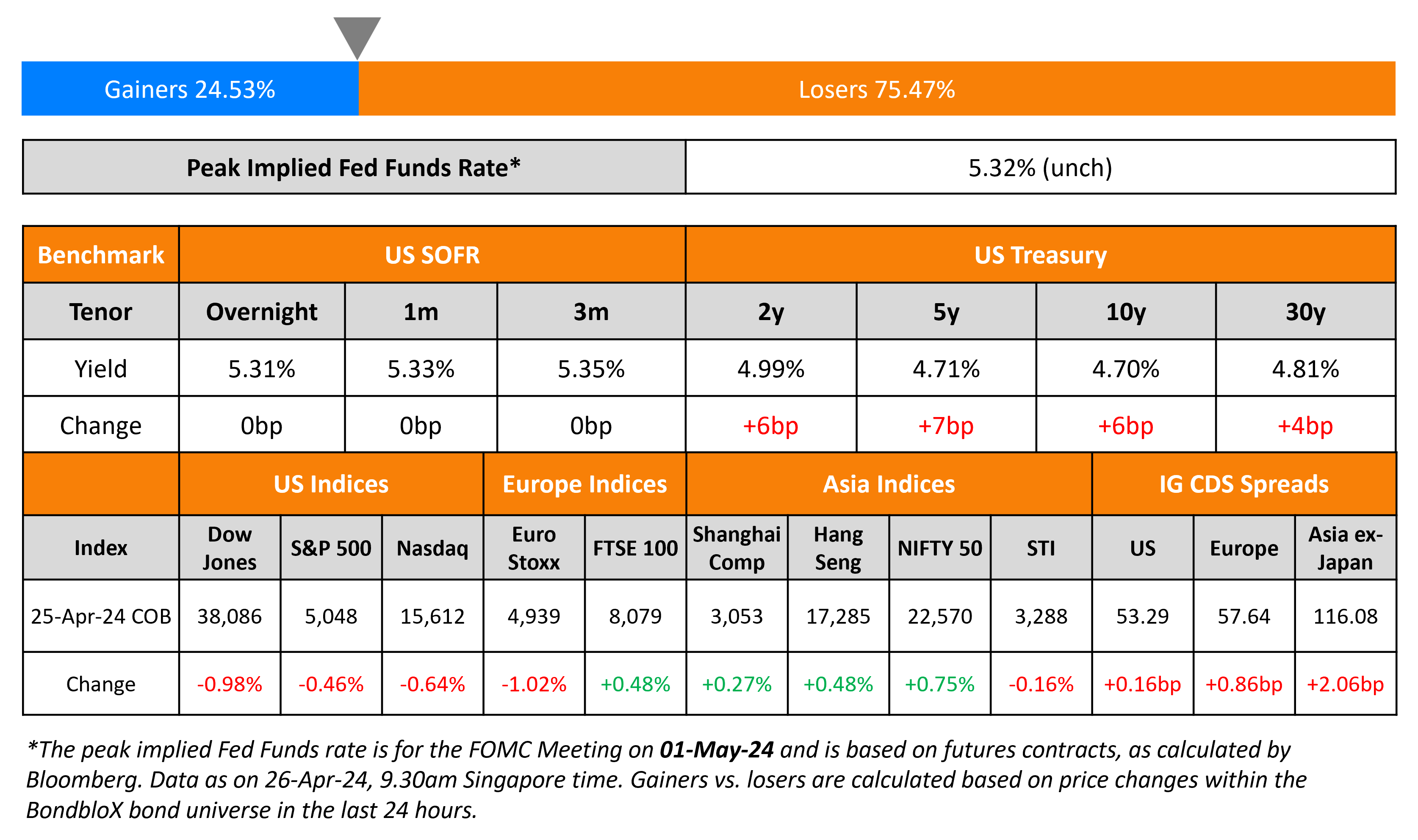

US GDP Softens; KIB Prices $ AT1

April 26, 2024

Turkey, FAB, Astrea Price Bonds; Muthoot Taps 2028s

July 10, 2024