This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Santander Prices $ AT at 8%; Royal Caribbean, Keppel, CapitaLand Price Bonds

July 30, 2024

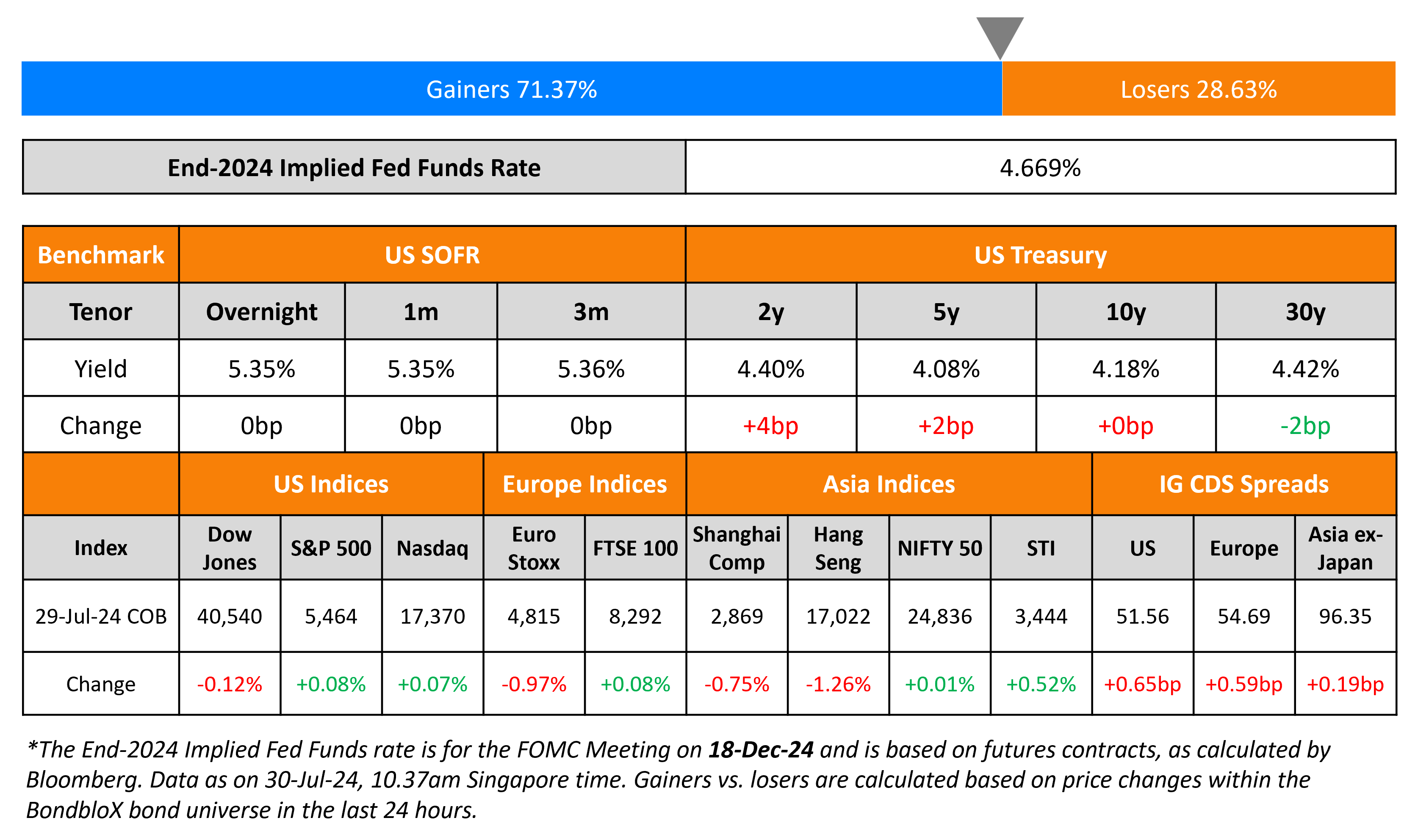

US 2Y Treasury yields were up 4bp while the rest of the curve held steady. The Dallas Fed manufacturing index fell to -17.5 in July vs. expectations of -14.2 and the prior month’s -15.1 print. Markets await the outcome of the two-day FOMC meeting that begins today and concludes with the press conference tomorrow. US equities were marginally higher on Monday, with the the S&P and Nasdaq up ~0.1%. US IG and HY CDS spreads widened by 0.7bp and 3.5bp respectively.

European equity markets closed higher too. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.6bp and 2.4bp respectively. Asian equity indices have opened in the red this morning. Asia ex-Japan CDS spreads were tighter by over 0.2bp.

New Bond Issues

- Amentum $ 8NC3 at 8% area

- Yunnan Communications Investment $ 2Y at 6.9% area

- Nanyang Commercial Bank $ 10NC5 T2 at T+250bp area

CapitaLand Ascott Trust raised S$150mn via a PerpNC5.5 bond at a yield of 4.6%, 30bp inside initial guidance of 4.9% area. The subordinated notes are rated BBB (Fitch). If not called by 7 February 2030, the bonds will reset then and every five years thereafter to the prevailing SGD 5Y SORA-OIS+195.7bp. There is no coupon step-up or dividend pusher. There is a dividend stopper on the notes. Private banks got a 25-cent concession.

Keppel Infrastructure raised S$200mn via a PerpNC10 bond at a yield of 4.9%, 25bp inside initial guidance of 5.15% area. The subordinated notes are unrated. If not called by 2 August 2034, the bonds will reset then and every ten years thereafter to the prevailing SGD 10Y SORA-OIS+220.2bp. There is a 100bp coupon step-up in addition to it and a dividend stopper too. There is no dividend pusher. Private banks got a 25-cent concession. Net proceeds will be used towards (a) refinancing its borrowings and that of its subsidiaries (b) working capital purposes and/or capex requirements of the group, and/or (c) financing/refinancing acquisitions and/or investments of the Group and any asset enhancement works.

Royal Caribbean raised $2bn via a 8.5NC3 bond at a yield of 6%, inline with initial guidance of 5.875-6% area. The senior unsecured bonds are rated Ba2/BB+. Proceeds, together with borrowings under its revolving credit facilities will be used to redeem all of its outstanding 9.25% 2029s and a portion of its 8.25% 2029s. The new bonds are priced at a new issue premium of 33bp over it existing 6.25% 2032s (callable in March 2027) that yield 5.67%.

Santander raised $1.5bn via a PerpNC10 AT1 bond at a yield of 8%, 37.5bp inside initial guidance of 8.375% area. The junior subordinated notes are rated Ba1/BBB-. The bonds are callable from 1 February 2034 to 1 August 2034, and if not called, the coupon resets to the 5Y US Treasury yield plus 391.1bp. Proceeds will be used for general corporate purposes, including managing potential refinancing of existing perps. A trigger event would occur if the issuer/group’s CET1 ratio falls below 5.125%. Santander’s new AT1 offers a yield pick-up of 72bp over UBS’s 9.25% Perp (callable in November 2033) and rated Baa3/BB/BBB- that yields 7.28% to call.

Rating Changes

- Fitch Upgrades Pakistan to ‘CCC+’

- Real Estate Developer PNC Investments LLC (Sobha) Upgraded To ‘BB’ On Stronger Expected EBITDA; Outlook Stable

- Moody’s Ratings upgrades two Paraguayan banks’ ratings; outlooks changed to stable

- Southwest Airlines Co. Outlook Revised To Negative On Earnings Pressure; ‘BBB’ Rating Affirmed

Term of the Day

Dividend Pusher

Dividend pushers are a common covenant seen in perpetual bonds issued by both banks and corporates that require the issuer to make a coupon payment if it has paid a dividend on its shares. These covenants can be found in a bond’s prospectus or offering circular. Dividend pushers are included in a bond’s terms to provide confidence to bond investors that they would be paid coupons if the issuer’s stockholders are paid a dividend. Dividend pushers are sometimes used along with dividend stoppers, which prohibit issuers from paying a dividend on its stock if it has not made a coupon payment on its perpetual bonds.

Talking Heads

On BOJ Likely to Focus on Cutting 10-Year Bond Buying

Eiji Dohke, SBI Securities

“The BOJ is likely to cut purchases of five- to 10-year notes more than others due to large purchases of these tenors relative to issuance”

Naoya Hasegawa, Okasan Securities

“The planned decrease in the BOJ’s bond buying is expected to center around tenors of 10 years and less”

On Liquidators Struggling to Recover Cash From China’s Broke Builders

Foreky Wong, founding partner at Fortune Ark Restructuring

“We have never seen anything of this scale before, where a whole sector has sunk. Liquidators who are seemingly powerful could end up powerless… If there are no resources and no one is interested in funding the case, sometimes you have to close the case”

Top Gainers & Losers- 30-July-24*

Go back to Latest bond Market News

Related Posts: